Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- Monero [XMR] registered conflicting traits throughout totally different timeframes

- The latest break in construction on the decrease timeframe meant the market might need proven its hand

Monero [XMR] recorded a bearish trajectory on the upper timeframe charts. In distinction, it posted vital good points of 9.14% over the past 4 days, earlier than going through rejection across the $155-zone. However is that this an indication that sellers are gaining energy or can bulls anticipate additional good points?

Learn Monero’s [XMR] Value Prediction 2023-24

Bitcoin can be more likely to have a say within the matter, however the worth motion confirmed that XMR is more likely to retrace the good points it made over the past 4 days.

Regardless of the bounce from $144, the bias has shifted to bearish favor

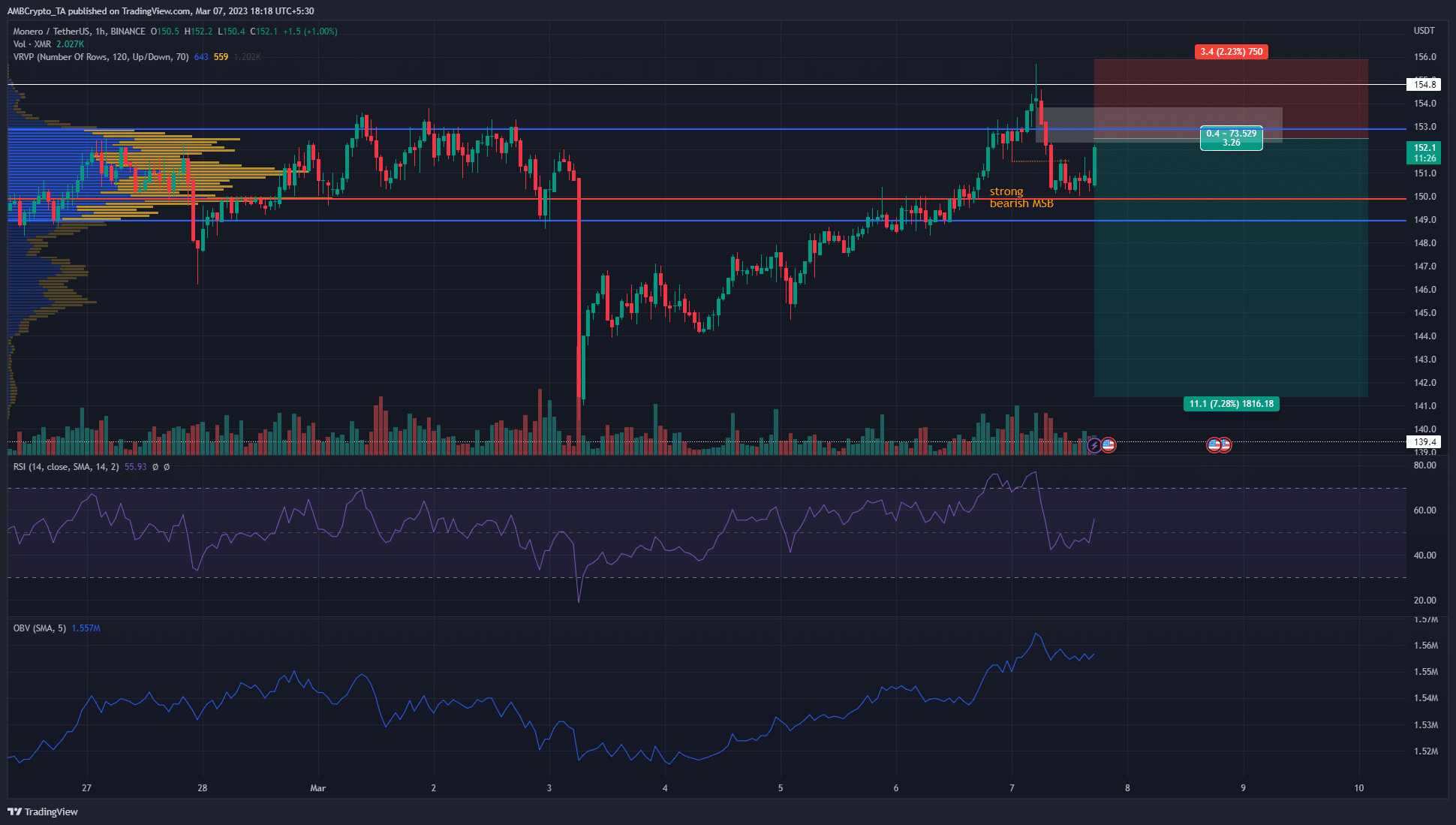

Supply: XMR/USDT on TradingView

The Quantity Profile Seen Vary instrument highlighted three ranges of significance. The Worth Space Excessive and Low at $153 and $149, respectively, and the Level of Management at $151.1. On the time of writing, the worth was capturing north after nearing the POC as help.

Though the bounce from $144 was robust, latest worth motion revealed bears have seized management. The market construction break highlighted in orange confirmed a shift in bias on the decrease timeframes. Furthermore, this was in settlement with the upper timeframe downtrend, resembling on the every day chart.

The $152-$155 space has acted as resistance since 24 February. On the day of writing, the worth pushed as far north as $155.7, earlier than tumbling to $150.4. This sharp rejection noticed a good worth hole (white) type on the chart. This space had confluence with the resistance of the previous ten days.

How a lot are 1, 10, 100 XMR value right this moment?

The OBV has trended upward since 4 March, when the costs bounced from $144. The RSI has additionally been above neutral-50 for almost all of the previous week. Nonetheless, in the home earlier than press time, the identical recorded a pointy plunge.

Taken collectively, the proof revealed that demand has been regular over the previous few days. And but, the robust break in construction means XMR might retrace most, if not all of its latest good points. A brief place may be thought of if Monero sees a rejection across the FVG. Invalidation of this concept can be a session shut above $155.7.

What does the Cumulative Quantity Delta say about demand?

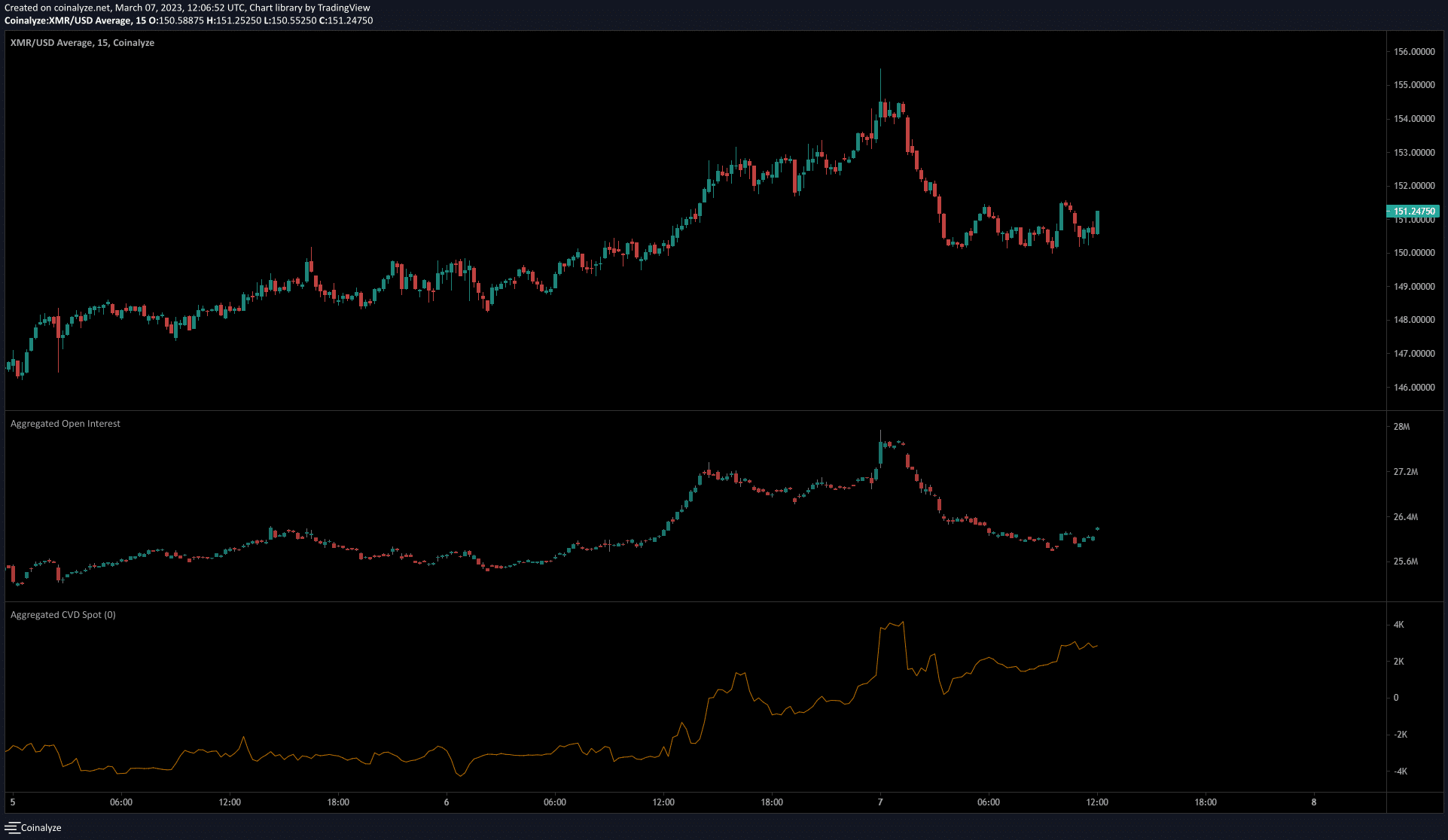

Supply: Coinalyze

The spot CVD has been on the rise over the previous couple of days. The 15-minute chart connected herein highlighted that regardless of the rising CVD, the sentiment might have shifted in favor of the sellers. When Monero famous rejection close to $155, the OI crashed. Almost $3 million value of OI evaporated to sign discouraged patrons – An indication that bearish sentiment had taken root.

If this pattern of a falling OI continues, it could help the bearish notion offered above. Therefore, the OI might assist sellers attain a bias as nicely.

![Sellers, look out for these signs on Monero’s [XMR] price charts](https://nomadabhitravel.com/wp-content/uploads/2023/03/PP-3-XMR-price-updated-1536x870.png)