- Litecoin retested four-month assist line, and promote stress confirmed indicators of bearish exhaustion.

- Whale transactions surged within the final 24 hours.

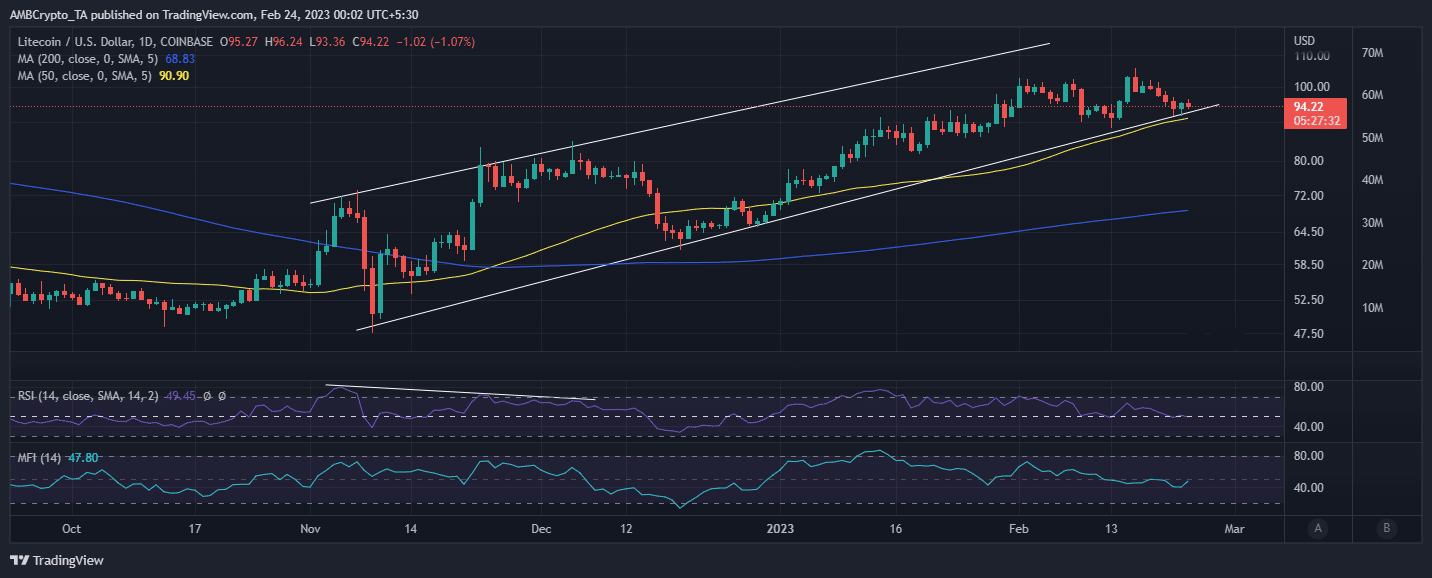

Litecoin’s [LTC] worth motion was shifting in an total ascending sample in the previous couple of months. Extra particularly, its worth was restricted inside a assist and resistance channel since November 2022. Its efficiency within the subsequent few days may be headed for a pivot, and right here’s why.

Litecoin bears have dominated since mid-February, and the next pullback resulted in a retest of its four-month assist line. This was the fourth time that the value had retested the identical assist degree – earlier occasions resulted in a large rally.

Supply: TradingView

The bearish efficiency put the value throughout the RSI’s 50% degree at press time. This meant that the possibilities of a pivot had been considerably greater with these two indicators. Presently, Litecoin’s MFI was already displaying indicators of liquidity inflows. This was additionally proof of elevated whale exercise throughout the assist vary.

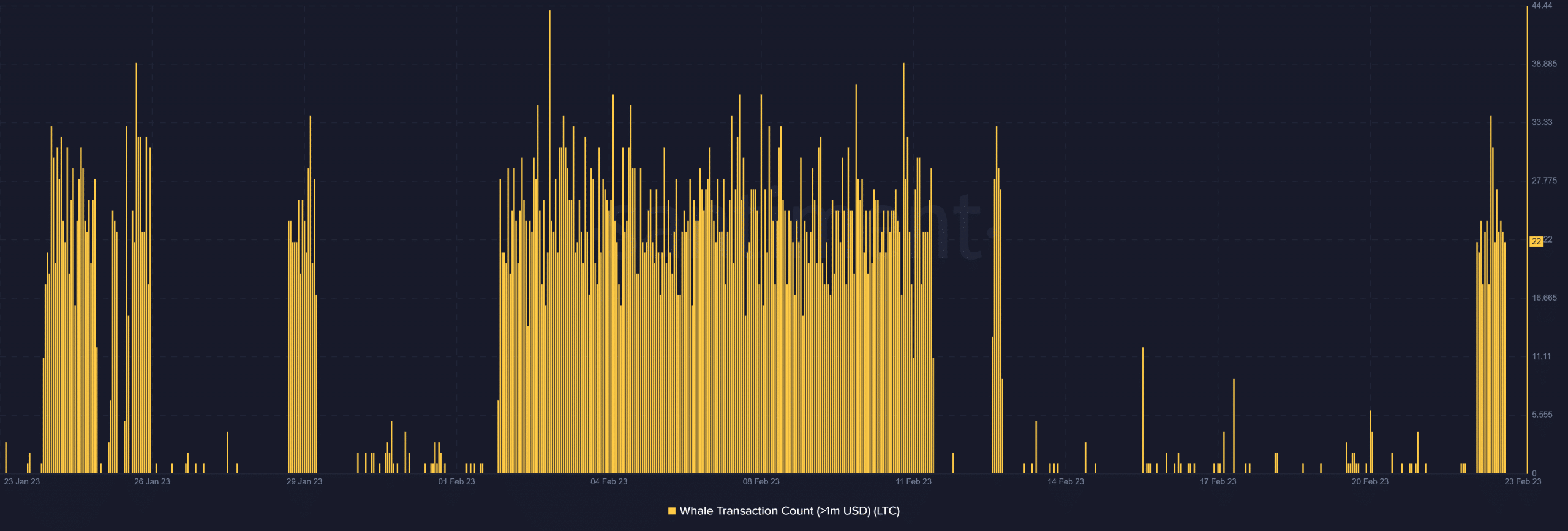

LTC’s whale transaction depend demonstrated a powerful surge within the final 24 hours on the time of writing. In distinction, the identical metric confirmed low transaction exercise in the previous couple of days since mid-February.

Supply: Santiment

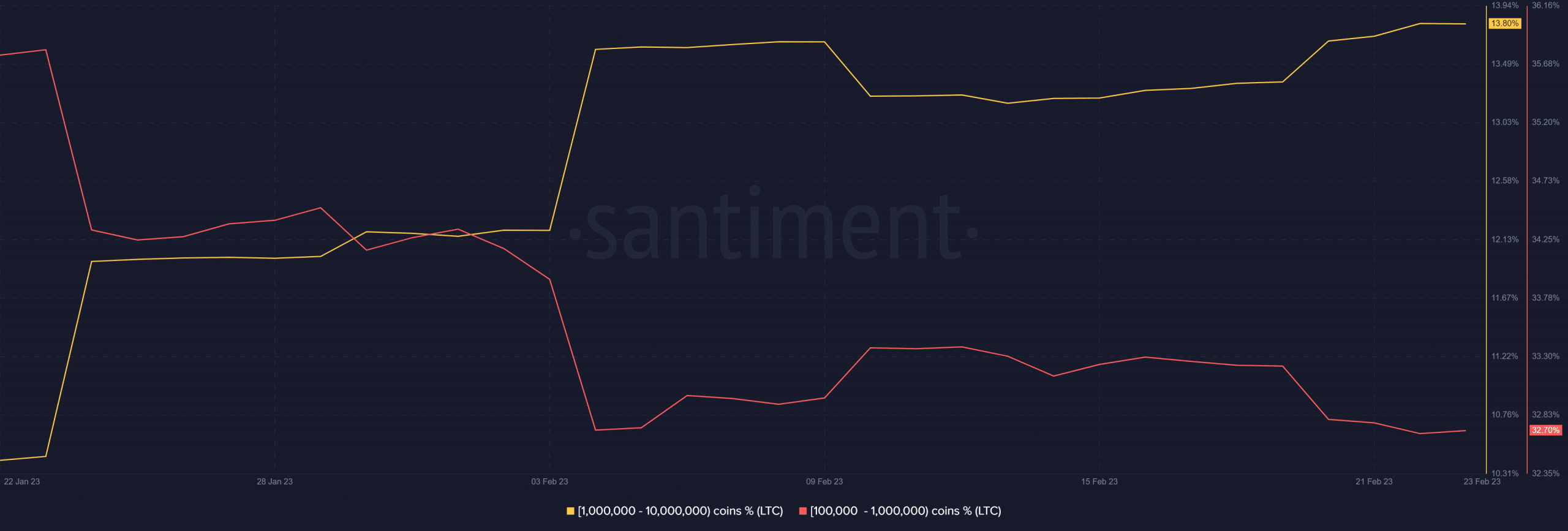

A provide distribution evaluation confirmed the directional momentum of this whale exercise. Addresses holding between 100,000 – 1 million LTC cash ceased contributing to promote stress. This was an necessary remark, as this class managed the most important share of Litecoin in circulation.

Supply: Santiment

As well as, addresses holding over a million cash have elevated their balances in the previous couple of days. This meant that high whales had been contributing to a rise in shopping for stress in the previous couple of days. Merchants might thus anticipate a bullish pivot if the shopping for stress intensified.

Reasonable or not, right here’s Litecoin’s market cap in BTC’s phrases

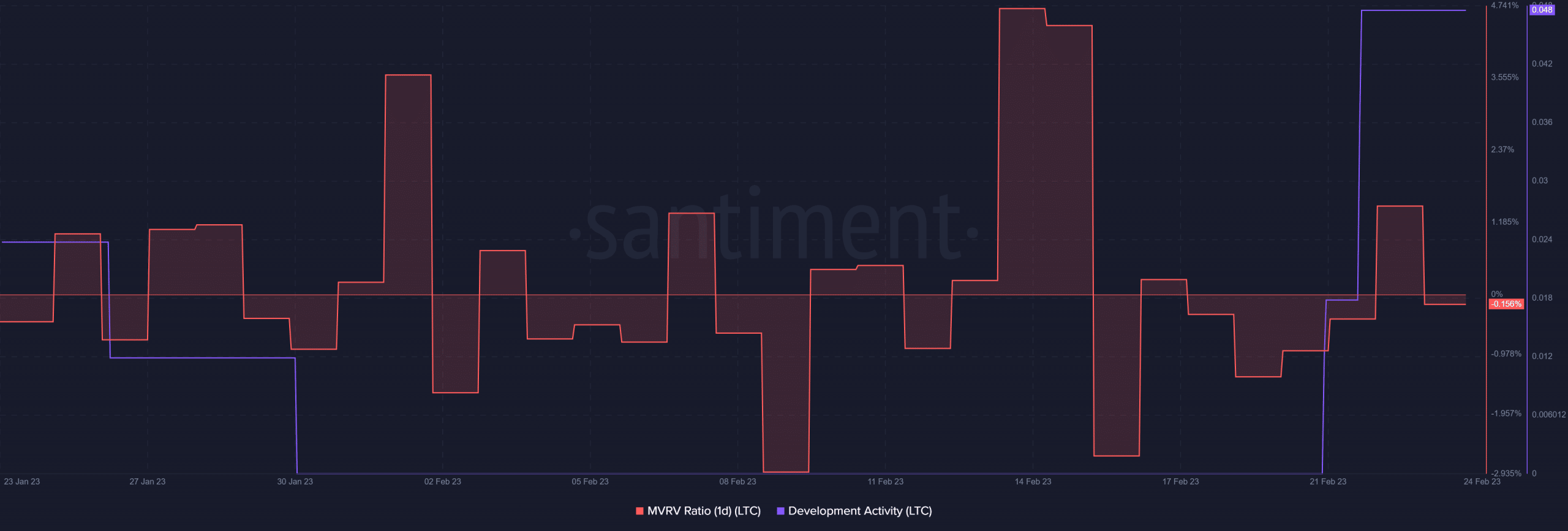

There was already a surge within the MVRV ratio from its lowest month-to-month vary on 18 February. This confirmed the return of some shopping for stress, as indicated by the availability distribution. It was price noting that the identical MVRV ratio dropped considerably between 22 and 23 February due to the bearish market situations throughout this era.

Supply: Santiment

Litecoin buyers and fanatics also needs to notice the current surge in improvement exercise. This end result might present an even bigger investor confidence increase, together with all the opposite beforehand talked about elements. However there may be nonetheless a chance that Litecoin bears would possibly preserve dominance if the market situations allowed.

![Litecoin [LTC] retests support after bearish cycle: Will bulls emerge victorious?](https://nomadabhitravel.com/wp-content/uploads/2023/02/LTCUSD_2023-02-23_21-32-28-1024x413.png)