Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- Solana threatened to interrupt out of a variety.

- A transfer again beneath $26 might encourage the sellers.

Solana made features of 21% inside the previous 4 days. Whereas Bitcoin consolidated beneath the $25.2k resistance, Solana shrugged off any reins and bounded larger. Some key ranges had been recognized for SOL, with $26 being one in every of these.

Learn Solana Value Prediction 2023-24

The symptoms and futures markets confirmed robust bullish sentiment behind Solana. The latest transfer upward from $23.6 to $26 was accountable for this shift in sentiment. However can the bulls proceed to make larger highs?

Vary continuation is extra doubtless however $26 shall be important both approach

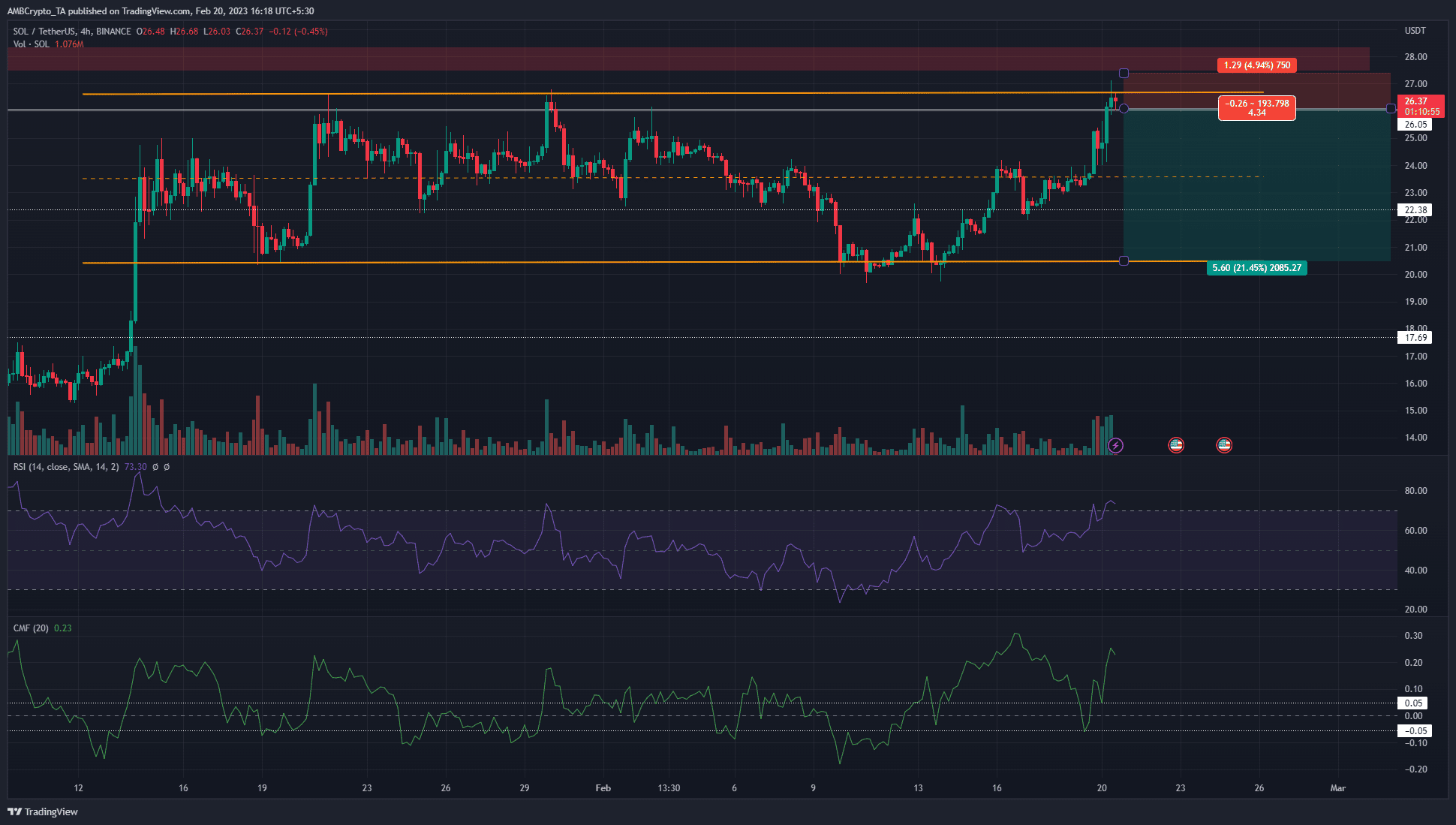

Supply: SOL/USDT on TradingView

Solana has traded inside a variety for a month. Highlighted in orange, the extremes of the vary lay at $20.5 and $26.7, with the mid-point at $23.6.

On the time of writing, SOL was on the verge of breaking out previous the vary highs. To the north, some resistance lay within the $27-$28 space.

Nevertheless, a bullish breakout will doubtless see this zone breached rapidly. The RSI was within the overbought territory to sign robust bullish momentum. The CMF was at +0.23 to point out important capital influx to the market.

Can we anticipate a breakout? The proof at hand confirmed that though momentum was bullish and demand was current, bulls can relatively stay flat than purchase Solana.

Based mostly on a risk-to-reward method, shopping for the asset earlier than a breach of the vary excessive was not possible. Bulls can look ahead to a 4-hour session shut above $27, and a retest of the $26.5-$27 space to purchase. A stop-loss might be set beneath $25.4 in that situation.

Is your portfolio inexperienced? Examine the Solana Revenue Calculator

Till then, a rejection on the vary highs was extra doubtless. A session shut beneath $26, adopted by a retest of the identical degree as resistance, would sign a transfer towards $23.6 was imminent. Additional losses may also be seen supplied Bitcoin confronted a wave of promoting.

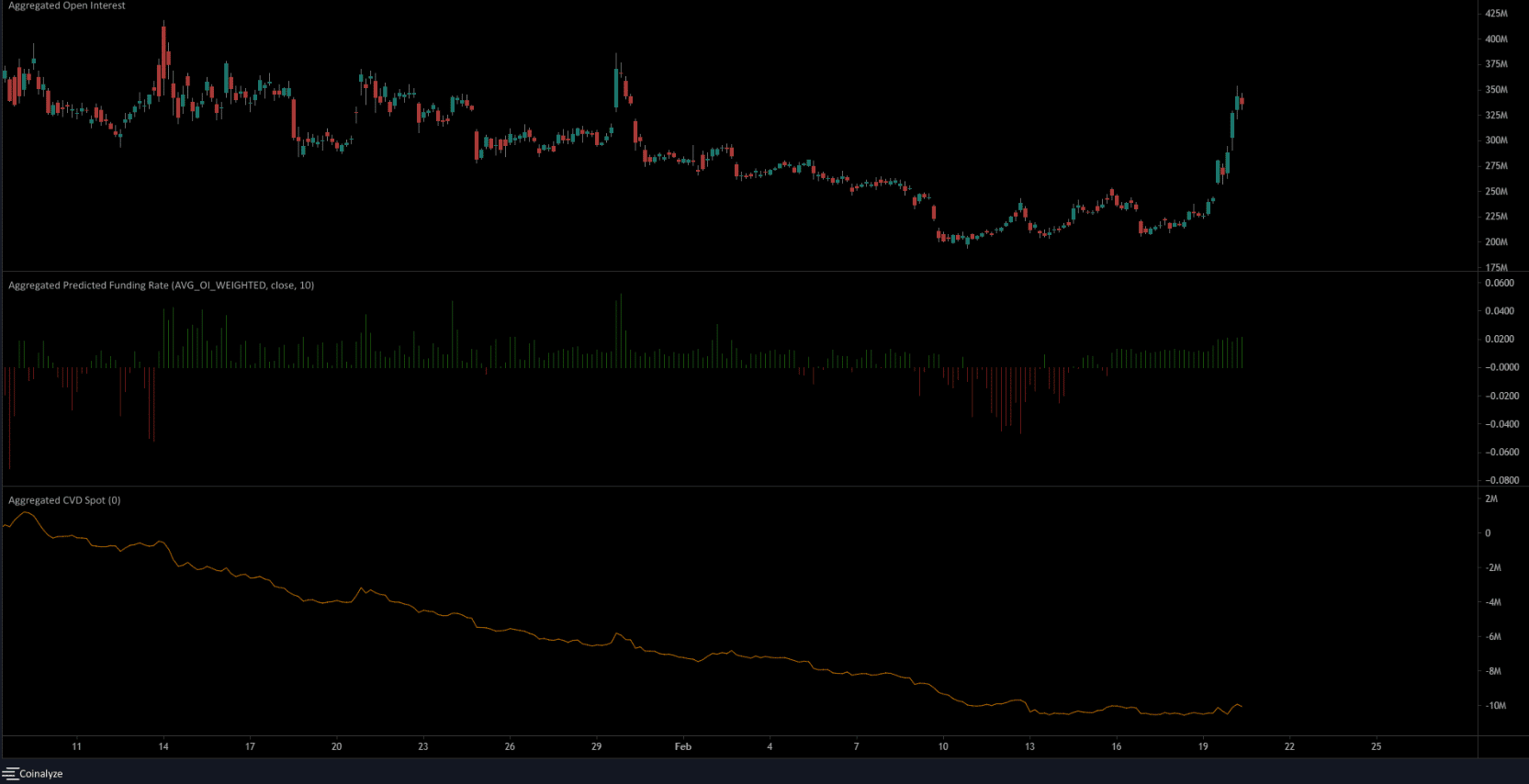

The fast rise in Open Curiosity confirmed bullish members from $23

Supply: Coinalyze

The mid-range mark has acted as a degree of robust assist and resistance over the previous month. Due to this fact, when SOL surged previous $23.6 on 19 February, it was accompanied by a spike within the Open Curiosity. This signified bullish sentiment and an inflow of capital.

Alternatively, the spot CVD has been flat over the previous week. This was an indication that bulls don’t management the market, though it doesn’t rule out a Solana breakout by itself. The expected funding fee was additionally constructive to spotlight the bullish sentiment.