On Tuesday, the crypto market was taken by storm when a tweet emerged from the official X (previously Twitter) account of america Securities and Alternate Fee (SEC) saying all Spot Bitcoin ETF functions had been accepted. This had been initially adopted by a surge in value however this was short-lived as the value would crash shortly after. The explanation for this was as a result of Gary Gensler, chairman of the Fee, revealed that the tweet was faux and the regulator’s social media account had been compromised.

SEC Hack Triggers $220 Million In Liquidations

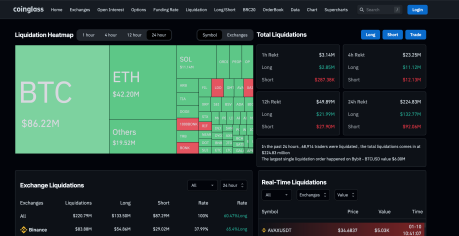

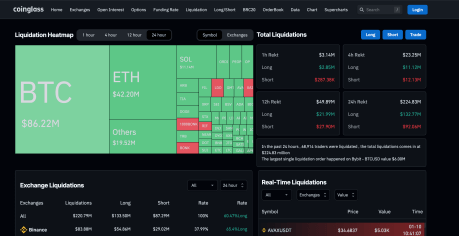

Within the wake of the wild Bitcoin value fluctuations that have been triggered by the SEC’s hack, a lot of crypto merchants discovered themselves with large losses on their fingers. In response to data from CoinGlass, over $220 million have been liquidated within the final 24 hours, resulting in the second-largest liquidation occasion up to now in 2024.

The web site additionally notes that over 70,000 merchants have been victims of this liquidation occasion as nicely. Additionally, on condition that the value of Bitcoin and different belongings within the crypto market had seen value fluctuations in each instructions, each lengthy and brief merchants have been affected.

Supply: Coinglass

Nonetheless, on condition that the crash to the draw back has endured for longer, lengthy merchants have come out because the group with probably the most liquidations throughout this time. Out of the greater than $220 million in liquidations recorded, lengthy trades made up 60.47% with $133.5 million, whereas the amount of brief liquidations got here out to $87.29 million for a similar time interval.

Bitcoin noticed the biggest single liquidation order throughout this time as nicely which happened on the ByBit trade. A single commerce value $6 million was liquidated throughout the BTCUSD buying and selling pair, with complete liquidations on the crypto trade popping out to $36.66 million. This falls behind market chief Binance with $83.88 million and OKX with $73.97 million.

BTC bears wrestle for management | Supply: BTCUSD on Tradingview.com

Spot Bitcoin ETF Is A Promote The Information Occasion?

The talk of whether or not the Spot Bitcoin ETF approval has already been priced in and if an announcement will result in a decline in value has been waxing stronger over the previous couple of weeks. Consultants have chimed in to present their ideas on what is going to comply with an approval.

Crypto analyst Andrew Kang believes that approval would result in a scramble amongst candidates to seize as a lot as doable from the $10 billion to $20 billion anticipated to return from charges. As such, they may all be on the forefront of selling to push their ETFs.

On the flip aspect, famend economist, Peter Schiff, believes that a spot ETF would actually not be good for the asset. Apparently, the arrival of a spot Bitcoin ETF would imply that there isn’t a longer any excellent news to set off a value rally. As such, it will flip right into a ‘promote the information’ occasion.

Nonetheless, if the efficiency from Tuesday is something to go by, it may imply that the ETF is already priced in on condition that there was a decline in value, even earlier than the SEC dismissed the tweet from the hacked account.

Featured picture from SoFi, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal danger.