All funds and NFTs are secure. No motion is required presently. The mission is suspended and can’t provoke new loans. The suspended state is to guard all belongings within the protocol. They verify that no funds are misplaced. The mission additionally mentioned that it has efficiently executed a white hat restoration script, saving all ERC20 and ERC721 belongings of all LPs and debtors. All info might be up to date for customers as quickly as doable.

On June twentieth, 4:42 am UTC, @AstariaXYZ was made conscious of a problem with the bottom implementation of BeaconProxy.sol permitting an attacker to govern the beacon into loading a rogue implementation that might let the attacker name self-destruct.https://t.co/iDvxLN4rk0

— Astaria (@AstariaXYZ) June 20, 2023

Astaria has been in public beta since Might 25. The restoration script makes use of an up to date contract implementation and the Restoration Token, which has withdrawn all funds and NFTs to Astaria’s multi-signature deal with.

Non-fungible token lending platform Astaria has gone public after a prolonged closed beta interval. The platform was co-founded by former decentralized finance (DeFi) protocol SushiSwap CTO Joseph Delong. NFT holders can lease their belongings to merchants who can’t afford blue-chip NFTs in a single buy. With assist for over 300,000 NFTs, Astaria seeks to inject liquidity into the bigger Ethereum-based NFT ecosystem.

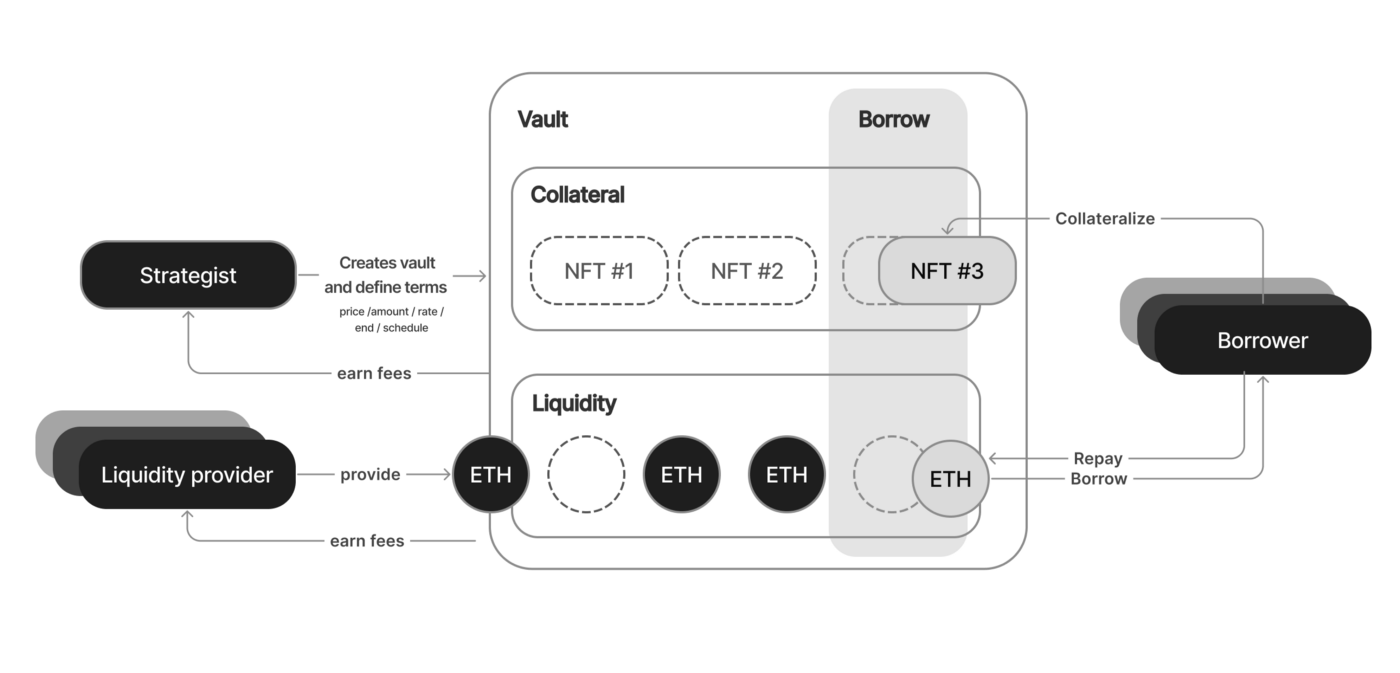

The Astaria protocol makes use of the three-actor mannequin

Not like different NFT lending platforms that work peer-to-peer with debtors and lenders, Astaria makes use of a 3rd celebration to facilitate its lending market, tapping into its NFT due diligence service. The upshot to performing as a “strategist” will assist liquidity suppliers enter the market whereas aiding debtors in leasing their properties.