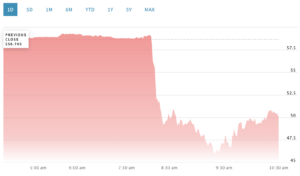

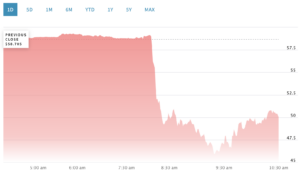

Coinbase shares fell 22% after information broke that the U.S. Securities and Trade Fee filed a lawsuit towards the platform for allegedly violating securities legal guidelines.

The U.S. alternate inventory fell to round $48 from $58.71 pre-market, in keeping with Nasdaq data. At press time it had recovered barely to $50.03, down 15% on the day.

In the meantime, the lawsuit additionally triggered a light decline in Bitcoin’s (BTC) worth, which fell by 0.51% on the 1-hour candle to $25,493 as of 13:30 UTC, in keeping with CryptoSlate’s knowledge. The shares of a number of Bitcoin miners like Riot Blockchain, CleanSparks, Bitfarms, and Marathon Digital noticed steep losses following the information.

Coinbase lawsuit

In response to the SEC, Coinbase operated as an unregistered dealer, alternate, and clearing company, providing unregistered securities through its Staking Program. The regulator additionally alleged that the alternate supplied American buyers with unregistered safety tokens like ADA, SOL, and so forth., through its platform.

SEC said:

“The Coinbase Platform merges three features which might be usually separated in conventional securities markets—these of brokers, exchanges, and clearing companies. But, Coinbase has by no means registered with the SEC as a dealer, nationwide securities alternate, or clearing company, thus evading the disclosure regime that Congress has established for our securities markets.”

In the meantime, the lawsuit is coming lower than a day after the watchdog filed related costs towards the biggest crypto alternate by buying and selling quantity, Binance. The SEC acknowledged that Binance profited within the billions by soliciting U.S. buyers to commerce utilizing its unregistered platform.

Coinbase had persistently highlighted the regulatory vacuum in US

Prior to now, the SEC and Coinbase have been concerned in a long-drawn authorized tussle over the shortage of regulatory readability throughout the crypto house. In a Could 15 court docket submitting, the monetary regulator acknowledged it was not obligated to supply the requested readability.

In a June 6 ready testimony earlier than the Home Committee on Agriculture, Coinbase chief authorized officer Paul Grewal mentioned:

“Regulation establishes clear guidelines for the trade, it additionally offers essential accountability measures for potential unhealthy actors. US laws helps good guys innovate and ensures unhealthy guys are held accountable.”

On Could 30, the alternate’s CEO, Brian Armstrong, mentioned the U.S. crypto trade confronted a powerful problem from China.

The publish SEC lawsuit triggers selloff in Coinbase inventory, COIN down 15% appeared first on CryptoSlate.