Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The market construction was bullish however the shopping for quantity was not encouraging.

- Solana was buying and selling at a crucial resistance zone and will face rejection.

Over the previous two days, Solana appeared to reverse the bearish trajectory it had been on since late February. This was a development throughout the crypto market following the short-term bullish sentiment behind Bitcoin within the early hours of Monday.

Is your portfolio inexperienced? Take a look at the Solana Revenue Calculator

Was this the start of an uptrend, or was this a transfer right into a liquidity pocket earlier than a reversal? The highs and lows of Mondays typically present data on the course of the approaching week.

Merchants may also incorporate this data earlier than formulating a plan of motion concerning Solana.

The confluence of the bearish breaker and vary lows may damage SOL bulls

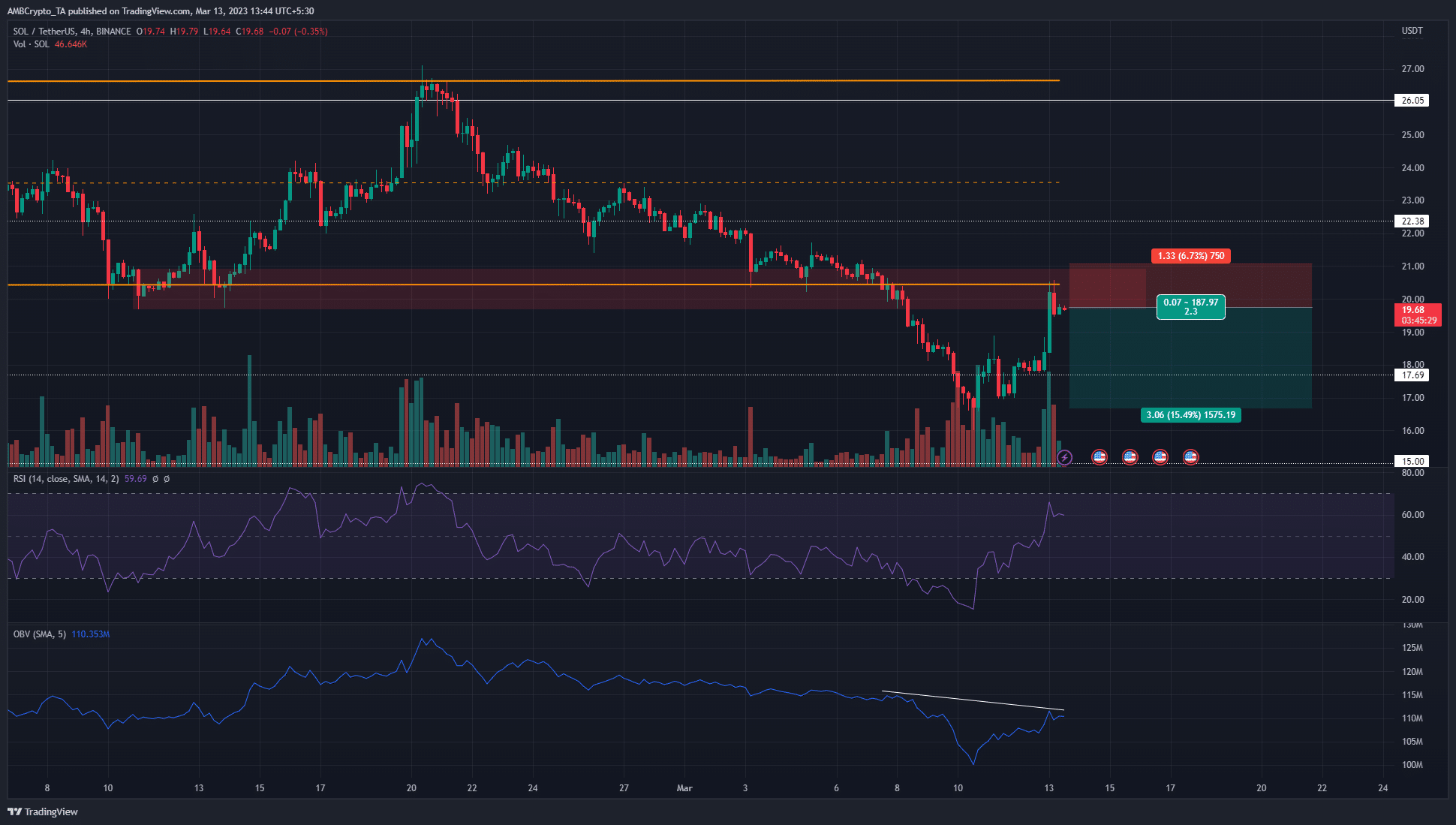

Supply: SOL/USDT on TradingView

On the time of writing, Solana was buying and selling at $19.68 and had retested the earlier vary lows as resistance. This vary was highlighted in orange and Solana had traded inside it from mid-January until the drop beneath it on 7 March. The vary prolonged from $20.5 to $26.6.

The good points of Solana measured 28.6% when measured from the swing low at $16 that SOL registered over the weekend. The RSI was additionally above impartial 50 and confirmed sturdy bullish momentum.

Nonetheless, the OBV was unable to type the next excessive, which confirmed barely muted shopping for stress over the previous three days of good points.

Though the buying and selling quantity has been excessive over the previous few H4 buying and selling periods when Solana made these good points, the development has not reversed but. From a technical perspective, the market construction was bullish, because the current decrease excessive at $18.9 has been overwhelmed.

How a lot are 1, 10, or 100 SOL price at this time?

Nonetheless, the $20 space represented a confluence of resistance from the vary lows in addition to the bearish breaker from February. Therefore, shorting the asset may curiosity aggressive bears. To the south, the $18.5 and $16.6 can be utilized to e book earnings.

Open Curiosity instructed a story of bearish sentiment flipping bullish

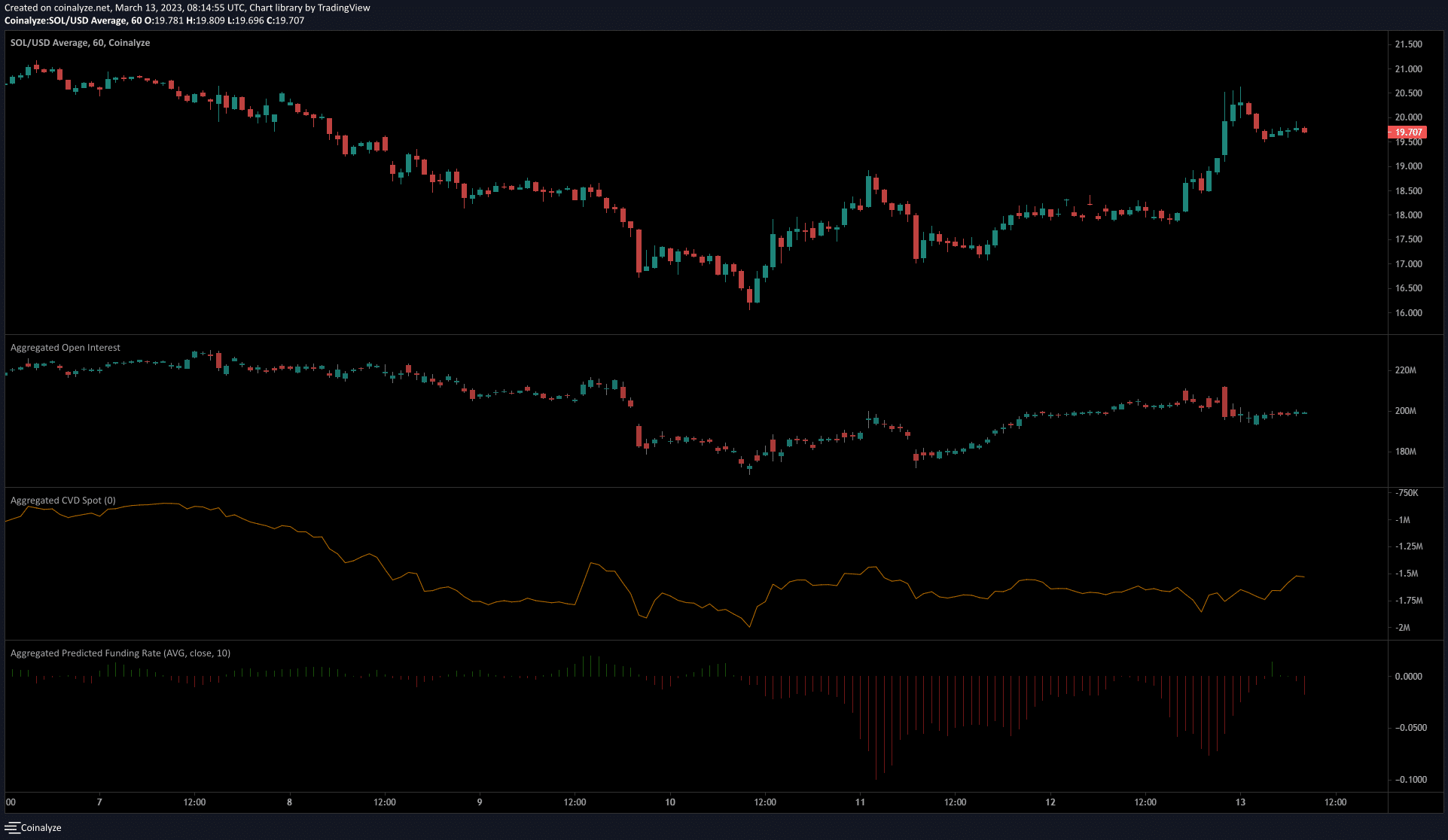

Supply: Coinalyze

The spot CVD has been flat over the weekend after seeing some shopping for stress on 10 March. The current transfer didn’t spark an rise on CVD. In the meantime, the funding price remained adverse to point out brief positions paid the lengthy positions.

This underlined the bearish sentiment behind Solana.

The Open Curiosity superior over the previous few hours and declined when the worth confronted resistance on the $20 mark. This seemingly confirmed bullish sentiment over the previous few hours.