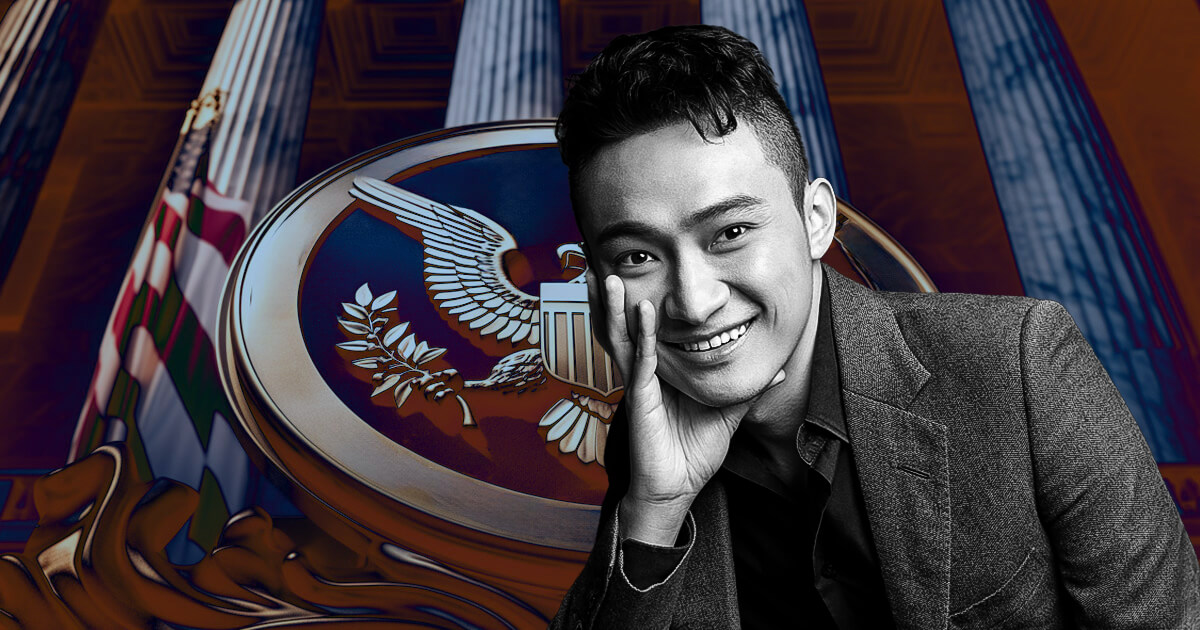

The US SEC filed an amended criticism in its case towards Justin Solar and different defendants on April 18, arguing that Justin Solar’s alleged visits to the US ought to grant it the jurisdiction required to pursue authorized motion.

The regulator alleged that Solar “traveled extensively” to the US whereas he and a number of other corporations carried out unregistered gives and gross sales of BTT and TRX tokens.

In keeping with the watchdog, Solar spent over 380 days within the US between 2017 and 2019 and made enterprise journeys to main cities, together with New York Metropolis, Boston, Massachusetts, and San Francisco. He carried out the journeys on behalf of the Tron Basis and the BitTorrent Basis — each of that are additionally named as defendants within the case.

The SEC desires to make use of these journeys to say jurisdiction over Solar and the businesses to pursue regulatory and authorized motion within the US.

Wash buying and selling

The SEC alleged that Solar and the businesses engaged in a wash buying and selling scheme on the now-defunct crypto change Bittrex.

Although the unique criticism recognized most of the identical wash buying and selling actions, it recognized the change on which wash buying and selling occurred solely as an unnamed “buying and selling platform.”

The company included the truth that Bittrex relies within the US alongside its different claims to private jurisdiction over Solar and the opposite defendants.

The amended criticism additionally alleges that Solar personally communicated with and supplied paperwork to Bittrex circa 2018 to have the change checklist the TRX crypto. The paperwork hyperlink Solar to the opposite corporations, and Solar personally signed some paperwork.

Countering the request for dismissal

The most recent allegations handle the issues raised by Solar in his request to dismiss the SEC case in March attributable to an absence of non-public jurisdiction. Protection legal professionals argued that Solar is a overseas nationwide and never “at residence” within the US and superior related arguments for the businesses.

The request for dismissal additionally recognized the supposed improper distributions on Bittrex however mentioned that “there isn’t a allegation that any US resident bought or tried to buy TRX on this unidentified platform, or that the hassle to checklist TRX succeeded.”

The SEC sued Solar and the opposite defendants in March 2023. On the time, it based totally private jurisdiction claims across the allegation that gross sales targeted on buyers within the Southern District of New York and the allegation that superstar promoters contacted people within the US through social media.

The SEC individually sued Bittrex in April 2023 and settled the case in August 2023. The corporate halted operations globally in late 2023.