Nonetheless, the quantity raised outpaced precise market quantity and person development, suggesting that enthusiasm stays concentrated amongst enterprise buyers. Mainstream collectors have but to match the curiosity. Distinctive customers and buying and selling quantity proceed to say no.

The market wants to maneuver past short-term hype and hypothesis and appeal to broader participation and success throughout initiatives.

Information of this report was obtained from Footprint’s NFT analysis web page. A straightforward-to-use dashboard containing probably the most important stats and metrics to know the NFT business, up to date in real-time, you will discover all the most recent about trades, initiatives, fundings, and extra by clicking right here.

Key Factors

Crypto Macro Overview

NFT Market Overview

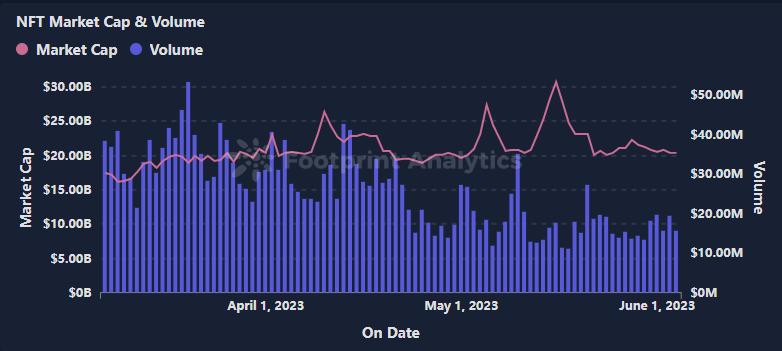

- The NFT market at present has a market capitalization of about $20 billion, with roughly 30,000 distinctive customers interacting with the market every day.

- The variety of customers within the NFT market just isn’t rising loads whereas Milady Maker’s getting sizzling talked about by Elon Musk.

Chains & Marketplaces for NFTs

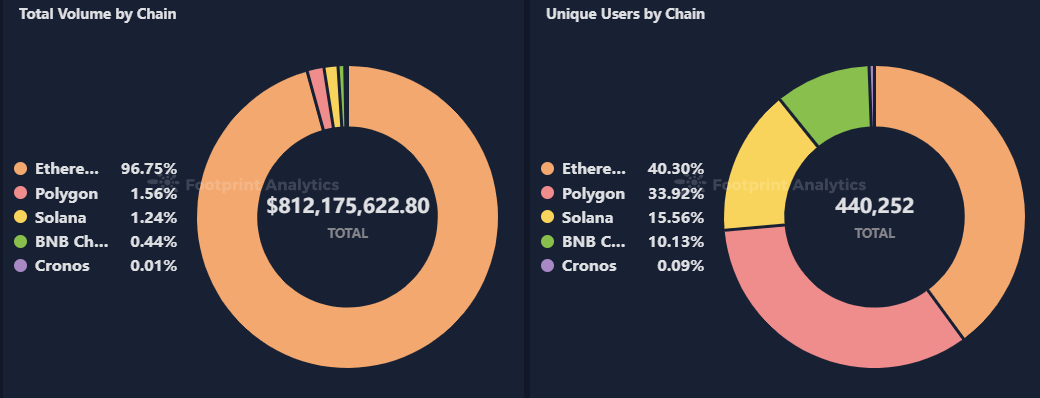

- Ethereum dominates NFT quantity with over 95% of the overall market.

- Nonetheless, by way of distinctive lively wallets, about 40% are on Ethereum, 34% on Polygon and 16% on Solana.

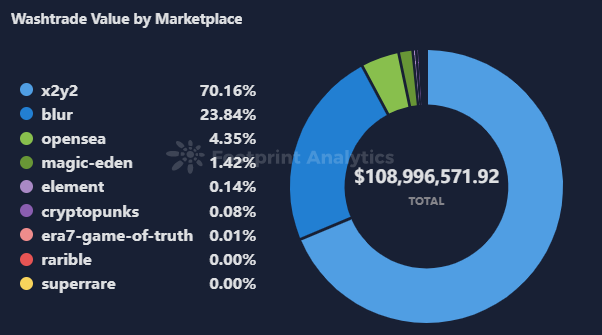

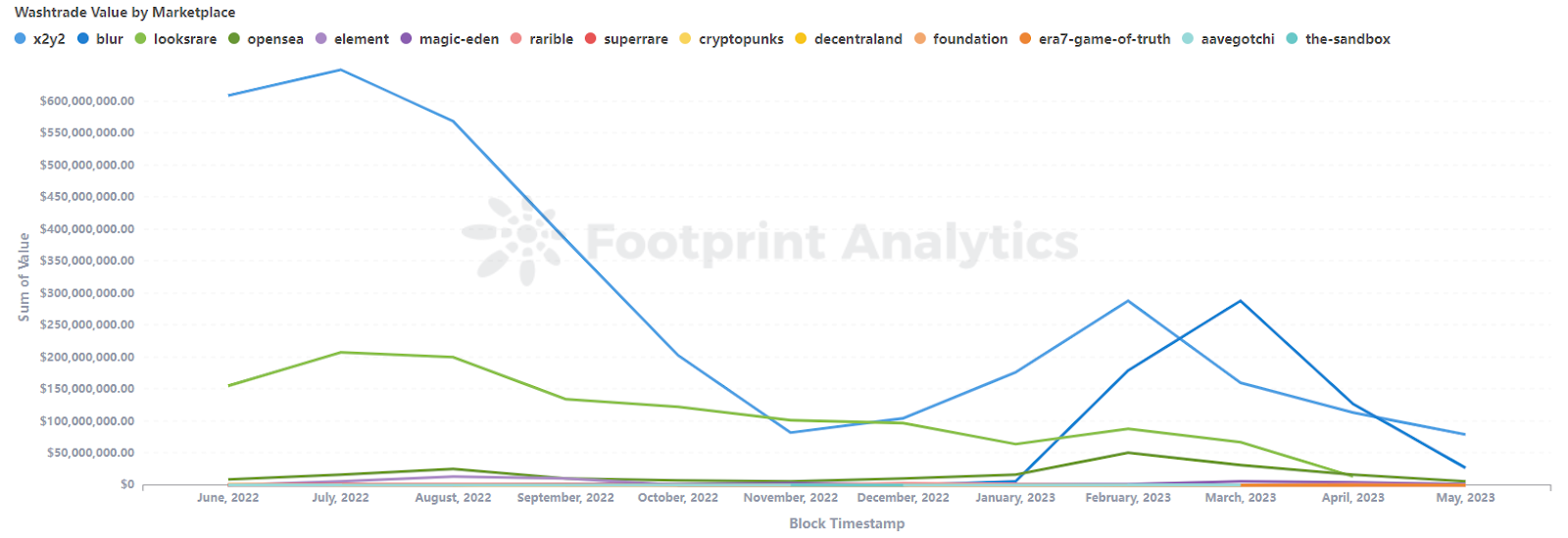

- Over 70% of wash-trading takes place on x2y2, indicating that their techniques and insurance policies permit manipulative behaviour with fewer limitations.

NFT Funding & Funding

- The full quantity raised in Could was $43.2 million, the very best since November 2022.

- Nonetheless, there have been solely 7 funding rounds, which is a comparatively low quantity.

Sizzling Subjects of the Month: Bitcoin Ordinals

- Ordinals are a singular class of NFTs which can be primarily based on the Bitcoin community.

- Individuals nonetheless anticipate the long run and additional enlargement of the Bitcoin community.

What’s new on this month?

- OKX Pockets Turns into First Multi-Chain Platform to Allow Viewing and Switch of Bitcoin Ordinals.

- Adidas and Pharrell Launch Digital Clothes for Doodles NFT Holders.

- NFT Market Blur Launches Mix, a Peer-to-Peer Lending Platform.

- Elon Musk Sends Milady NFTs Hovering.

- Binance Provides Assist for Bitcoin Ordinals to Its NFT Market.

- Sony Launches Web3 Incubator Program.

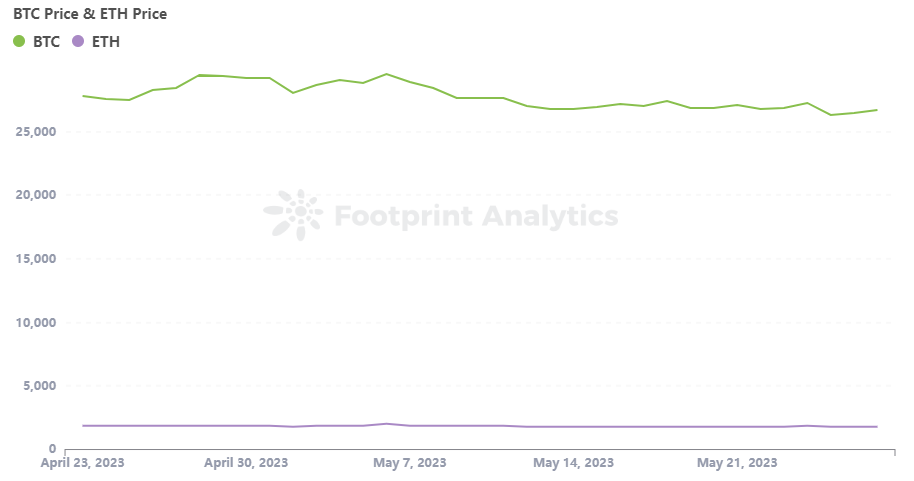

BTC opened the month of Could at $28,074, peaked on Could 5 at $29,528, and turned right down to $27,223 on Could 31. For the month as an entire, bitcoin was down barely by 0.5%.

BTC Value & ETH Value

Nonetheless, BTC as a advertising and marketing indicator, remains to be up greater than 64% year-to-date, in comparison with its value of $16,605 on Jan. 1. ETH is following the identical development, down lower than 1% in Could, and up 58% year-to-date in 2022.

Market gamers shouldn’t have a false feeling of safety on account of the present quiet within the volatility of Bitcoin and ETH. Particularly, BTC noticed a major 13.3% drop in on-chain quantity, indicating a lower in buying and selling exercise on Bitcoin Community.

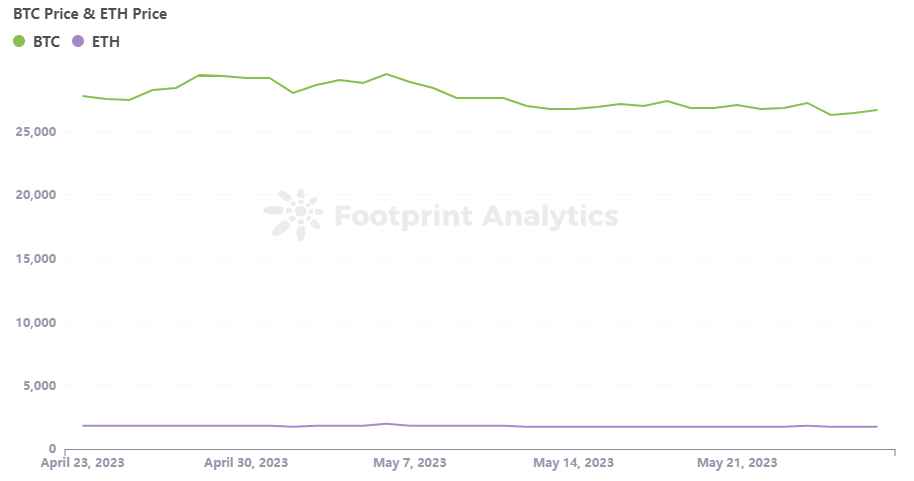

The NFT market at present has a market capitalization of about $20 billion, with roughly 30,000 distinctive customers interacting with the market every day.

NFT Market Cap & Quantity

NFT quantity is random and can’t totally characterize the market as an entire, however we will nonetheless see that quantity is down considerably evaluating to April. In Could, quantity began strong at $27 million, jumped to $35 million, then dropped by two-thirds earlier than partially recovering.

Elon Musk’s Twitter

The Milady Maker assortment was talked about in a tweet by Elon Musk on Could 10, 2023, which induced buying and selling quantity to spike to $13.95 million, sending costs hovering. The mid-month spike reveals how younger the NFT market is. The larger image might be skewed by “sizzling” new collections or gross sales that come and go rapidly by way of reputation.

Day by day Distinctive Customers

Although, on Could tenth, the variety of customers within the NFT market just isn’t rising loads, so we might speculate that the NFT person base just isn’t rising considerably in the mean time, regardless that Milady Maker’s assortment is getting sizzling, the customers are nonetheless the identical individuals who have been on this market for a very long time.

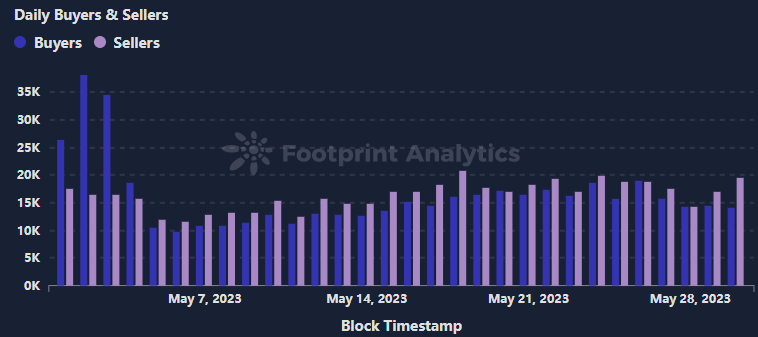

Day by day Consumers & Sellers

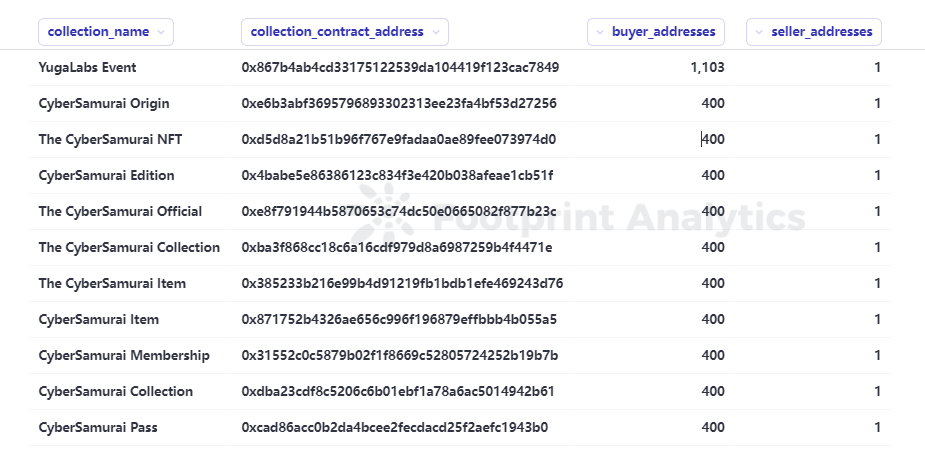

At first of Could, there have been extra NFT patrons than sellers, with the ratio being 2:1, principally due to some initiatives on Polygon as beneath, with a bunch of patrons and solely a number of sellers on the secondary market.

NFT Consumers & Sellers on Could 2

Based on the information of every day patrons & sellers, there are nonetheless extra NFTs listed on the market than lively patrons fascinated by shopping for them, indicating a possible oversupply of NFTs, not essentially subpar collections.

Whereas the NFT market has skilled fluctuations, it’s nonetheless a rising business with the potential for long-term development and acceptance.

Ethereum dominates NFT quantity with over 95% of the overall market. Nonetheless, by way of distinctive lively wallets, about 40% are on Ethereum, 34% on Polygon and 16% on Solana.

Complete Quantity & Distinctive Customers by Chains

Whereas nonetheless small in comparison with conventional markets, rising distinctive participation throughout a number of chains is a more healthy signal for the NFT area than if the massive majority remained focused on Ethereum alone.

Washtrade Worth by Market

Based on Footprint Analytics, over 70% of wash-trading takes place on x2y2, indicating that their techniques and insurance policies permit manipulative conduct with fewer limitations – whether or not intentional or not, this highlights the speculative nature of the present NFT market and the necessity for continued progress in direction of transparency, belief and real mainstream curiosity.

Washtrade Worth by Market

It’s anticipated for the wash commerce worth to lower because the NFT market experiences a downturn, however it’s noteworthy that the wash commerce proportion has additionally decreased over the previous three months.

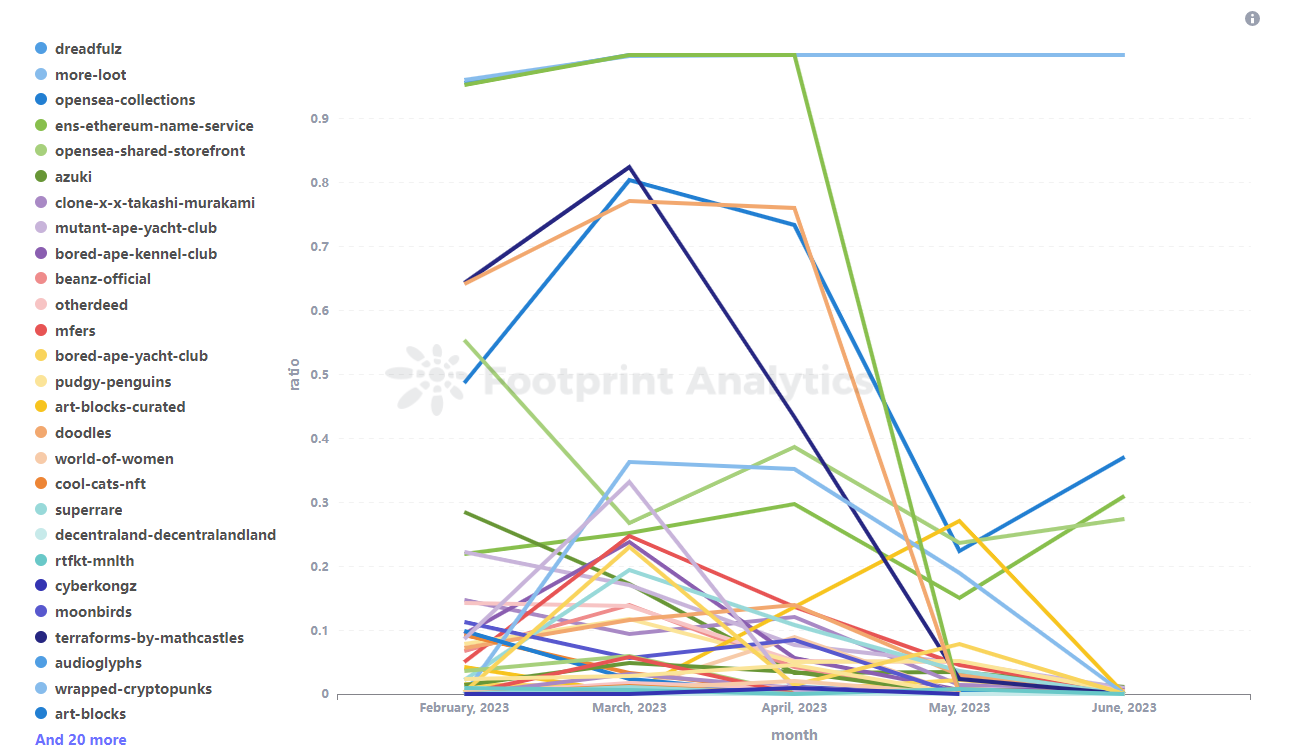

Wash Commerce Ratio of NFT Market

After a quick interval of euphoria attributable to the Blur airdrop, the NFT market has now returned to a bearish state, characterised by a marked decline in speculator enthusiasm.

Washtrade Ratio

Footprint Analytics has performed an evaluation of the highest 50 quantity collections. This reveals a lower within the prevalence of wash buying and selling, which might be primarily attributed to 2 key elements:

- Hypothesis-driven initiatives

Initiatives resembling MineablePunks and Terraforms by Mathcastles initially gained vital buying and selling quantity primarily based on hypothesis. Nonetheless, these initiatives had been primarily based solely on hype and lacked substantial underlying worth. As merchants and buyers realised the restricted utility and long-term potential of those collections, curiosity waned, leading to a lack of sustained buying and selling exercise.

- Wash buying and selling through the hype

Wash buying and selling performed a major position in sure collections on the top of their hype. Nonetheless, as the joy and frenzy round these collections subsided, speculators now not discovered it advantageous to interact in such exercise. Because of this, each wash buying and selling and general buying and selling quantity declined. This development was notably evident for collections hosted on the Opensea platform(Opensea collections).

As speculators cut back their buying and selling exercise, it’s anticipated that the costs of sure collections might take a success. Nonetheless, this era of lull within the NFT market truly fosters a more healthy setting, paving the best way for future prosperity.

As well as, the market slowdown is decreasing limitations to entry, offering alternatives for real customers and recreation builders to take part. With much less speculative buying and selling dominating the market, undertaking groups can now deal with their undertaking. This strategic shift permits them to put the groundwork for a possible restoration within the subsequent market cycle and appeal to long-term buyers who worth the sustainable development and utility of NFT initiatives.

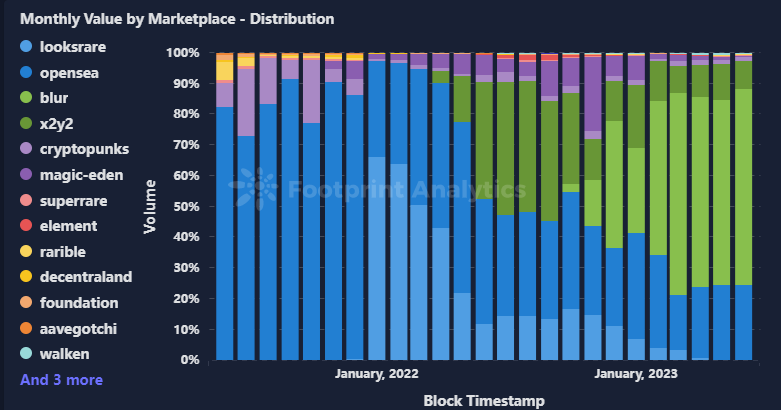

When it comes marketplaces, in keeping with the most recent information, Blur is at present the main NFT market with a month-to-month worth share of round 60%. That is adopted by OpenSea with round 20% and x2y2 with round 10%.

Month-to-month Worth by Market – Distribution

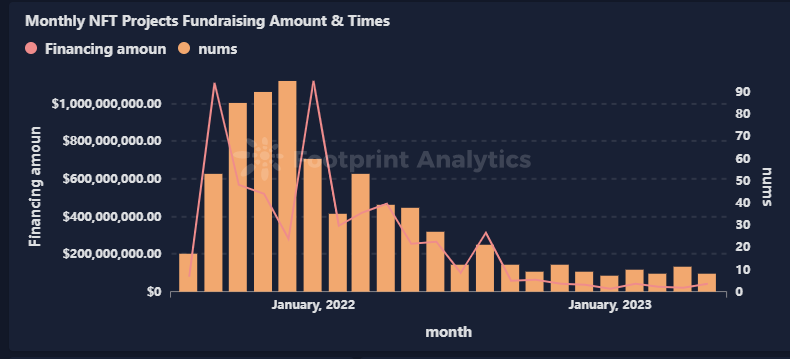

The full quantity raised in Could was $43.2 million, the very best since November 2022. Nonetheless, there have been solely 7 funding rounds, which is a comparatively low quantity.

Month-to-month NFT Initiatives Fundraising Quantity & Instances

In Could, two vital NFT funding with probably the most quantity are Pudgy Penguins and AlienSwap. Pudgy Penguins raised a $9 million seed spherical led by 1kx to construct the following nice IP firm. And AlienSwap raised $12 million led by NEXT Chief Capital and C² Ventures to increase the AlienSwap engineering staff.

Pudgy Penguins

The upper quantities invested in Could are a constructive sign of renewed optimism, regardless of a slowdown in precise market exercise and participation. Nonetheless, sustainability relies on broader success throughout extra initiatives.

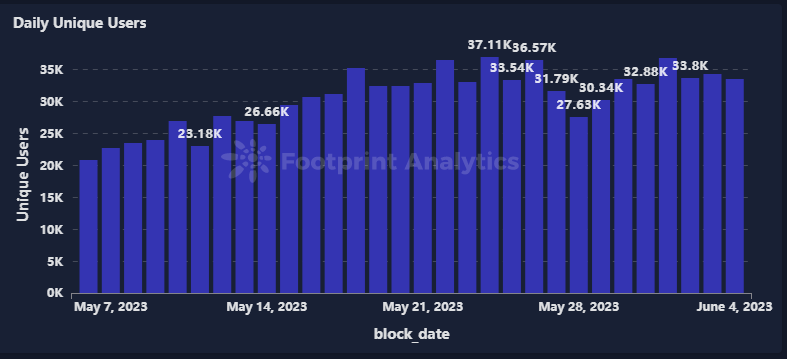

Ordinals are a singular class of NFTs which can be primarily based on the Bitcoin community. Ordinals have seen insane development within the few months. A Twitter Area from Footprint Analytics talked about this subject.

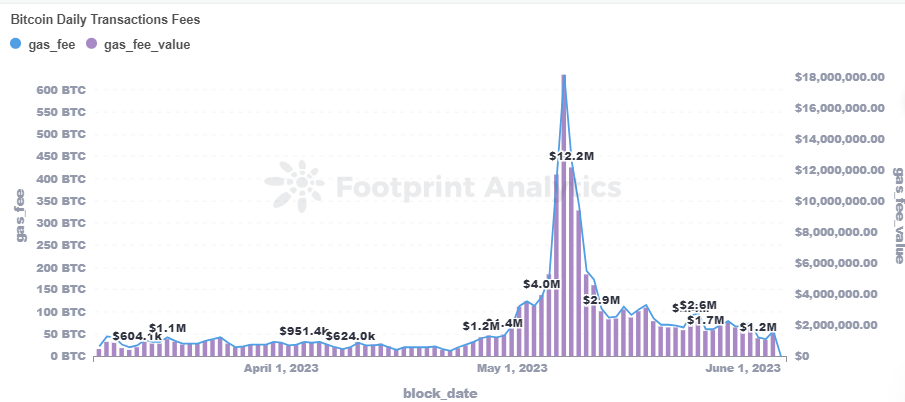

It begins on January 21, 2023, when programmer and crypto fanatic Casey Rodarmor launched the Ordinals protocol on the Bitcoin community. The innovation permits for the minting of Bitcoin NFTs. Ordinals induced a excessive variety of Bitcoin transactions in Could.

Bitcoin Day by day Transaction Charges

They introduce a brand new dimension to digital collectibles and asset possession by permitting customers so as to add arbitrary information to a Bitcoin transaction and tie that information to a person satoshi, creating a singular asset referred to as an ordinal. For now, it has minted over 10 million in keeping with Footprint information.

The Ordinals protocol remains to be in its infancy, with light-weight pockets functions, NFT buying and selling markets, and different “infrastructure” but to be constructed. Individuals nonetheless anticipate the long run and additional enlargement of the Bitcoin community.

This piece is contributed by the Footprint Analytics group.

The Footprint Group is a spot the place information and crypto fans worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or another space of the fledgling world of blockchain. Right here you’ll discover lively, numerous voices supporting one another and driving the group ahead.

Footprint Web site: https://www.footprint.community

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

DISCLAIMER: The data on this web site is offered as common market commentary and doesn’t represent funding recommendation. We encourage you to do your analysis earlier than investing.