A brand new report reveals that 95% of mainstream non-fungible tokens (NFTs) have recorded plunging values with many now virtually nugatory.

On Sept 20, media outlet Rolling Stone highlighted a report by dappGambl “Lifeless NFTs: The Evolving Panorama of the NFT Market” an evaluation that explains why most NFTs have dropped in values with out posting vital traction previously months.

Per the report, out of 73,257 NFT collections analyzed, a staggering 69,795 totaling 95% wouldn’t earn a single greenback within the current market. These ‘utterly nugatory’ tokens are held by about 23 million buyers.

The story has sparked a number of reactions throughout digital asset areas with many in assist of the evaluation as they’re a part of the 23 million customers who personal the nugatory tokens.

A number of crypto fanatics termed the growth as worrisome, agreeing that their property are nugatory. “Do individuals even purchase these?” “That’s such a spectacular fall,” they added.

Others merely criticized the advertising and marketing of NFT initiatives as the main cause why many really feel disenchanted within the current actuality and restricted use instances along with hype resulting in a surge in token costs.

On the flip facet, pro-NFT makes use of highlighted inconsistencies in Rolling Stone’s stance through the years after a consumer dug up an article on their website from November 2021 selling a Bored Ape Yacht Membership Assortment (BAYC).

Others opined that the crypto winter affected the value of NFTs and a serious reversal may happen as issues get higher.

“Some will make a comeback. Some will go up 1000% due to bull. Folks will get mad once more that pixels are value tens of millions.”

Is there hope for a rebound? NFTs are drowning

The thrill of NFTs in 2021 attracted a number of adopters to blockchain expertise because the area of interest was fairly totally different from the cost service mannequin of conventional digital property.

As extra initiatives received mainstream, buying and selling volumes of NFTs surged over $17 billion in the course of the bull run in 2021 however has remained a shadow of itself.

The crypto winter which has tightened the market has been raised as an element as many say the decline in utilization and whole values locked on decentralized functions (dApps) is a serious cause for the established order.

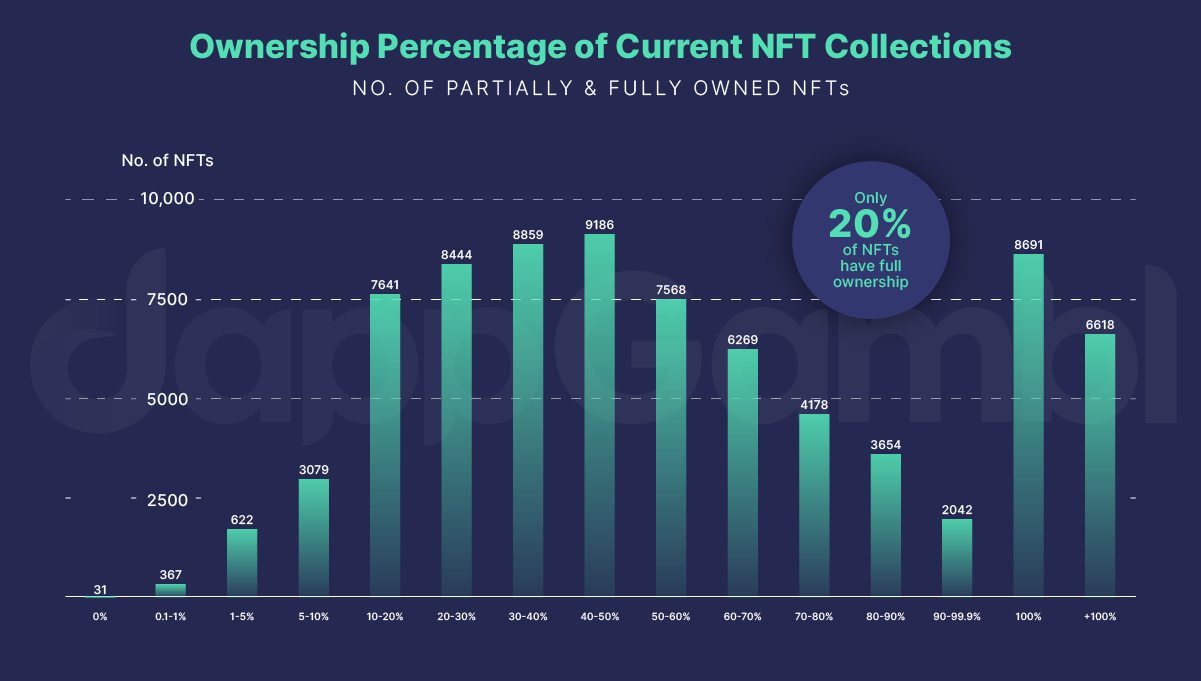

Making issues a bit worse for NFTs is the ecosystem recording much less demand because the highlighted report notes {that a} mere 21% of the gathering has full possession with the majority unsold.

“initiatives that lack clear use instances, compelling narratives, or real creative worth are discovering it more and more tough to draw consideration and gross sales,” the report added.

“initiatives that lack clear use instances, compelling narratives, or real creative worth are discovering it more and more tough to draw consideration and gross sales,” the report added.

Whereas it stays unknown if most NFTs will make a rebound, NFT bulls cling to a resurgence within the wider market as a bolster for his or her valuable property.