Key Takeaways

- Solana made numerous massive bulletins at Breakpoint this weekend, however SOL did not react.

- Solana has confronted many challenges over crypto winter, together with ongoing outages and a decline in DeFi exercise.

- Whereas Solana has points to beat and competitors to face, it stays one among crypto’s strongest and most promising ecosystems.

Share this text

Solana is one among a number of Layer 1 networks to have suffered within the enduring crypto winter. However sunny skies may return, Chris Williams writes.

Solana Makes a Splash at Breakpoint

It was an enormous weekend for Solana because the Layer 1 community hosted the 2022 version of its Breakpoint convention. As for SOL? Not a lot.

The hundreds of Solana followers that flocked to Lisbon for the Layer 1 blockchain’s flagship occasion had been handled to a number of massive bulletins all through the convention. Arguably the largest one got here Saturday when Google Cloud revealed that it was operating a Solana validator and would begin indexing Solana information through its BigQuery product in early 2023. Google Cloud will even make Solana out there through its Blockchain Node Engine to assist customers run their very own nodes within the cloud. Per CoinGecko data, SOL instantly rallied double digits previous $38 because the announcement broke, however the momentum didn’t final. It’s since cooled by 5.5%, buying and selling at round $34 at the moment.

In a unique strategy to different blockchains reminiscent of Ethereum, the assorted engineers working within the Solana ecosystem have targeted on constructing merchandise for the mass market. An instance of such a product is its Saga telephone, which goals to be the world’s first Web3-ready smartphone. Solana introduced at Breakpoint that it will ship the product to builders as quickly as subsequent month.

USDC issuer Circle additionally appeared at Breakpoint, announcing that it will make its Euro Coin providing out there on Solana within the first half of 2023. Euro Coin is already stay on Ethereum. Circle additionally revealed that its forthcoming cross-chain protocol would assist Solana.

Arguably GameFi’s most anticipated title, Star Atlas builders shared an early demo for the sport at Breakpoint. Solana’s high-speed capabilities (it claims to course of 65,000 transactions per second) may make it a first-rate candidate for the Web3 gaming area, however as there are not any main titles out there to play at the moment, it’s unclear how a lot progress groups have made—and whether or not Solana will develop into a hub for the area of interest. Video games sometimes take years to develop, so it could possibly be a while till Solana’s GameFi ecosystem picks up.

The State of Solana DeFi

Like a lot of the crypto area, Solana has had a rocky 12 months, not least in its DeFi ecosystem.

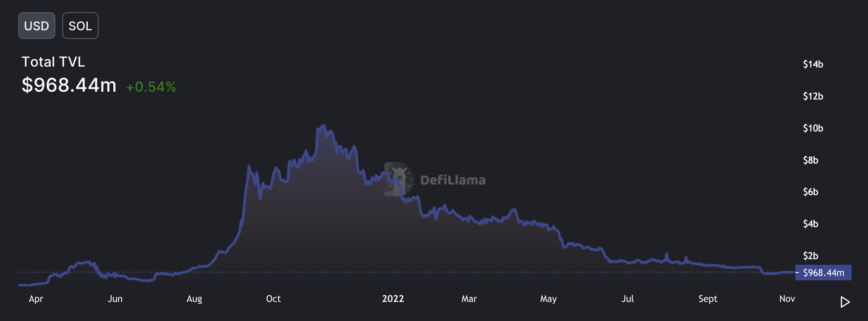

Solana topped $10 billion in whole worth locked as SOL neared $260 in November 2021, across the time of the inaugural version of Breakpoint.

Nonetheless, Solana DeFi has taken a beating this 12 months because of crashing market costs, liquidity withdrawing to different networks, and brutal token unlock schedules diluting the worth of a few of the ecosystem’s stars of 2021. Based on Defi Llama data, at the moment the full worth locked on Solana is round $968 million, which is barely lower than Avalanche’s $1.31 billion and a fraction of Ethereum’s $32.29 billion. If the numbers don’t drastically change sooner or later, Solana could discover that it thrives in different areas. Nonetheless, it’s additionally value noting that the full worth locked has remained extra steady in SOL phrases this 12 months, down round 54% from its June 2022 peak to roughly 31.3 million SOL.

Notably, Solana now trails the Ethereum Layer 2 community Arbitrum in whole worth locked phrases, and solely barely leads forward of Optimism. If Layer 2 continues to develop at its present tempo, Solana may discover that it’s not solely in competitors with different Layer 1 networks for liquidity.

Each the Mango Markets and Solend exploits had been attainable attributable to low liquidity ranges on their platforms, which made it simpler for whales to govern their markets to take out outsized loans. Whereas Solana protocols are arising with options to such issues, the community’s DeFi ecosystem may proceed to run into points so long as liquidity is low.

Whereas Solana DeFi is down, by far the largest criticism leveled on the community is over its repeated outages. Solana has suffered from hours-long downtimes on a number of events over the previous two years, most notably in September 2021 when it went down for 18 hours. Solana has been hit by 4 main outages in 2022, with the latest downtime final month occurring attributable to a misconfigured node.

Although outages have been a persistent drawback for the community, Solana Labs CEO Anatoly Yakovenko has said {that a} forthcoming improve will stop such incidents sooner or later. If Solana can overcome the issue as he guarantees, the community ought to be in a significantly better place by the subsequent crypto market growth.

Leveraging Excessive Speeds and Low Prices

Whereas Solana DeFi could also be in a hunch, the identical can’t be mentioned for the community’s NFT ecosystem.

With the second greatest NFT ecosystem behind Ethereum, Solana has constructed a fast-growing neighborhood of so-called “JPEG lovers.” This 12 months, collections like DeGods and y00ts have taken the NFT scene by storm, buying and selling at hundreds of {dollars} on the secondary market regardless of antagonistic market situations.

Solana has additionally attracted many massive names from the digital artwork world. At Breakpoint, Metaplex announced that it will launch “immersive 3D NFTs” from Beeple on Solana, taking a notable department out from Ethereum. pplpleasr, one other main artist within the NFT area, has additionally beforehand launched Solana NFTs. The place a lot of the mainstream consideration over non-fungible digital collectibles has been on Ethereum, NFT natives have seen that exercise is rising on its strongest competitor community. The subsequent NFT bull cycle may look totally different to the final one now that Solana’s NFT neighborhood and infrastructure have gained a lot tempo all through the bear market.

Solana additionally appears to concentrate on its standing within the GameFi world attributable to its high-speed, low-cost capabilities. Breakpoint featured a complete day devoted to the buzzy sector, which was the place Star Atlas and different groups confirmed off their newest progress to a packed room of would-be Web3 avid gamers.

What’s the Future for Solana?

Whereas the community has challenges to beat, it’s abundantly clear that many optimistic developments are coming from the community. The assorted bulletins made at Breakpoint show that proficient firms, artists, and initiatives are taking a eager curiosity within the Solana community regardless of the difficulties it has confronted.

It’s additionally value declaring that Solana and SOL aren’t the one victims of crypto winter. Whereas SOL is down round 86.9% from its peak after outperforming in 2021, many different Layer 1 networks have suffered comparable losses. DeFi has additionally taken a beating throughout the board, with Ethereum popping out strongest. Traditionally, Ethereum’s opponents—typically dubbed “Ethereum Killers”—have seen exercise wane and their tokens die off in bear markets, however none of them has had as many optimistic developments as Solana has completed over latest months.

Maybe the best hurdle forward for the community lies in its competitors. The brand new Layer 1 networks Aptos and Sui, each developed by former Meta staff, have been in comparison with Solana owing to their promise of excessive speeds, and each initiatives have raised nine-figure battle chests this 12 months. Aptos, which claims it may well course of 100,000 transactions per second via its Transfer programming language, launched with a token airdrop final month and anticipation for its progress is excessive. Sui can be believed to be getting ready its personal airdrop. Capital is cruel in crypto; if these initiatives efficiently seize the area’s consideration, they might find yourself outpacing Solana on the subsequent market rally.

As with different leaders of what’s develop into generally known as the “various Layer 1” area, Solana will even quickly have competitors within the type of Layer 2 networks. Arbitrum and Optimism’s speedy progress this 12 months has confirmed that liquidity will flood to Layer 2 if Ethereum succeeds, and lots of different Layer 2 initiatives are but to launch in earnest.

Nonetheless, Solana has one among crypto’s most energetic and fastest-growing ecosystems with a number of promising developments on the horizon. Regardless of its points, it’s clear that the community isn’t going wherever anytime quickly. As for SOL, whereas the utility token is probably not shifting at the moment, that’s not unusual for crypto bear markets—nevertheless optimistic the information cycle seems. As soon as sentiment flips to bullish, although, there’s good purpose to imagine that SOL may see the profit.

Disclosure: On the time of writing, the writer of this piece owned ETH and a number of other different cryptocurrencies.