- OpenSea slashed market charges briefly, and royalties have been made elective.

- Its competitor Blur captured virtually half of the whole quantity throughout all marketplaces.

Widespread NFT market OpenSea introduced that it’ll reduce its 2.5% service charge on gross sales for a restricted time period and can transfer in direction of elective creator royalties, because the competitors amongst NFT marketplaces heats up.

We’re making some huge adjustments at the moment:

1) OpenSea charge → 0% for a restricted time

2) Shifting to elective creator earnings (0.5% min) for all collections with out on-chain enforcement (outdated & new)

3) Marketplaces with the identical insurance policies is not going to be blocked by the operator filter— OpenSea (@opensea) February 17, 2023

OpenSea acknowledged that it’ll implement a minimal of simply 0.5% creator royalty for all collections with out on-chain royalty enforcement.

It additionally mentioned that it’ll enable gross sales on NFT marketplaces like Blur with the identical insurance policies, going again on its earlier coverage of blocking marketplaces that don’t honor royalty funds.

‘Blur’crimson path for OpenSea

Blur market, which launched its native token BLUR not too long ago, has expanded at a fast tempo since its launch simply 4 months in the past. A mixture of attractive market guidelines, the place it expenses zero buying and selling charges, and a advertising technique of dropping BLUR tokens to spice up exercise on the platform, has threatened OpenSea’s dominance within the NFT market panorama.

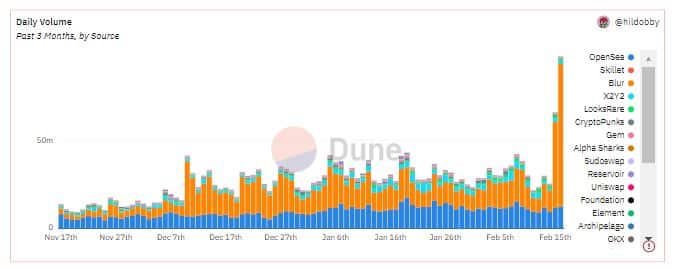

The truth is, the every day buying and selling quantity on Blur elevated by greater than 4 occasions for the reason that launch of Blur token, knowledge from Dune Analytics revealed. Blur’s share of the whole NFT buying and selling quantity remained above 70% for the reason that launch, comfortably surpassing OpenSea.

Supply: Dune Analytics

OpenSea’s every day lively customers plunge

Blur’s achieve has been OpenSea’s loss. As evident from knowledge by Token Terminal, key indicators on OpenSea confirmed a decline. The every day lively customers on {the marketplace} nosedived from a month-to-month peak of 90.6k on 10 February to just a little over 42k, on the time of writing.

Supply: Token Terminal

OpenSea’s income has additionally been hit as extra merchants flocked to Blur, leading to decreased transaction charges on the platform. With OpenSea successfully chopping off its main income by dropping charges, it stays to be seen which different avenues can be explored to extend income.

How a lot are 1,10,100 BLURs value at the moment?

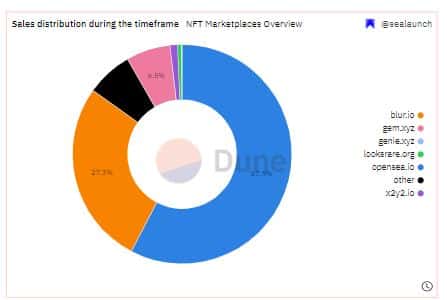

Apparently, regardless of Blur’s reputation, OpenSea obtained the higher of its competitors when gross sales numbers have been checked out. Information from Dune Analytics revealed that OpenSea loved a 57% market share in general gross sales counts.

This may very well be as a result of it catered extra to particular person buyers, not like Blur which has pitched itself because the NFT market for skilled merchants.

Supply: Dune Analytics