Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- MATIC has depreciated by 15%.

- A consolidation was underway, and bulls may win if $1.3405 help remained regular.

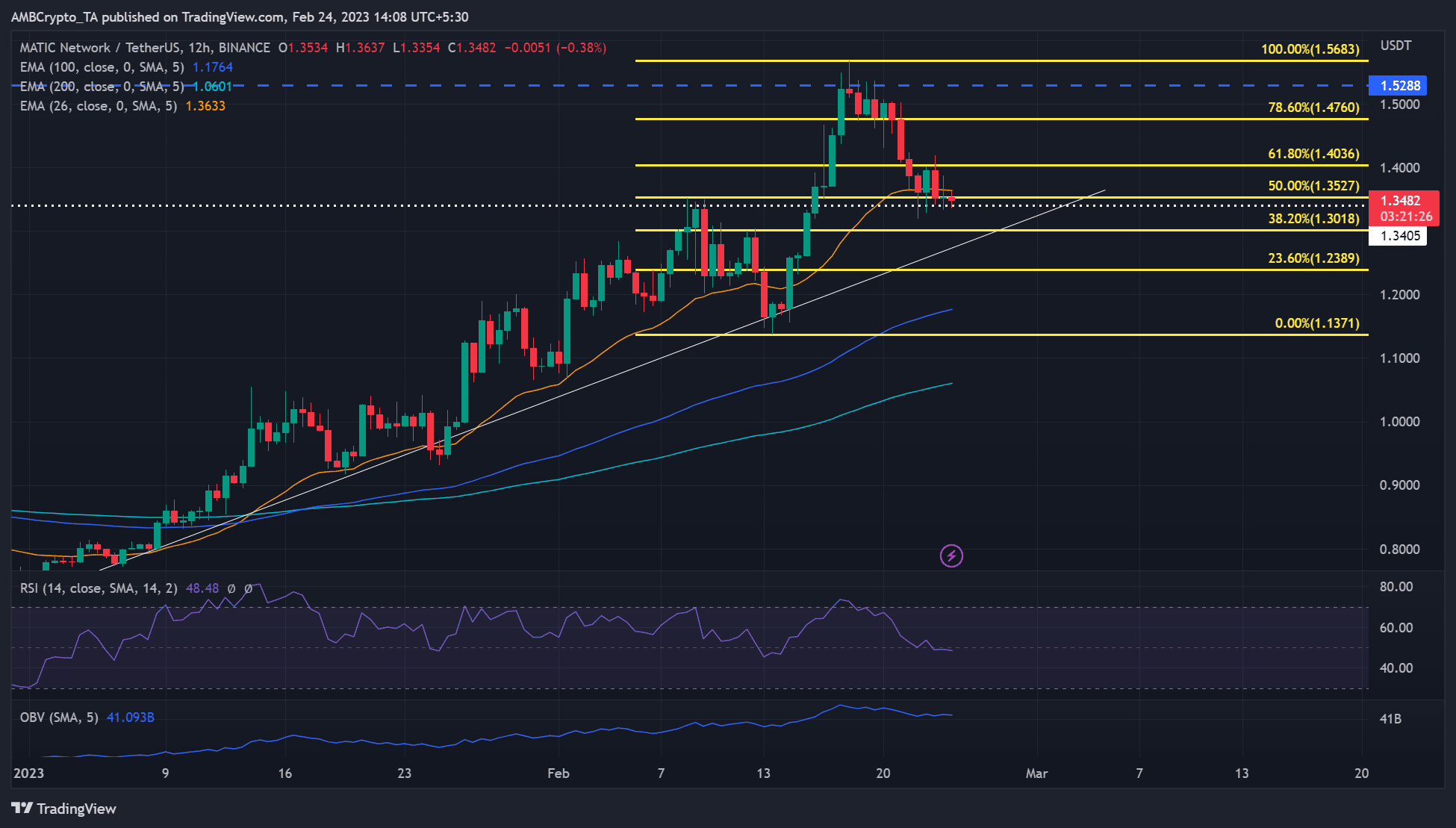

Polygon [MATIC] took a cue from Bitcoin [BTC] and traded in vary on Friday. BTC oscillated within the $23.76 – $24.20k vary, whereas MATIC consolidated between $1.3527 and $1.4036.

Learn Polygon’s [MATIC] Value Prediction 2023-24

MATIC leaned on the decrease vary boundary at press time however may provide a market entry for bulls if this help turns into regular.

Can the $1.3405 stage provide bulls a gentle floor?

Supply: MATIC/USDT on TradingView

The $1.3405 has briefly checked the ADA’s correction after a value rejection at $1.57 – a 15% depreciation. If it continues to carry, bulls may goal the 61.8% Fib stage of $1.4036 or the 78.60% Fib stage of $1.4760. That may provide a 4.5% or 9% potential rally, respectively.

A breach of the $1.3405 help stage may provide shorting alternatives. If ADA breaks under the consolidation vary, short-sellers can look to e book positive factors on the 38.20% Fib stage of $1.3018 or 23.60% Fib stage of $1.2389. Furthermore, the ascending trendline (white) may additionally decelerate.

Nevertheless, an prolonged drop may choose the 100-period or 200-period EMAs (exponential shifting averages).

The Relative Energy Index (RSI) retreated to the mid-range, moved sideways, and was at 48, indicating that the market weakened and was nearly impartial. Equally, the OBV (On Steadiness Quantity) dropped, underlying the bearish sentiment on the time of writing.

Though these fundamentals may undermine a powerful rebound, buyers ought to observe BTC’s value motion earlier than making strikes.

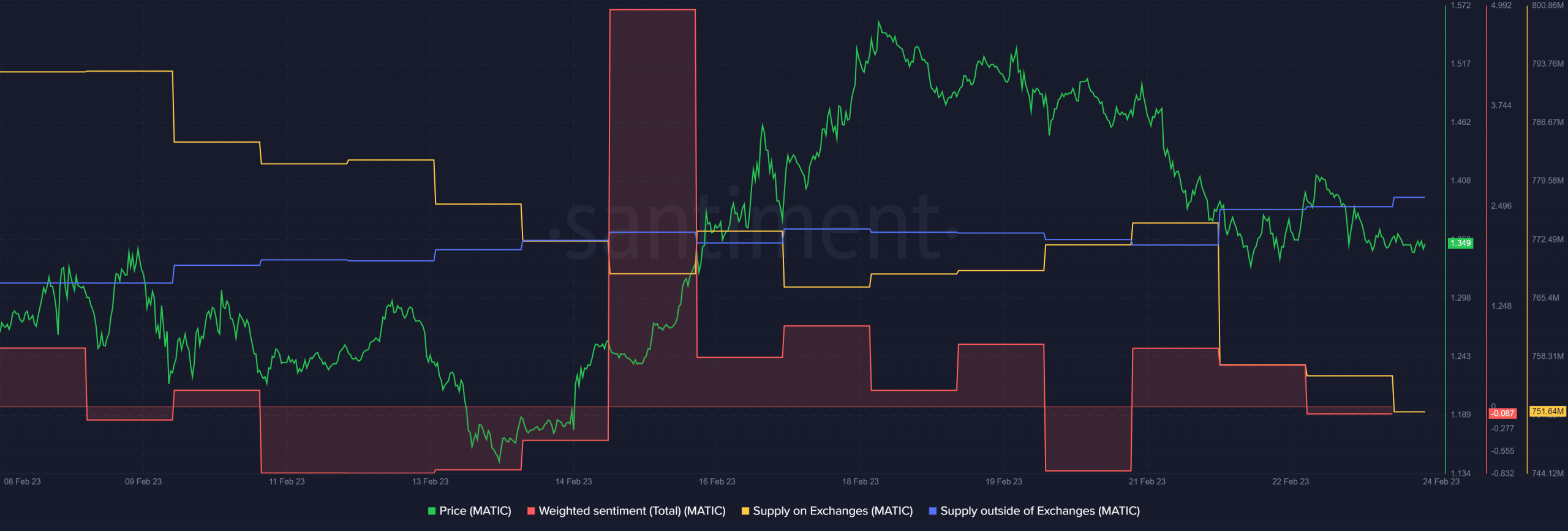

MATIC noticed short-term accumulation, however …

In response to Santiment, MATIC’s provide out of the exchanges spiked, indicating a short-term accumulation for the pattern. The quantity of MATIC sitting on exchanges on the market additionally dipped considerably, as proven by the declining Provide on Trade metric.

Supply: Santiment

Is your portfolio inexperienced? Try the MATIC Revenue Calculator

Merely put, there was a brief provide and extra demand for MATIC within the close to time period, which may positively affect an uptrend in the long term if the pattern continued.

Nevertheless, the weighted sentiment has not reached the constructive ranges recorded after the FOMC assembly. At press time, the sentiment dropped and flipped into adverse, indicating a bearish outlook for the asset amidst rising macroeconomic uncertainty. Therefore, warning needs to be exercised.

![Polygon [MATIC] correction slows down – Can bulls get new opportunities?](https://nomadabhitravel.com/wp-content/uploads/2023/02/pasted-image-0-24-1-1536x874.png)