Within the historical past of the cryptocurrency market, stablecoins have performed a vital function in stabilizing merchants’ earnings. In line with the newest crypto market information, stablecoins have a reported valuation of roughly $130.8 billion and a 24-hour buying and selling quantity of about $28 billion.

For Additional Context: Stablecoin Vs Fiat Currencies: Options, Distinction, And Elements.

Stablecoin Denominations

As international crypto laws improve, stablecoins denominated in numerous international currencies have emerged. Among the many prime traded stablecoins are these denominated in the USA greenback, the Euro, and the Japanese Yen, amongst others. This pattern permits merchants to carry belongings of their most popular foreign money and keep away from fluctuations in worth as a consequence of foreign money change charges.

Which Stablecoins Are The Whales Accumulating?

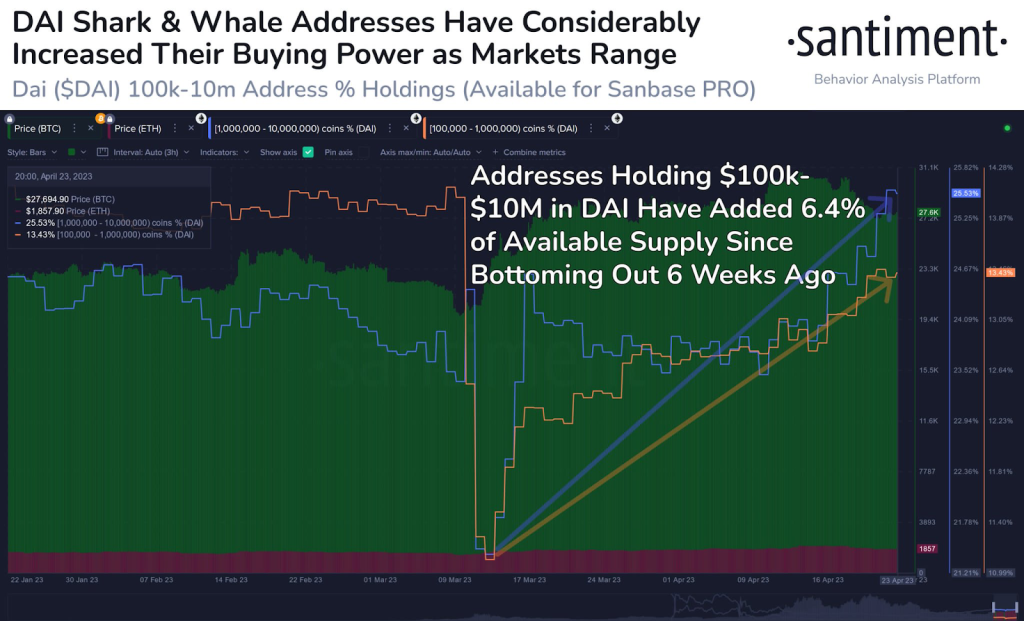

In line with a research carried out by market intelligence platform Santiment, crypto sharks and whales are accumulating prime secure cash like MakerDAO’s DAI. Because the crypto market led by Bitcoin ranged round $28k, Santiment famous that giant crypto traders elevated their fee of stablecoins accumulation. Notably, DAI is a favourite amongst crypto customers preferring to generate stablecoins on their phrases.

“Even with crypto markets rollercoastering in April, prime stablecoins like $DAI are being amassed by sharks & whales. Since $DAI was exchanged for pumping $BTC & $ETH in mid-March, $100k-$10m DAI addresses have added 6.4% of the provision again since.”

Governance by MKR Token Holders

Furthermore, a neighborhood of MKR token holders governs the Maker protocol and the good contracts that energy DAI stablecoins. This decentralized governance mannequin allows token holders to vote on modifications to the protocol, together with setting the steadiness charge and figuring out the collateralization ratio.

Declining Market

Nonetheless, a just lately revealed report by Glassnode indicated that the stablecoins market has continued to shrink from its peak of round $161 Billion. The decline can partially be attributed to the autumn of the Binance-backed BUSD earlier this 12 months. Nonetheless, the general stablecoins market stays vital and is important to the cryptocurrency market’s stability.