- Following the bulletins to make Silicon Valley Financial institution (SVB) depositors complete, MKR’s value rallied by double digits.

- Resulting from DAI depeg, MakerDAO’s payment revenue slipped by 10% over the weekend.

In response to current developments, Maker’s [MKR] value skilled a considerable improve of practically 30% within the final 24 hours.

This surge adopted the announcement by Federal regulators to completely restore all deposits at failed Silicon Valley Financial institution (SVB). Moreover, fintech firm Circle made a statement to cowl any of its stablecoin USDC reserves, which additional bolstered market confidence.

Circle’s USDC operations will open for enterprise on Monday morning, together with with new automated settlement by way of our new partnership with Cross River Financial institution. https://t.co/ybkSEedzrC

— Jeremy Allaire (@jerallaire) March 13, 2023

MKR’s value had seen solely double-digit declines for a lot of the weekend prior to those bulletins.

Additional, these bulletins have additionally helped drive up the values of de-pegged stablecoins DAI and USDC. At press time, each cash traded at $0.99 and geared toward reclaiming their $1 peg earlier than the top of buying and selling at the moment, per knowledge from CoinMarketCap.

Is your portfolio inexperienced? Try the Maker Revenue Calculator

MKR holders have a trigger to smile

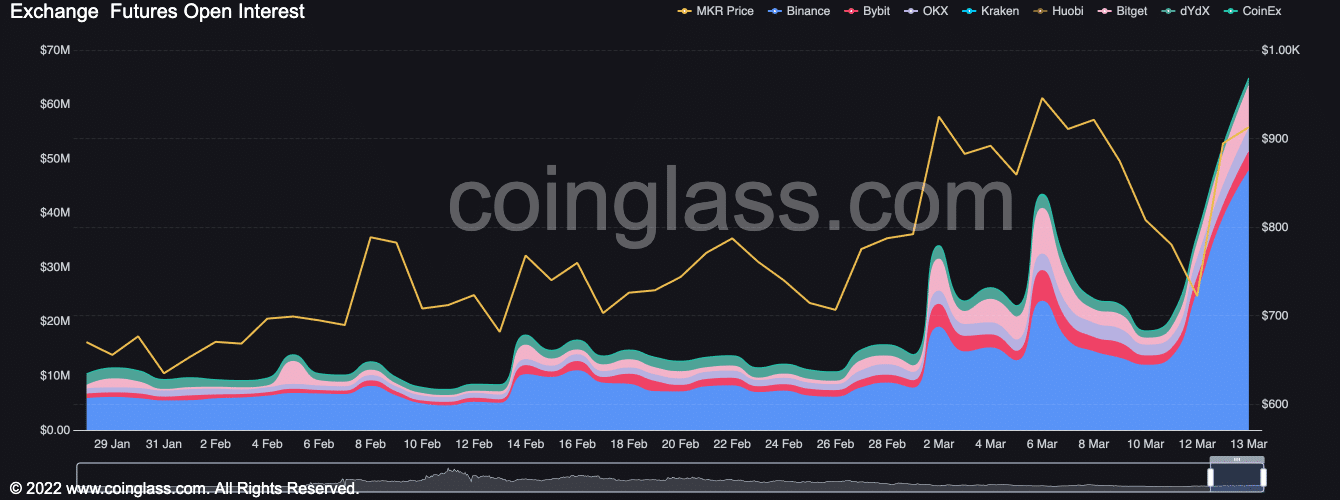

At press time, MKR exchanged arms at $915.60. With improved sentiment within the final 24 hours, MKR’s Open Pursuits shot up considerably, per knowledge from Coinglass. At $64.87 million at press time, MKR’s Open Pursuits rallied by 24% within the final 24 hours.

A leap in a crypto asset’s Open Curiosity is a considerably bullish sign, indicating that the variety of excellent contracts or positions for that asset has elevated. It additionally displays elevated buying and selling exercise and improved market sentiment for a selected crypto asset.

Supply: Coinglass

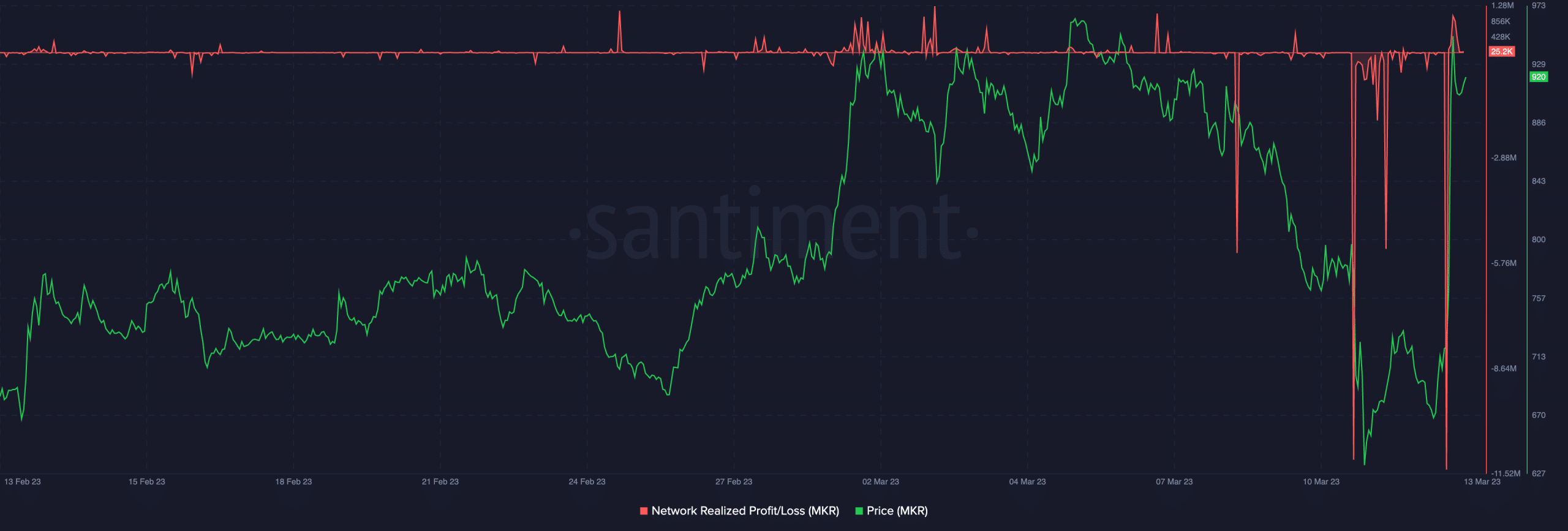

As well as, an evaluation of MKR’s on-chain efficiency revealed a dip in its Community Revenue/Loss ratio instantly earlier than the value rally.

Usually, NPL dips typically sign short-term capitulation of ‘weak arms’ and the re-entry of ‘good cash,’ in line with Santiment. Because of this “they have a tendency to coincide with native bounce backs and intervals of value restoration.”

Supply: Santiment

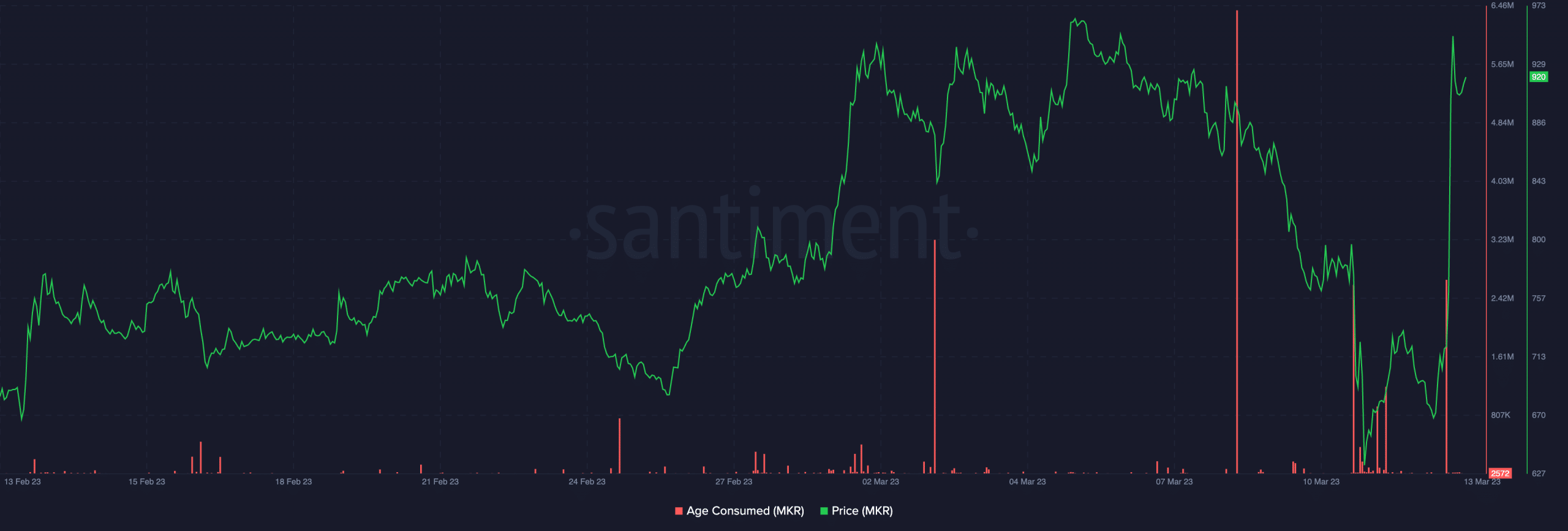

Moreso, improved sentiment led to a spike in MKR’s Age Consumed after the bulletins had been made. This spike earmarked an area backside and corresponded with a pointy uptick in MKR’s worth.

A rise in an asset’s Age Consumed metric signifies a major switch of inactive tokens to new addresses, indicating a sudden and important change within the habits of long-term holders.

Lengthy-term holders are usually affected person and cautious, so any sudden motion of idle cash could also be related to important modifications in market circumstances.

Supply: Santiment

Learn Maker [MKR] Worth Prediction 2023-24

Maker nonetheless has to take care of the income decline

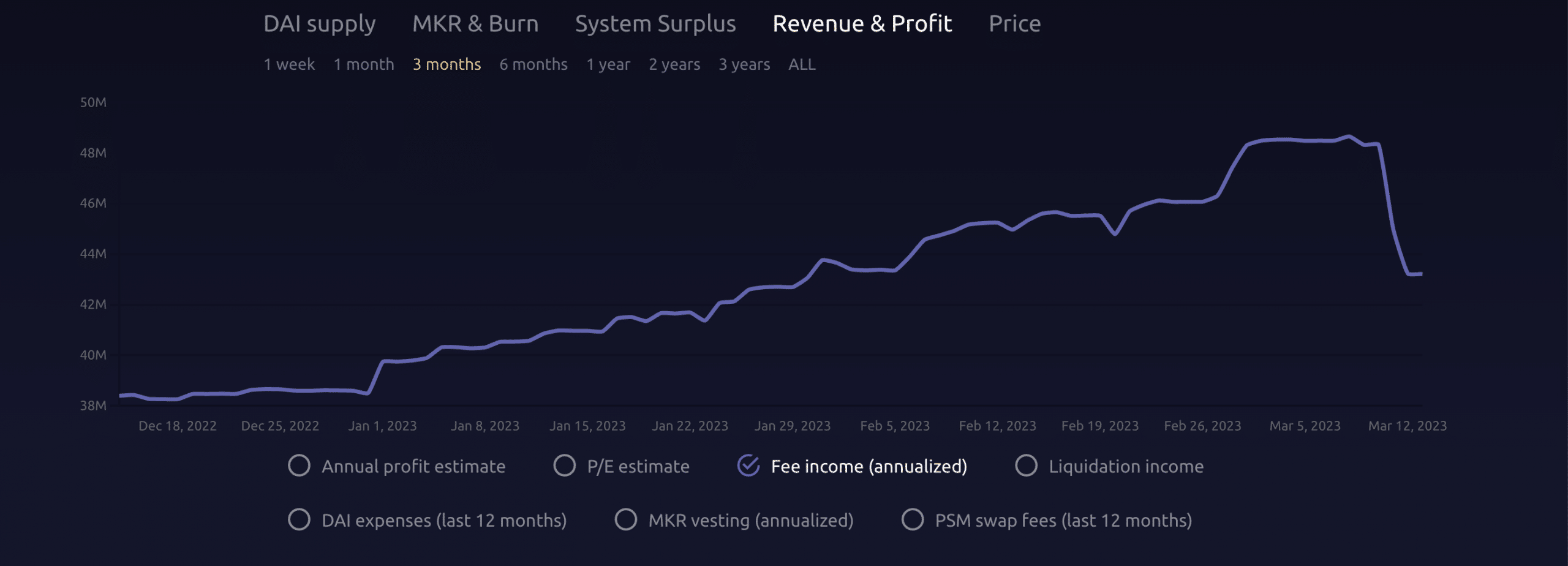

Resulting from DAI’s de-peg and drop in worth up to now few days, MakerDAO suffered a decline in its payment revenue (annualized), knowledge from Maker Burn revealed.

This stood at 43.21 million DAI at press time, having fallen by 10% over the weekend. That is anticipated to embark on an uptrend as soon as DAI reclaims its $1 peg.

Supply: Maker Burn