- MakerDAO’s RWA holdings led to income amid stablecoin market points.

- Protocol maintains stability however faces a decline in distinctive customers.

The stablecoin market confronted a big problem as USD Coin [USDC] got here beneath scrutiny. MakerDAO, the protocol behind stablecoin DAI, additionally felt the affect. However regardless of this, MakerDAO noticed income, because of its RWA holdings.

Is your portfolio inexperienced? Try the Maker Revenue Calculator

In response to information supplied by Delphi Digital, MakerDAO made a $3.8 million revenue via its RWA holdings. These holdings contribute considerably to MakerDAO’s general earnings, making up 11.6% of its complete holdings. Actual World Asset (RWA) is a kind of collateral that’s not cryptocurrency-based however is extra conventional and tangible, reminiscent of U.S. Treasury Payments and Bonds.

.@MakerDAO has profited $3.8M via their investments in U.S. short-term treasuries. pic.twitter.com/q10AkGxLn8

— Delphi Digital (@Delphi_Digital) March 15, 2023

Having a better look

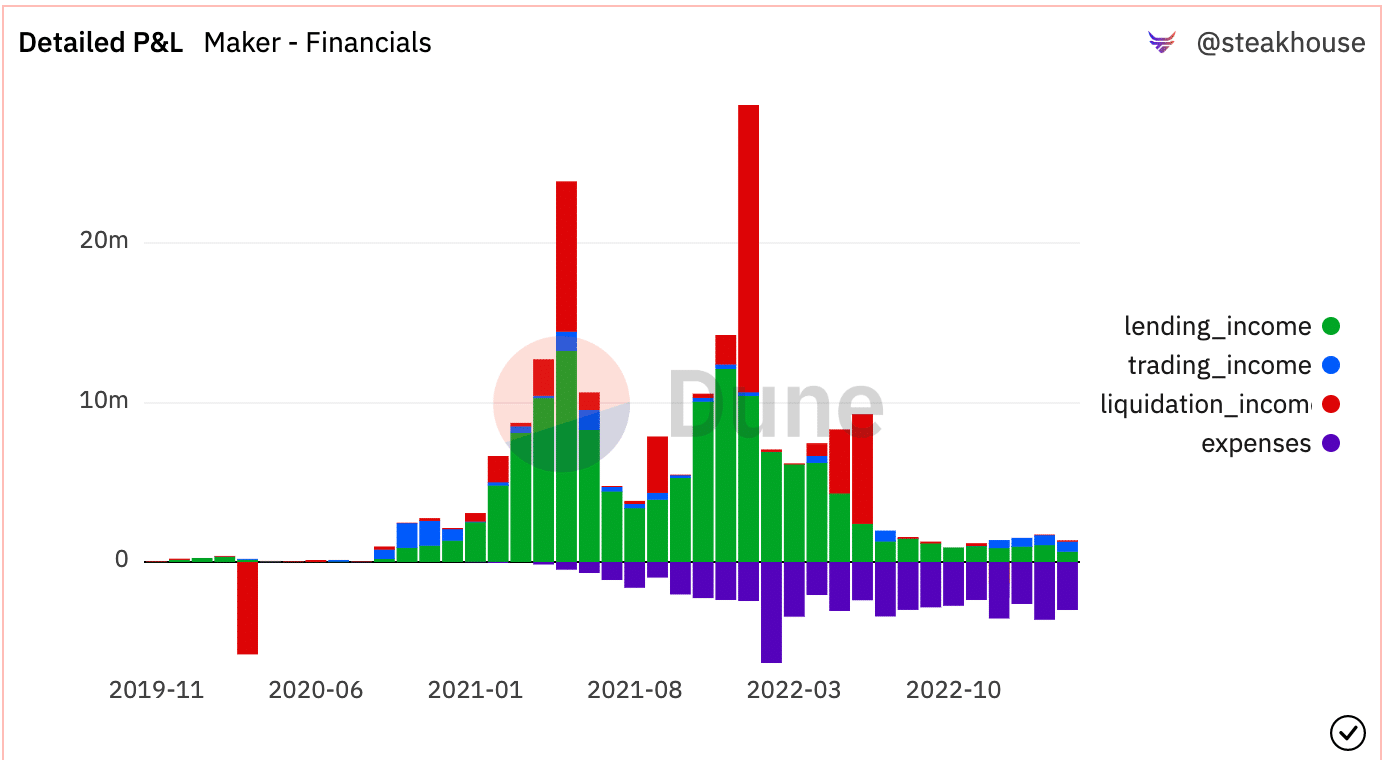

Nonetheless, MakerDAO’s PnL assertion painted a damaging outlook because of excessive bills on upgrades and updates. A good portion of MakerDAO’s earnings are probably being spent on upgrading and sustaining the protocol. These bills outweighed their earnings, resulting in a internet loss for MakerDAO.

Supply: Dune Analytics

Nonetheless, MakerDAO’s current proposal to create PSM circuit breakers exhibits its dedication to bettering its protocols, contemplating the market’s volatility. This proposal will enable Maker governance to disable a PSM instantly with out governance delay. This step will make sure that the protocol can react rapidly to market adjustments and preserve stability.

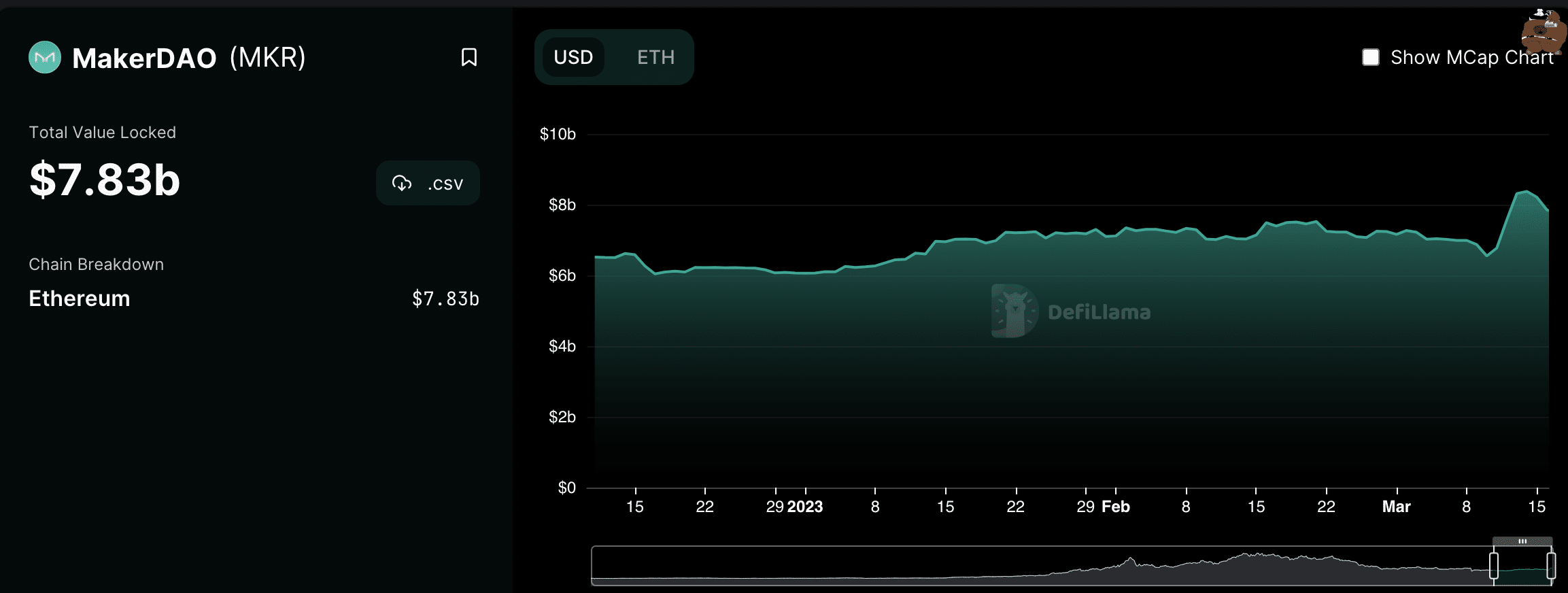

The state of the protocol was comparatively wholesome as the amount on MakerDAO elevated by 55% over the previous month. This exhibits that regardless of the challenges confronted by the stablecoin market, MakerDAO has maintained its momentum.

Nonetheless, the variety of distinctive customers in the identical interval declined by 14% based on Messari’s information. This decline has affected the general TVL generated by MakerDAO, resulting in a decline over the previous few days.

Supply: Defi Llama

Learn Maker’s [MKR] Worth Prediction 2023-2024

MKR and DAI

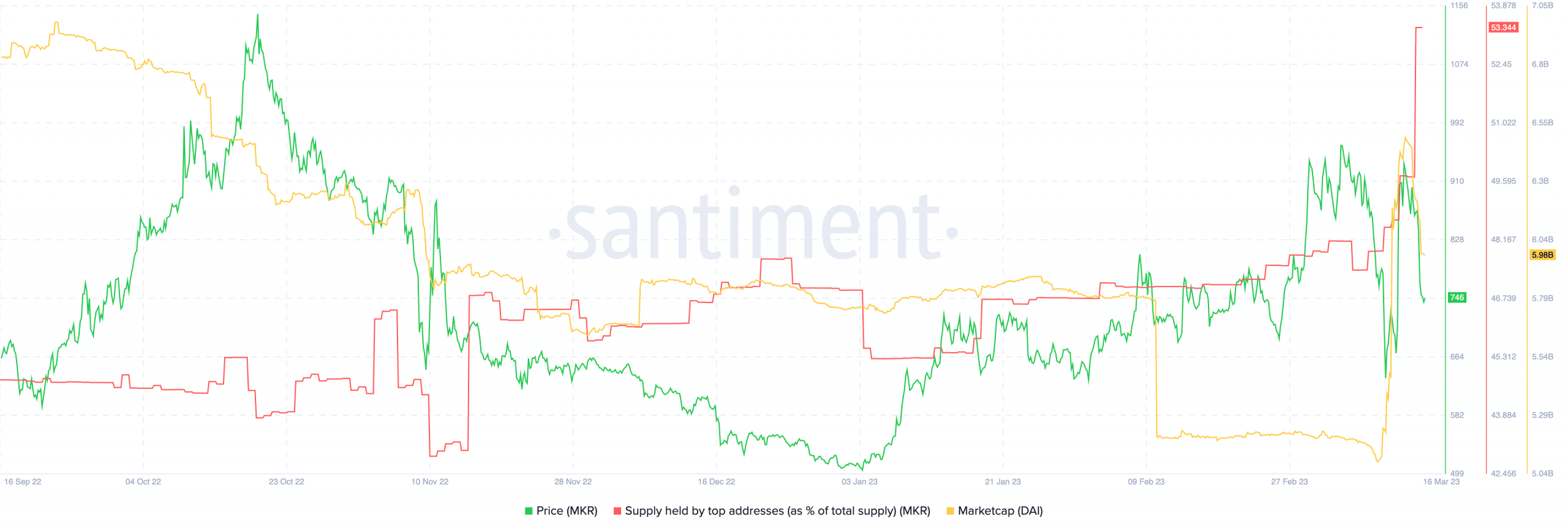

Together with a decline in TVL, MKR token’s costs declined.

Nonetheless, whale curiosity within the token skyrocketed. This curiosity from whales might be because of the truth that the market cap of DAI elevated materially over the previous couple of days. This curiosity in each MKR and DAI indicated the potential for future income and perception within the long-term viability of the protocol.

Supply: Santiment