NFT

On this article we focus on a tragic story by which the protagonist is a well-known NFT dealer, particularly of the well-known Bored Ape (BAYC).

After falling sufferer to a $4 million rip-off, the unlucky person was pressured to place most of his Bored Ape up on the market to repay a debt incurred in DeFi. The estimated loss quantities to greater than 2,000 ETH.

Let’s see the small print of this affair collectively.

An NFT dealer places a lot of his Bored Ape up on the market to repay a debt

A couple of days in the past an NFT dealer, recognized by the nickname “Franklin,” misplaced about $4 million on account of a rip-off.

The loss pressured him to liquidate most of his NFT Bored Ape to take care of a debt he had beforehand incurred by means of a decentralized platform.

Franklin himself shared the information through a tweet by which he recounted that he had been the sufferer of a rip-off about which he doesn’t want to talk publicly for privateness causes.

On this rip-off mission, the unlucky person had invested greater than 2,000 ETH.

I bought rug pulled on an funding I put nearly 2000 ETH into, pondering it was credible on account of who else invested (not naming anybody for privateness causes). Somebody used our $$ as a on line casino playing Ponzi and flushed it down the drain. Please study any classes potential from this.

— Franklin (@franklinisbored) April 13, 2023

Franklin then recounted that he had beforehand misplaced one other 650 ETH or so by means of playing on a decentralized platform known as Rollbit.

Due to these two mishaps, he needed to make the onerous alternative: to place up on the market most of his Bored Ape NFT property he had collected through the previous few years so as to have the ability to repay a debt on BendDao.

The latter is a Web3 knowledge liquidity platform that permits individuals to borrow ETH by depositing NFTs as collateral.

If you apply for a mortgage in DeFi, as on this case, you comply with pay an rate of interest that’s accrued every day in proportion to the requested capital.

Most definitely the rising mortgage charges and the shortcoming to repay the debt with solely the money he had left in his portfolio pressured Franklin to place his prestigious assortment of NFTs up on the market.

The extreme blow he suffered, each financially and psychologically, satisfied him to withdraw momentarily from the NFT enterprise.

The information got here as a shock to the BAYC group, as Franklin was one of many predominant holders of the Bored Ape and a serious supporter of the mission.

As if that weren’t sufficient, just a few days later, one other well-known Bored Ape holder liquidated his NFT investments to the tune of a number of hundred thousand {dollars}

Jimmy.eth, one of many OGs of BAYC and an enormous contributor to their progress early on, simply left a whole bunch of 1000’s of {dollars} on the desk promoting off some grails to bids

Confirmed not a hack too… pic.twitter.com/23mBbqiocR

— Cirrus (@CirrusNFT) April 15, 2023

What number of Bored Ape NFTs had been bought by Franklin?

The NFTs belonging to the “Bored Ape Yacht Membership” assortment that had been bought by Franklin between 13 and 14 April amounted to 34 distinctive Bored Ape specimens.

All NFTs had been bought individually at a determine starting from 51.8 to 59.59 ETH.

The piece liquidated on the highest determine was Bored Ape 5876, which was bought at this handle for $126,000.

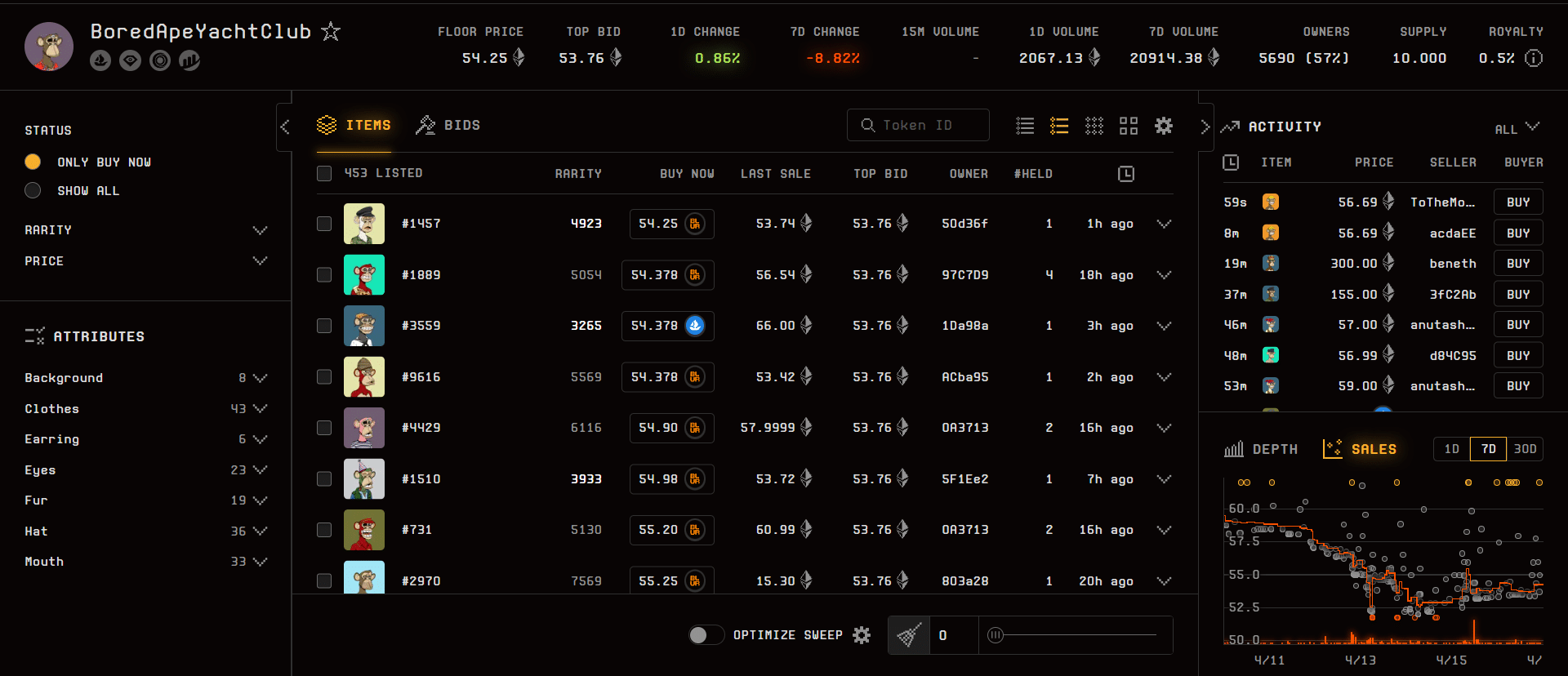

At the moment the ground worth of the gathering is 53.74 ETH. Over the previous 7 days there was a lower within the BAYC ground worth of 8.82% with buying and selling volumes of 20,914 ETH.

In whole Franklin managed to build up about 1872 ETH from the sale of those Non-fungible tokens, not sufficient to repay everything of the debt however actually serving to to place a patch over this tragedy.

The group was shocked to search out out that every one these NFTs had been bought in such a brief time frame, particularly contemplating that the triggers for this stream of gross sales had been an alleged rip-off and a playing downside from which Franklin was struggling.

On Rollbit, a crypto on line casino the place he himself admits to dropping about 650 ETH, it’s potential to watch that because the starting of the 12 months he had deposited greater than 6,000 ETH equal to $12.7 million.

A narrative that serves as a lesson for the group

Sadly, even those that seem like trade specialists with multimillion-dollar portfolios will be incorrect.

Franklin made a double mistake: first by falling sufferer to a rip-off, about which little or nothing is but recognized, and second by succumbing to playing by throwing away one other 650ETH.

Ludopathy is a major problem for many individuals around the globe: take into account that in Italy alone greater than 1 million individuals endure from it.

Within the context of decentralized finance platforms, the variety of protocols that permit customers to wildly gamble their cryptocurrencies has been growing tremendously lately.

The crypto group must take care of this, given and contemplating that an excellent many customers who assume they’re skilled cryptocurrency merchants open positions within the markets with out figuring out what they’re doing and punctually lose greater than they may afford to guess.

It’s important to have good notions of “threat administration” earlier than making any sort of commerce, whether or not it’s a easy swap, or opening a place on a perpetual futures market, or worse but taking up debt partially collateralized by unstable property. It’s essential to do analysis earlier than participating in such advanced actions.

Let’s hope that “poor” Franklin has discovered his lesson, though this isn’t the primary time he has made errors of such proportions: in July 2022 he had set “for enjoyable” a proposal of 100 ETH on an “ENS Domains” NFT, however sadly he didn’t have time to take away the provide and it was instantly accepted by the counterparty.

Each tales with a tragic, and on the similar time comical, character current a key perception that shouldn’t be underestimated: what if it was an try and launder cash by means of the sale of NFTs?

Maybe we are going to discover this delicate difficulty in additional element in one other article.