NFT

NFT traders and artists have had a tough April. Each buying and selling quantity and distinctive customers hit lows not seen since July 2021, and the royalty wars have artists in an limitless market blacklisting cycle.

The phrase, “we’re nonetheless early” is now previous. Early and new adopters want it like a cigarette addict sucks dopamine from a nicotine patch.

In conventional markets, chasing novelty is a shedding technique, resulting in cynicism in occasions of alternative and over-optimism in occasions of prudence.

The NFT market, although, is a singular beast as a result of it’s a direct monetization of novelty. Like the normal artwork market, it follows the intangible whims of originality and mimetic need – however at lighting velocity.

Regardless of the obvious randomness of those whims, they do observe cyclical patterns of change. These historic lows amid {the marketplace} battle for customers is an indication that the NFT trade is coming into a brand new period of investing. However earlier than we clarify why and the way, we have to evaluate NFT investing fundamentals.

What makes an NFT beneficial?

In some unspecified time in the future, you’ve gotten in all probability learn that the worth of NFTs comes from their demand. This round and lazy reasoning misses the query by a mile. NFT collections derive worth from the power to encourage new and unique non-fungible works. It’s finally measured by their potential to form and pull from the collective unconscious.

For instance, the variety of spin offs of the Bored Ape Membership assortment demonstrated that the challenge tapped right into a deeper societal meme – one thing that might be replicated with little issue. It launched the idea of monkey NFTs and is now thought of a blue-chip asset within the area.

As soon as the idea behind a group stops inspiring new works, the novelty and buying and selling quantity of the gathering tends to drop because the meme fades to black. However just like the demise of a god, new memes are all the time prepared and desperate to fill a emptiness. They will even pull forgotten artistic endeavors again into the highlight.

The perfect method to NFT investing is to review markets the identical approach you’ll a Greek pantheon. You need to map the hierarchy of ruling memes, how they differ, the size of their dynasty, and their potential usurpers. NFT traders usually check with this narrative mapping because the meta – a sequence of things that hold an NFT assortment alive and related. Here’s a transient checklist.

Shortage

NFT traders are inclined to view the shortage of a group as a key indicator of its worth. They consider it a number of methods. First they measure the limitation of provide. For instance if a challenge units a everlasting cap to a group’s provide, its collectors might understand the NFTs as extra beneficial and unique.

Secondly, they have a look at the rarity inside the assortment. If there’s a distribution of traits that produce frequent, uncommon, and extremely uncommon NFTs, it may possibly generate a way of urgency and competitors inside collectors. Better complexity and depth of which means tends to draw extra critical and dedicated collectors.

The well-known success of CryptoPunks is an ideal instance. The creators completely capped the gathering at 10,000. And inside the set, there are numerous ranges of rarity primarily based on the traits of every character. Some CryptoPunks have frequent options, whereas others have uncommon or ultra-rare attributes, comparable to distinctive hairstyles, equipment or facial expressions.

Neighborhood

A powerful NFT neighborhood offers social validation and credibility. This could appeal to extra collectors, traders and lovers, resulting in elevated demand and better costs. It could actually additionally create a community impact, the place the worth of the NFT assortment will increase as extra folks be a part of the neighborhood and take part within the ecosystem. This sample provides to the shortage by rising competitors.

These neworks foster collaboration and partnerships between new and current creators. The synergy finally helps propagate the broader meme in new and attention-grabbing methods.

Performance

Collectors and traders could also be extra inclined to buy NFTs with particular use instances or functions, which might drive up demand and costs. For instance, NFTs can symbolize in-game gadgets, characters or property which have utility inside a selected recreation or digital world. The extra helpful or highly effective these property are, the upper their worth may be. They will additionally grant holders unique entry to occasions, content material or experiences.

Moreover, NFTs which have a connection to real-world property can enhance their worth. Examples embody NFTs that symbolize bodily artwork, actual property or tickets to stay occasions.

Kind

Kind, and aesthetic and creative qualities of an NFT assortment, can play a major position in figuring out its worth. There is no such thing as a limitation to type. It may be a JPEG, music file, textual content, video, area handle, digital land, and even geo coordinates.

Nevertheless, the preferred NFTs are inclined to gravitate towards one type. For instance, the highest 5 NFT collections are all JPEGs.

The visible attraction, design, and uniqueness has extra variation between the main NFTs. Collectors like to judge popular culture attraction, evaluate storytelling depth and general creative high quality. Kind is one the highest elements in most traders’ meta and investing technique.

Many commit their time to predicting what fashion or animal will turn out to be common sooner or later. This phenomenon tends to be a self fulfilling prophecy the place if a gaggle of traders predict that folks will purchase penguins sooner or later, they would be the ones to satisfy their prophecy. These tendencies although are generally socially engineered in a solution to prey on secondary traders.

Creator royalties

The significance of creator royalties is a scorching matter of debate. Some traders argue that royalties add worth as a result of they supply higher sustainability to artists and create a more healthy ecosystem. In addition they incentivize higher funding from the artist to advertise the gathering and type new collaborations and partnerships.

Different traders keep away from collections or marketplaces that implement royalties due to the added value. If their buy is a short-term funding, then charges take a higher minimize in revenue margins.

Learn extra: How NFT Royalties Work and Generally Don’t

Advertising and marketing

A powerful social media presence may help an NFT assortment attain a wider viewers, create a neighborhood and have interaction with potential patrons. Platforms comparable to Twitter, Instagram, Discord and Reddit are sometimes used for promotion and community-building.

Moreover, collaborating with influencers, artists, or celebrities can enhance the visibility and credibility of an NFT assortment. These partnerships can appeal to new audiences, generate hype, and create a way of exclusivity across the assortment.

However influencer advertising and marketing has additionally been used deceptively. For instance, a category motion lawsuit alleged that Paris Hilton and Jimmy Fallon uncared for to reveal that they had been paid to advertise Bored Ape Yacht Membership NFTs. Many different influencers have additionally been unknowingly pulled into selling initiatives that will later get rug pulled.

Psychology of NFT Investing

NFT investing could also be a singular beast that performs by a unique algorithm, but it surely’s not pure chaos. To know the psychology of investing, we have to evaluate the historical past of meme idea.

Meme idea

Meme idea is the psychological and philosophical research of how concepts, symbols and tales unfold via tradition and historical past. The primary to review this, Rene Girard, believed {that a} central part of the phenomenon is mimetic need – the assumption that people are wired to mimic the will of others.

Richard Dawkins was the primary to coin the time period “meme” and outlined it as models of cultural transmission. Dawkins believed that via the pressure of pure choice, memes search their very own survival as if they’re a residing organism.

Historical past exhibits that some memes are extra contagious and helpful than others. And whether or not by pure choice or some mysterious pressure, they type tremendous buildings that always compete for consideration and adoption. This dynamic and contentious tapestry is why the Greek pantheon and usurper delusion is a becoming analogy. Every area of interest, like NFT investing, is a microcosm of what’s occurring on a world scale. So for the aim of readability, let’s outline a few of these phrases as they relate to NFTs:

Meme: An concept of what an NFT may be (not the NFT itself)

Instance: The monkey NFT and penguin NFT memes

Each meme has a narrative arc, which may be mapped to raised perceive the present stage and potential way forward for a selected NFT pattern. NFT investing entails figuring out the place a meme is in its arc and predicting its trajectory.

This requires some creativity and storytelling fundamentals. For instance, to gauge the standing of the meme of Penguin NFTs, an investor would use market knowledge and social sentiment to plot a narrative arc of it in relation to its rivals. This perception permits traders to capitalize on alternatives and navigate dangers related to the ever-evolving NFT panorama.

Meta narrative: A hierarchical checklist of traits that make an NFT extra beneficial than others

Instance: The prioritization over type than operate

All memes inside a given area of interest and period observe a meta narrative. These archetypal patterns symbolize the shared traits and values driving the recognition of sure NFTs. These narratives get extra summary than the memes themselves. However traders ought to pay attention to the competing narratives inside the NFT area and acknowledge that these narratives all have expiration dates (some later than others) and can finally evolve or get left behind.

Meta cycle: The emergent narrative driving the worth behind all or most NFTs

Instance: That is tougher to pin down as a result of it’s the invisible venn diagram of all shared meta narrative traits

Meta cycles embody the overlapping parts of those narratives and function a mirrored image of the collective habits of the NFT market. At any given time, there can solely be one NFT meta cycle, which dictates the general route of the market. Understanding the present meta cycle helps traders determine patterns and tendencies, offering beneficial context for his or her funding choices.

Analyzing NFT meta narratives

One of many main narratives surrounding NFTs is the thought of supporting artists and creators via a sustainable revenue stream. This ruling narrative was challenged when NFT marketplaces stopped implementing royalties. This sparked a serious divide between communities and the marketplaces themselves.

Whereas backlashes ensued, a rival dealer’s first narrative emerged. This meta prioritizes the potential of NFTs as speculative property over different traits and argues that royalties restrict the market as a complete from potential upside.

This rigidity finally got here to a head between NFT marketplaces OpenSea and Blur.io. Blur initially adopted the pattern of most marketplaces and dropped royalties and all buying and selling charges to embrace a trader-first narrative. They even created buying and selling incentives via airdropping a loyalty token.

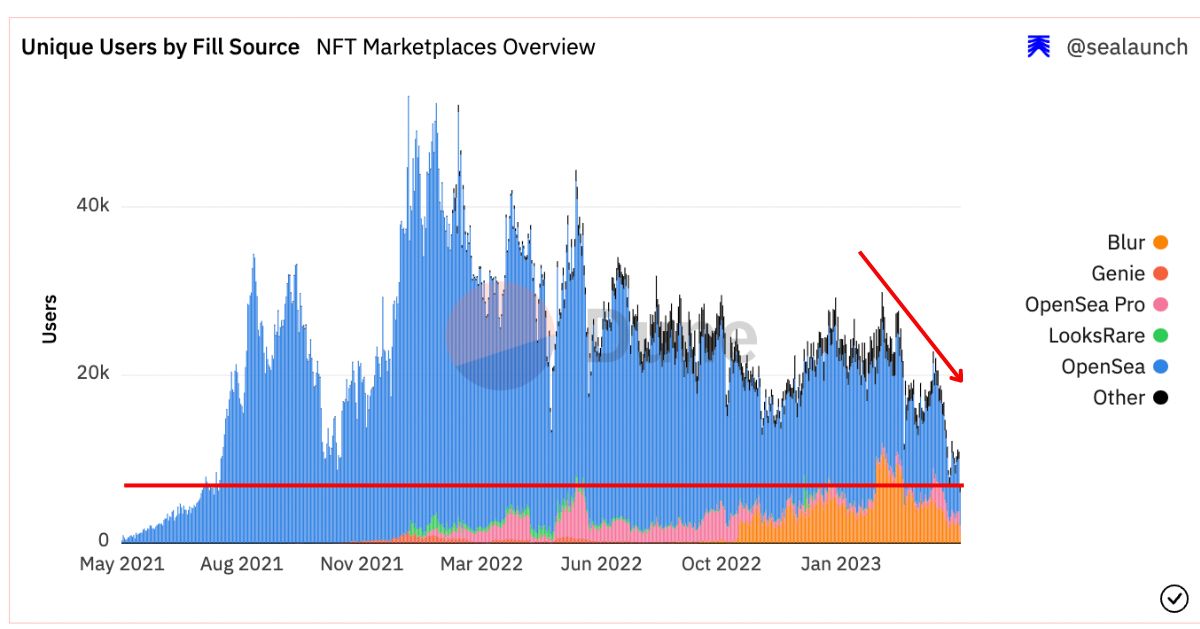

This shift in narrative initially created a surge in buying and selling quantity in mid February 2023 and even helped Blur.io flip OpenSea as {the marketplace} with probably the most buying and selling quantity.

Supply: @sealaunch

Previous to this surge, in November 2022, OpenSea applied a coverage that required collections to dam non implementing marketplaces like Blur in the event that they wished royalties on OpenSea.

This infected the competition between the rivals. Blur initially tried and didn’t make a approach for creators to get across the blacklist. After which on Feb. 15, 2023, sooner or later after the token airdrop, Blur reinstated royalties with a clause requiring collections to dam OpenSea.

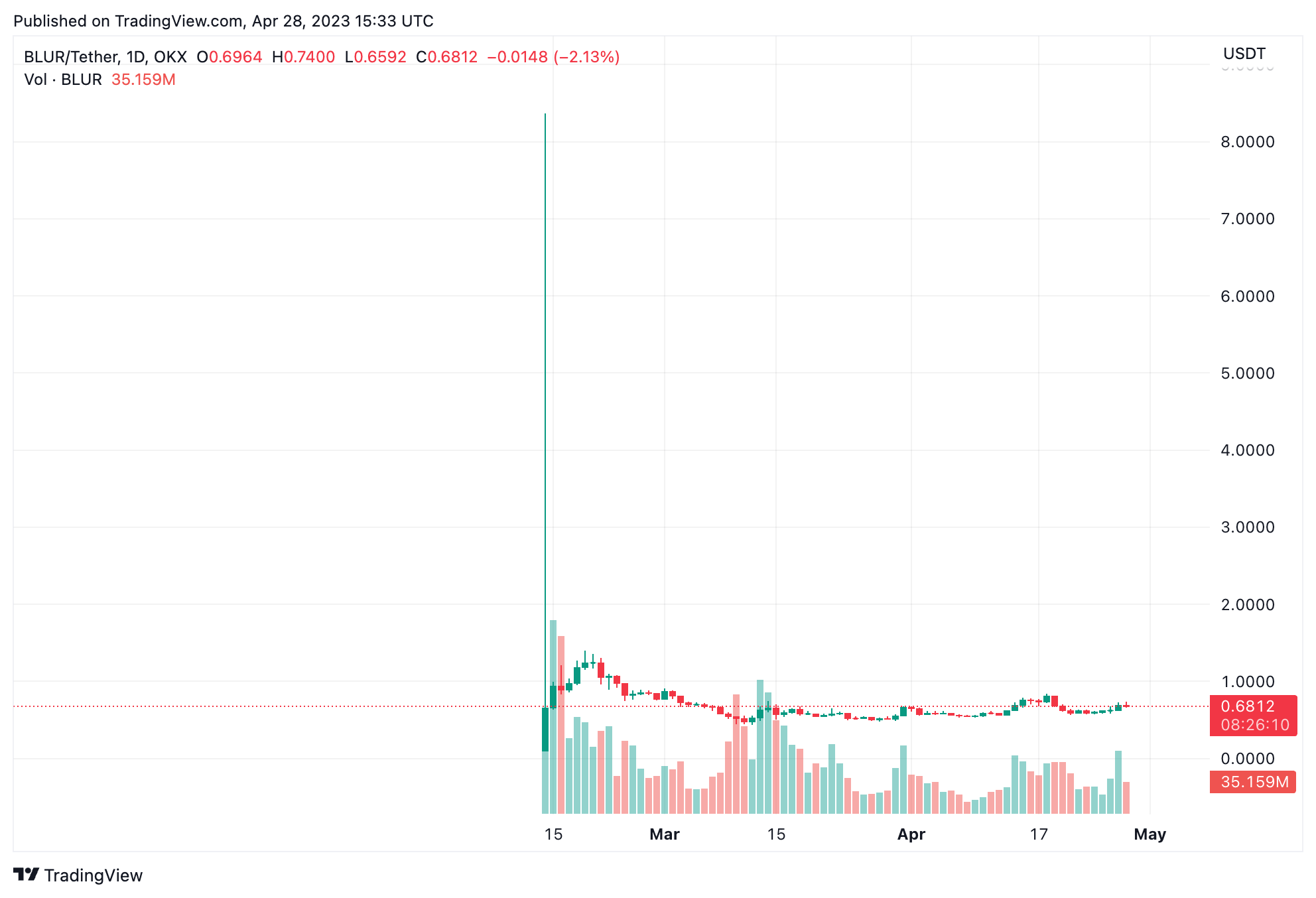

With the surge in quantity from the Blur airdrop, this motivated many collections to observe go well with in blocking OpenSea. However the worth of the BLUR token has dropped from $5 on Feb. 14, 2023 to the $0.60 vary on the time of writing – making it tougher to incentivize buying and selling.

Supply: TradingView

NFT buying and selling itself has adopted an analogous decline in curiosity. Distinctive customers dropped to lows not seen since Aug. 2021.

Supply: @sealaunch

The subsequent period of NFT investing

Some like Erick Calderon, the artist and founder behind distinguished NFT studio ArtBlocks see this market battle as a “race to the underside.” Some creators view the trader-first narrative as a approach for hype and hypothesis to finally suck out all the worth of current works. They consider that low charges and airdrop gimmicks are a meme fated to die quickly. And perhaps the present market is a sign that we’re on the cusp of a brand new meta cycle.

It’s onerous to say precisely what is going to substitute it, however rising recognition in Bitcoin NFTs comparable to Taproot Wizards, the approaching Amazon NFT market, developments in gaming NFTs and main media pivots from NFT initiatives like Doodles might provide clues.

Steadily requested questions on NFT investing

How do you purchase and promote an NFT?

You should buy and promote NFTs on common platforms like OpenSea, Blur.io and Rarible. Anybody who needs to buy an NFT on certainly one of these platforms might want to arrange a digital pockets able to holding non-fungible tokens, after which fund it with a cryptocurrency, comparable to ether (ETH). Then it would be best to join it to {the marketplace} via a browser extension. If you wish to use a {hardware} pockets, extensions like Metamask can join it in your behalf. Then you should utilize the pockets to signal the transaction obligatory to buy the NFT.

Promoting an NFT is equally easy. Start by itemizing your NFT on a market that helps the particular token commonplace of your asset (e.g., ERC-721 or ERC-1155). Add your NFT, and supply obligatory particulars, such because the title, description, and any royalties you’d wish to obtain for secondary gross sales. Set a worth to your NFT or go for an public sale format to permit potential patrons to bid in your asset.

Learn extra: The Investor’s Information to NFT Marketplaces

How are you going to earn money with NFTs?

Flipping/buying and selling

Shopping for and promoting NFTs ceaselessly, like day buying and selling cryptocurrencies, can yield earnings. Buying NFTs throughout minting occasions and promoting them after challenge milestones or information developments can lead to substantial positive aspects. Merchants should decide the proper foreign money and worth stage to maximise earnings.

Royalties

Creators can obtain royalties on every secondary sale of their NFTs, producing passive revenue. Royalties sometimes vary between 1% to 10% and are outlined throughout the token mint occasion. Loyal communities can deliver important royalties over time, due to sensible contracts.

Staking

NFT staking permits traders to earn rewards on their property. Depositing NFTs on artist portals or DeFi lending protocols can yield further revenue. NFT staking rewards are nonetheless rising, with platforms like NFTfi and Solend providing restricted functionalities.

Gaming

Investing in Web3 gaming initiatives, or play-to-earn video games, entails buying in-game character NFTs and incomes revenue via gameplay. Tasks like Axie Infinity, MOBOX and Zookeeper assist NFT staking and supply in-game marketplaces for straightforward gross sales.

Renting

Renting NFTs can generate passive revenue, significantly for costly or utility-rich collections. Platforms like reNFT and Vera provide NFT renting choices, and demand for such providers will doubtless develop because the NFT market expands.

Nothing on this article is meant to offer funding, authorized or tax recommendation and nothing on this article ought to be construed as a suggestion to purchase, promote, or maintain any funding or to have interaction in any funding technique or transaction.