- MakerDAO has proposed allocating a further $750M to spend money on U.S Treasury bonds

- As of January 2023, this funding technique had generated $2.1 million in lifetime charges

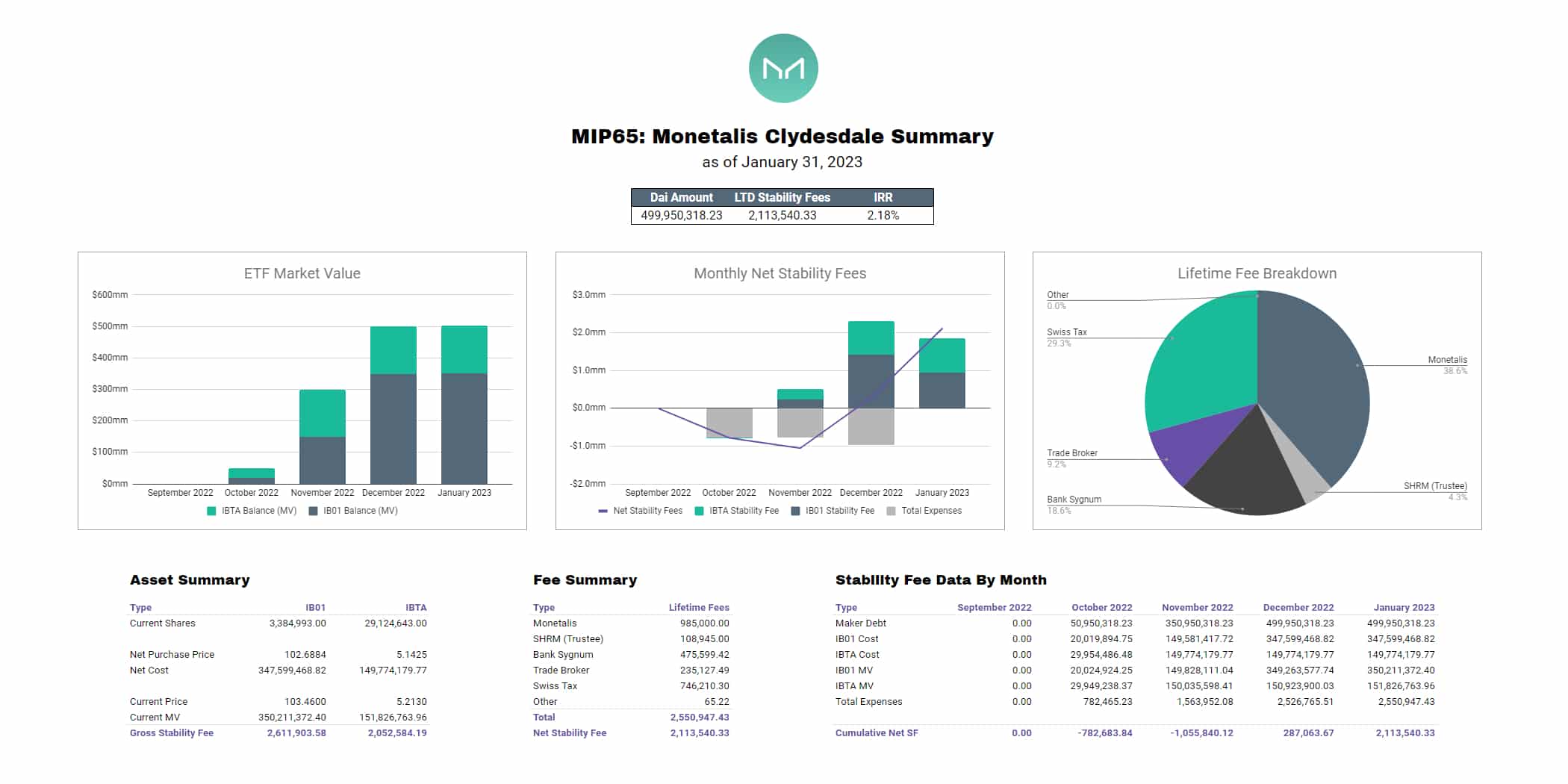

MakerDAO, the decentralized autonomous group (DAO) behind the DAI stablecoin, has proposed allocating a further $750 million to spend money on U.S Treasury bonds in an effort to capitalize on a positive yield surroundings. The decision, if handed, would add $750 million to the $500 million already authorised in October 2022, bringing the full worth to $1.25 billion.

As part of the brand new proposal, the DAO would spend money on six-month U.S Treasury notes through a ladder technique with a bi-weekly rollover. This might indicate that the maturities of the bought notes could be evenly distributed over your entire interval. Maker would be capable of swap to a extra complicated or totally different ladder scheme, if obligatory.

Maker needs this allocation to occur as quickly as doable in order that it may well benefit from the present yield surroundings as a lot as doable.

A choice to allocate $500 million to Treasury funds was first introduced in June final 12 months. It was famous on the time that it may help Maker in decreasing counterparty and credit score danger – Crucial given the market turmoil. Maker’s first funding within the Treasury was meant to assist additional stabilize its DAI stablecoin, which was already over-collateralized on the time.

A sound technique for MakerDAO

As of January 2023, this funding technique had generated $2.1 million in lifetime charges for the Maker Protocol.

Supply: Dreamstime

Monetails CEO Allan Pederson claimed that his staff discovered the answer of laddering U.S Treasury over a six-month interval with bi-weekly maturities, presenting a robust, versatile, and an efficient resolution for Maker. He talked about the low prices, tax effectivity, and inherent liquidity as advantages of the technique.

Maker has continued to develop and is now one of the highly effective entities within the DeFi area. The MakerDAO neighborhood voted 73% towards Cogent Financial institution’s bid to borrow $100 million from its platform. The neighborhood, however, had approved an identical mortgage of $100 million to a different financial institution, Huntingdon Valley Financial institution, bringing in additional conventional monetary entities.