NFT

Blur takes the lead

On February 15, Blur’s native token BLUR was launched for buying and selling, and the transaction quantity exceeded $1 billion in lower than 24 hours. Maybe benefiting from this robust momentum, Blur started to confront OpenSea in a brand new chapter of the NFT royalty warfare.

On February 16, sooner or later after the BLUR token was launched, Blur issued an official announcement asserting the replace of the royalty coverage, which straightforwardly recommends that customers block OpenSea; so long as they don’t use OpenSea, they will get pleasure from full royalties.

NFT tasks set non-obligatory royalty settings. If OpenSea cancels this coverage, NFT tasks will have the ability to gather royalties on each platforms on the identical time. Blur emphasizes that presently, NFT venture creators can’t gather royalties on two platforms on the identical time and might solely gather full royalties on both OpenSea or Blur, however not on the identical time.

In actual fact, it was not unintended that Blur confirmed his sword this time. In November 2022, OpenSea introduced that with a purpose to implement full creator charges on the platform, people who create NFT good contracts after January 2, 2023, should take on-chain actions to make royalties enforceable.

In different phrases, OpenSea requires creators to make use of on-chain instruments to ban the sale of NFTs on marketplaces that don’t implement royalties for creators — an apparent transfer towards Blur, which is a royalty-free platform the place creators must ban NFTs offered on Blur can get pleasure from full royalties on OpenSea. If this isn’t executed, OpenSea will routinely set the royalties of those NFT collections to “non-obligatory,” which in flip impacts creator earnings.

Blur took concern with OpenSea’s use of a “blacklist” to suppress it, claiming that creators ought to resolve the place and the way their merchandise are offered – not corporations – however had little success, after which additionally had to make use of the Seaport settlement Bypass restrictions.

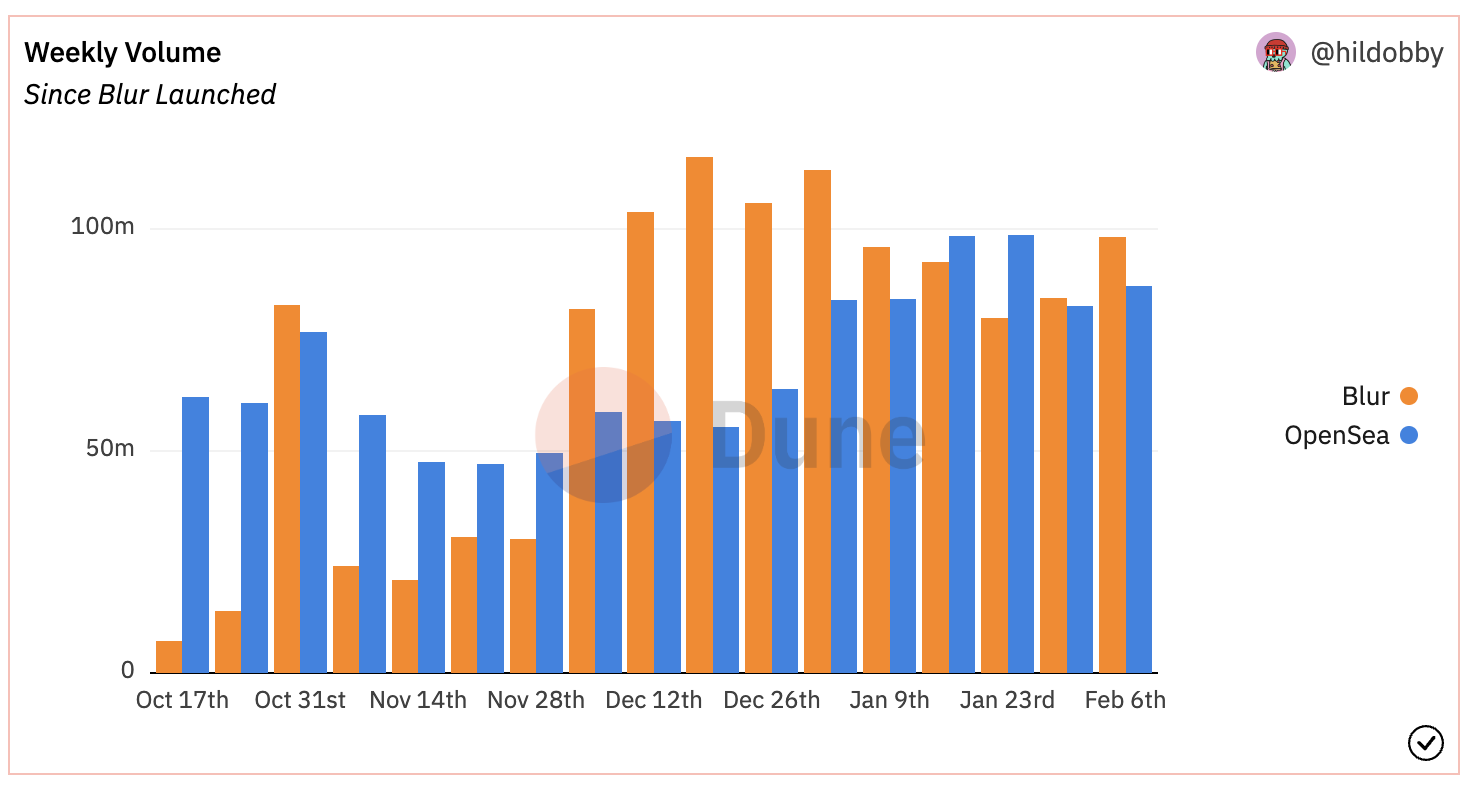

Nevertheless, OpenSea’s wishful considering didn’t reach suppressing the speedy growth of Blur however brought about customers to defect. The determine beneath is a comparability of two platforms’ single-week transaction quantity. It may be seen from the determine that for the reason that starting of December 2022 (that’s, OpenSea started to limit Blur), OpenSea’s transaction quantity was larger than that of Blur in solely two weeks, and it lagged behind in the remainder of the time.

NFT ecosystem “huge reversal”? OpenSea has given up

Within the early hours of February 18, OpenSea introduced the launch of a time-limited 0-fee transaction, offered an non-obligatory copyright service with a minimal normal of 0.5% and relevant to all NFT sequence that don’t implement royalties on the chain, and in addition up to date the operator filter This enables NFT markets with the identical coverage to work collectively to extend market liquidity.

We’re making some huge adjustments at present:

1) OpenSea charge → 0% for a restricted time

2) Shifting to non-obligatory creator earnings (0.5% min) for all collections with out on-chain enforcement (outdated & new)

3) Marketplaces with the identical insurance policies is not going to be blocked by the operator filter— OpenSea (@opensea) February 17, 2023

Lastly, OpenSea bowed its head and gave in.

The NFT market defined the explanation for this resolution, purportedly due to “dramatic adjustments within the NFT ecosystem,” of their phrases:

“In October, we began to see significant quantity and customers transfer to NFT marketplaces that don’t absolutely implement creator earnings.

At the moment, that shift has accelerated dramatically regardless of our greatest efforts.

We’ve labored to defend creator earnings on ALL collections when others didn’t. And once we launched the Operator Filter, it was our perception that on-chain enforcement was one of the best ways for creators to safe their income stream from the continuing resale of their work.

We thought we might catalyze widespread enforcement of creator earnings, and we hoped others may give you extra resilient options – this hasn’t occurred.”

The speedy growth of Blur has exacerbated OpenSea’s considerations. In line with Dune Analytics information, the transaction quantity of its platform has exceeded 1 million ETH, reaching 1,028,378 ETH, which is about $1.75 billion in accordance with the present value, and the overall gross sales quantity has additionally exceeded 200 million ETH. 10,000, presently reaching 2,027,752. As well as, the variety of impartial patrons on the Blur platform is 109,655.

Did Blur win huge?

Frankly, it’s too early to say Blur has gained the turf warfare with OpenSea.

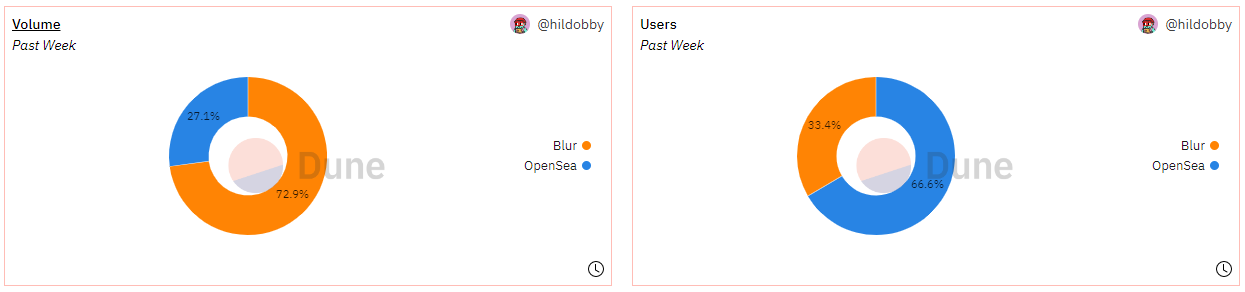

Blur’s current surge in transaction quantity is essentially associated to its airdrop of BLUR tokens, and it’s unsure whether or not it may well keep longer-term natural progress. It must be famous that the variety of customers of OpenSea is sort of twice that of Blur (as proven within the determine beneath), which signifies that they nonetheless have a powerful person base, and extra importantly, OpenSea has not launched its personal governance token or platform to this point as soon as it tries Blur’s foreign money issuance technique, it’s sure to have an effect on all the NFT market construction.

Galaxy researchers identified that NFT merchants ought to pay shut consideration to the continuing “battle” between OpenSea and Blur. In actual fact, most of Blur’s prime merchants have carried out wash gross sales with a purpose to acquire airdrop tokens, which exhibits that the connection with OpenSea In distinction, the transaction quantity on Blur’s platform might not be natural.

However, maybe with a purpose to go away extra retreats for itself, Blur’s counterattack technique is definitely not too radical as a result of its up to date royalty coverage additionally supplies the choice to not block OpenSea and block Blur if the creator doesn’t set blocking.

Blur will cost a 0.5% royalty (sellers can even select a better royalty), whereas OpenSea is an non-obligatory royalty; if blocking Blur or different NFT tasks within the zero-royalty/royalty non-obligatory market will probably be enforced on OpenSea royalty, transactions, and listings can nonetheless be carried out on Blur, topic to a minimal 0.5% royalty.

The Galaxy analyst added:

“Clearly, Blur is utilizing their affect to drive OpenSea to work with them reasonably than present hostility to them, time will inform if Blur’s technique will work, however each when it comes to metrics and merchandise By way of each, they’re by far probably the most profitable OpenSea rivals.”

Moreover, Galaxy researchers additionally acknowledged in a brand new report on Friday:

“With regard to Blur, there are two key points to deal with. Firstly is how a lot market share Blur can retain as their BLUR token has Liquidity. Second is buying and selling quantity, Blur buying and selling quantity just isn’t anticipated to see a severe decline within the quick time period as a result of their token incentive plan will proceed for at the least one other 30 days within the second quarter, however it’s value seeing whether or not this mannequin can work in the long term.”

Briefly, because the turf battle between two NFT marketplaces continues to warmth up, the competitors within the NFT market will solely intensify. Maybe after this battle is over, we can discover a growth path that’s most fitted for NFT creators and merchants.

DISCLAIMER: The Info on this web site is offered as normal market commentary and doesn’t represent funding recommendation. We encourage you to do your individual analysis earlier than investing.