Whereas many crypto fans are hopeful that digital property are coming into the proverbial spring, there’s one phase of the market that’s clearly nonetheless deep in winter: non-fungible tokens.

A part of the zeitgeist of the 2022 crypto market mania, NFTs have plummeted in worth and haven’t seen a lot reduction over the previous yr. The Bitwise Blue-Chip NFT Index fund — which supplies institutional traders publicity to the most important NFT collections — is down 28.8% for the reason that starting of the yr, while bitcoin has appreciated 70% over the identical interval.

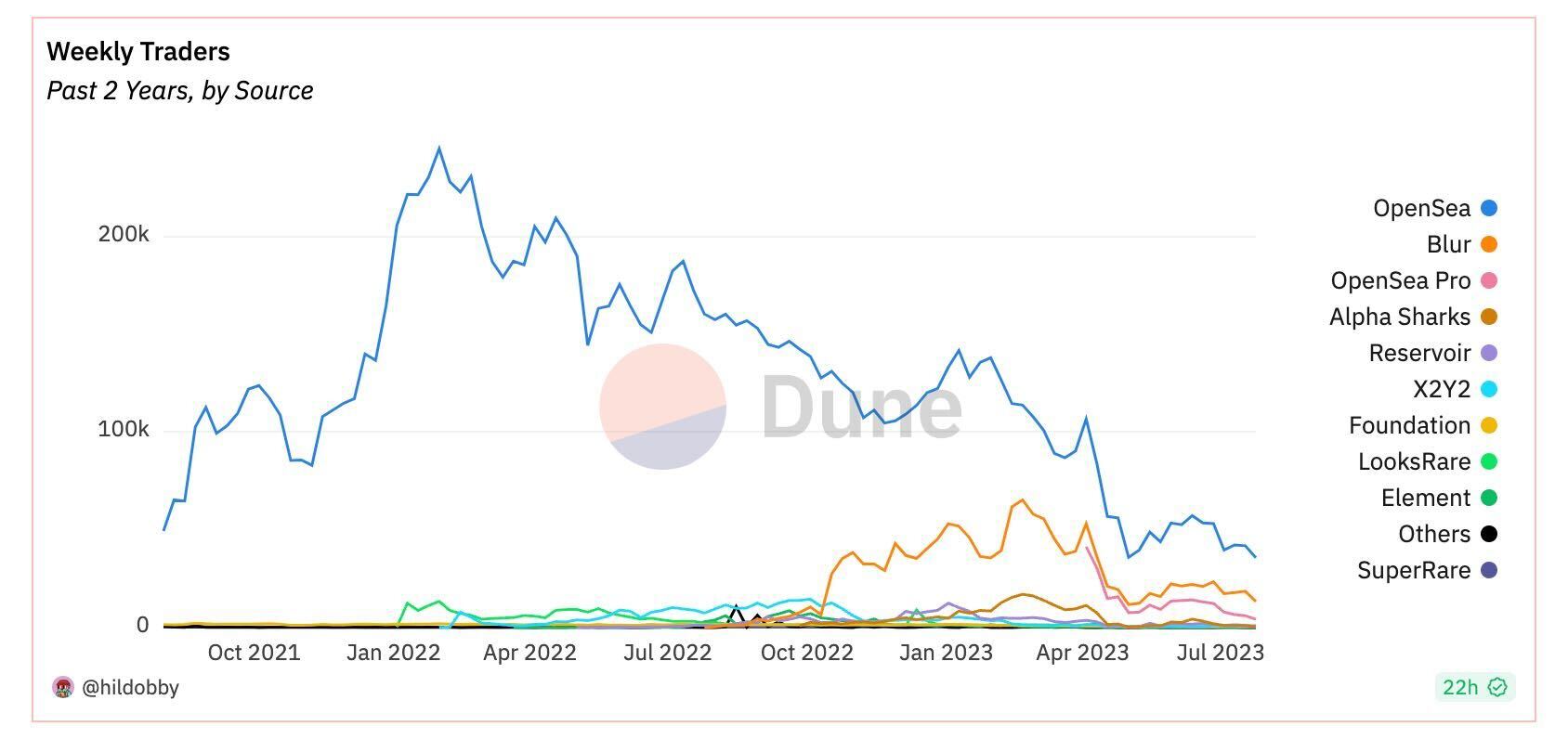

Unsurprisingly, it has been a brutal interval for marketplaces, which have seen the variety of energetic weekly customers and quantity decline since January 2022.

Down solely

OpenSea — which was at one level the darling of the NFT market sporting a $10 billion-plus valuation — has seen energetic merchants on its platform decline from practically 250,000 per week to round 40,000.

Supply: Dune Analytics

Month-to-month volumes for Ethereum-based NFTs throughout marketplaces declined from a excessive of $1.72 billion in February 2023 to $455 million in July 2023, in keeping with The Block’s knowledge dashboard.

NFTs stroll to their very own beat

In an sense, the hole between NFTs and cryptocurrencies should not come as a shock to shut observers of the market, given they usually do not commerce in lockstep. As the newest bull run started to fizzle, NFTs have been nonetheless buying and selling increased in pattern that pundits on the time thought illustrated their resiliency.

“They will proceed to lag fungibles by a while as they’re extra of a luxurious product,” famous Mike Dudas of sixth Man Ventures.

In a way, that lag is tied to the truth that most traders in NFTs are the crypto wealthy, so would-be energetic NFT collectors sit on the sidelines till broader crypto costs are strong sufficient for traders to ape in, famous outstanding NFT fanatic, collector and commentator known as “DCInvestor.”

“I don’t count on quantity to meaningfully pickup till we enter a sustained uptrend in ETH and crypto extra broadly,” he advised The Block. “When crypto individuals really feel wealthy, they purchase NFTs.”

Nonetheless, he pointed to some indicators that NFTs have caught some extent of mainstream attraction together with latest auctions performed by Sotheby’s. In Might, the public sale home introduced in $2.4 million from promoting a portion of the NFT portfolio of bankrupt hedge fund Three Arrows Capital. The agency additionally launched a secondary, peer-to-peer market for NFTs that very same month.

In any case, different market individuals level to a broader issues inside the NFT area that transcend the cyclicality of the market and clarify its present woes. These collectors and traders advised The Block that the trade must witness a elementary pivot earlier than costs and exercise return to ranges seen within the earlier cycle.

Gaming pivot

One phase that might breathe new life into NFTs is gaming, in keeping with Loopify, a self-described jpeg fanatic and anon behind metaverse and NFT studio Infinite Clouds. In his view, the market must shift from being dominated by the menagerie of cartoon profile footage to NFTs that signify in-game gadgets like “skins.”

“NFTs are simply the underlying tech for these digital property so that you simply await good video games and customers, the distinction between what I imagine the long run bull market will probably be vs the earlier is the place quantity comes from,” he advised The Block. “Mass quantity of customers (a whole bunch of 1000’s to million) transacting on-chain (and even on custodial options) doing small quantities of quantity provides as much as so much.”

DCInvestor additionally sees gaming as a possible catalyst, however a return to the heady days of 2022 will probably be contingent on strong crypto costs throughout the board.

“It’s all the time doable that some new use instances actually pop off (like gaming) and herald many new customers/consumers, however normally I count on that to happen coinciding with extra bullish market circumstances,” he stated.

To regulate to that new world, corporations like OpenSea — which made cash hand over fist facilitating the gross sales of Bored Apes and Pudgy Penguins — must cater to the demographic of sport studios growing this content material.

“You actually need good curated marketplaces particular to the video games, so I don’t assume most quantity will undergo present MPs in the event that they don’t adapt or work along with the studios,” he stated.

Disclaimer: Mike Dudas is a co-founder of The Block.