On Feb. 17, a pockets that had been previously engaged in front-running token listings on Binance made one other commerce, this time buying and promoting the Good points (GNS) token simply earlier than itemizing on the world’s main trade.

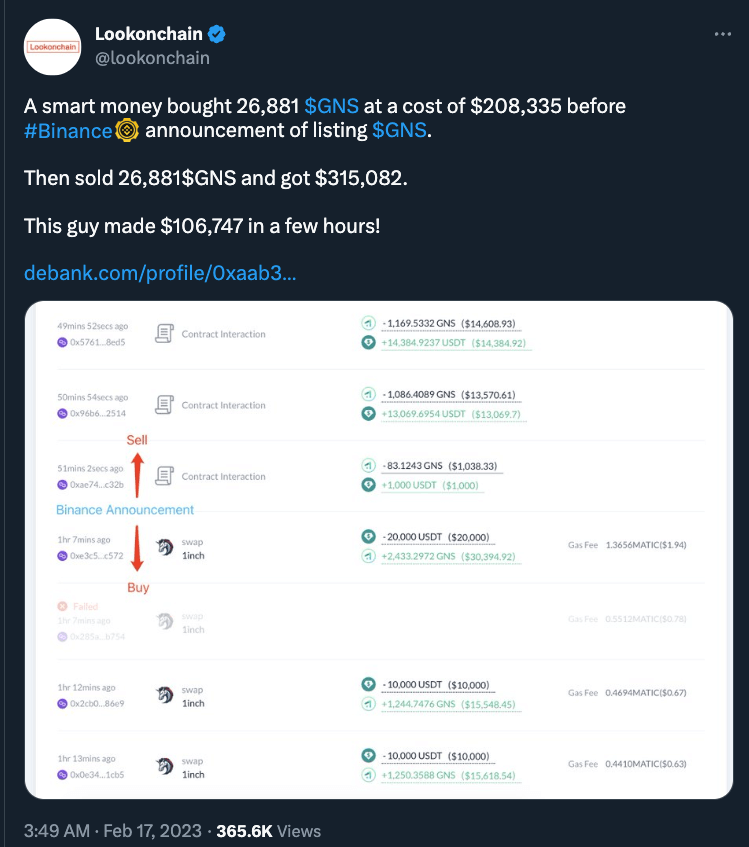

In keeping with an evaluation by Lookonchain, the crypto dealer, whose id stays unknown, made a revenue of greater than $100,000 by buying a token only a few minutes earlier than it was listed on Binance.

The on-chain sleuth discovered that simply earlier than being listed on Binance, a dealer purchased Good points Community (GNS) tokens value $208,335 simply half-hour prior. Following the itemizing, GNS elevated by 51%, from $7.92 to $12.01, and the dealer bought their GNS holdings for a revenue of $106,747, a flip made in slightly below one hour.

Lookonchain satirically referred to the commerce as “sensible cash” within the Twitter submit. Nonetheless, it’s a apply few discover humorous, as insider buying and selling is illegitimate in most international locations, together with the USA, Canada, the European Union, and lots of different jurisdictions worldwide. Usually, buying and selling on personal info, akin to details about a pending itemizing, is taken into account dishonest and might hurt the integrity and equity of the markets.

What’s entrance working?

Within the context of crypto exchanges, entrance working can happen when a dealer or an trade worker makes use of confidential details about a buyer’s commerce to put their commerce earlier than the client’s commerce is executed, which may end up in a revenue on the expense of the client.

Entrance working provides the particular person partaking in it an unfair benefit out there. It is usually a violation of belief, because it breaches the responsibility of confidentiality that will exist between the particular person with insider info and the opposite events concerned within the transaction.

Over the previous yr, quite a few outstanding crypto exchanges have confronted scrutiny for alleged or confirmed cases of front-running, the place merchants, armed with insider data, take vital positions in tokens which can be extremely prone to respect, typically on account of being listed on a centralized crypto trade akin to Binance.

Entrance working at Coinbase

In a current case, former Coinbase product supervisor Ishan Wahi pleaded responsible to collaborating in an insider buying and selling scheme that generated $1.1 million in earnings. Federal prosecutors regarded the case as the primary insider buying and selling case involving cryptocurrencies.

In Aug. 2022, one academic research report discovered that 10-20% of recent crypto listings on CoinBase had been topic to entrance working.

Binance CEO responds to entrance working, says most occurs on the token aspect

In July, when prices had been initially introduced in opposition to Wahi, Changpeng Zhao (CZ), the CEO of Binance, condemned the actions of the Coinbase worker, stating that “insider buying and selling and entrance working must be prison offenses in any nation,” whether or not they contain cryptocurrencies or not.

Binance maintains that it enforces a coverage of self-regulation to ban staff from partaking in short-term buying and selling. Nonetheless, Coinbase’s Wahi, for instance, shared insider details about tokens that had been about to be listed along with his brother and buddy, which led to the fees.

In a current AMA, CZ mentioned that most of the leaks and entrance runs don’t come from inside Binance however slightly from the undertaking/token aspect. Binance is evident that anybody who tries to entrance run on information that they’ll get listed on Binance can be placed on a blacklist.

“We attempt to not inform undertaking groups when they are going to be listed on Binance to the purpose the place we are able to. However when we now have these type of discussions, typically the undertaking groups do know that, okay, we built-in the pockets already, so we’re in all probability fairly near itemizing or launch or one thing. After which the information, the information typically leaks on the undertaking aspect. So we need to stop that as a lot as potential. It’s not 100%, however I believe we do a greater job than most different exchanges.”