Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- Though the sentiment is bullish round Solana, the upper timeframe bias has not shifted.

- A breakout previous the vary highs was not but in sight.

Bitcoin consolidated on the $21.6k mark for a couple of days. Up to now couple of days, the value of BTC shot upward swiftly to succeed in $24.8k. The $24.8k-$25.2k is a zone of resistance from mid-August. Solana additionally posted robust beneficial properties over the previous two days.

Is your portfolio inexperienced? Test the Solana Revenue Calculator

The token registered beneficial properties of twenty-two.6% from the lows on 13 February at $19.73, to the highs on 16 February at $24.2. This rally additionally broke above the mid-range mark. Can the bulls press their benefit?

Solana breaches $23.5 however long-term buyers won’t have an interest but

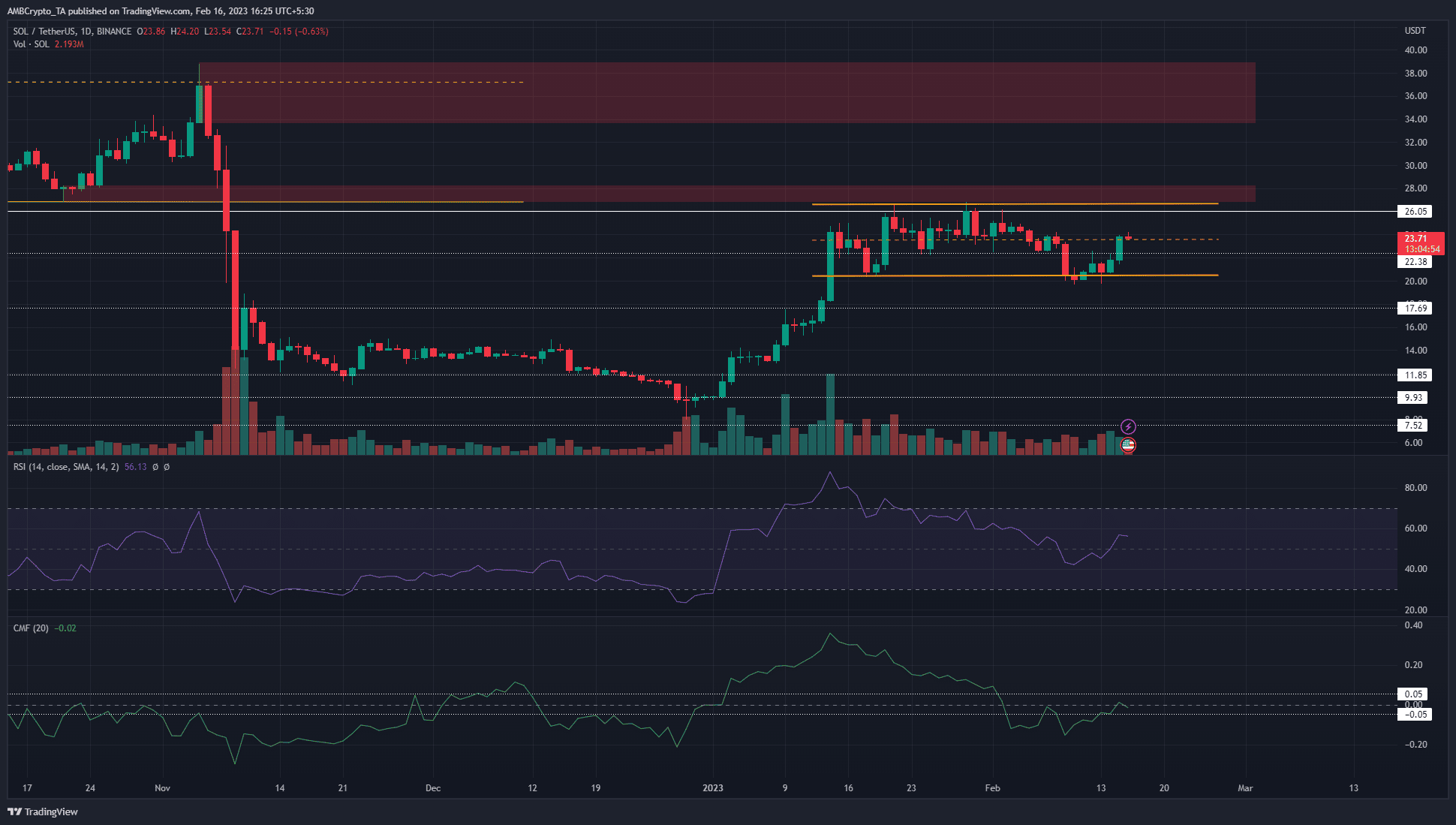

Supply: SOL/USDT on TradingView

The restoration from $8 to succeed in $26.6 took a month. Within the three weeks that adopted, Solana traded inside a spread from $20.5 to $26.6. The mid-range mark at $23.55 has served as help and resistance in current weeks. On the time of writing, SOL traded simply above this degree of resistance. The subsequent few hours can see it flipped to help.

Decrease timeframes confirmed that bulls can look to purchase SOL at $23.55 and $22.4, with stop-losses set simply 1% beneath both degree. Extra risk-averse merchants can await a transfer again above $24 and a subsequent retest of $23.55-$23.7 to purchase SOL, concentrating on the vary highs.

Reasonable or not, right here’s SOL’s market cap in BTC’s phrases

On the upper timeframes, the vary remained price watching. Above the highs sat a every day bearish breaker at $27.5. One other bearish order block was noticed at $35. Traders can look to take income on Solana in case of a transfer as much as $28, and await a major pullback to purchase.

Sentiment shifted to bearish on the vary lows however quick sellers had been punished

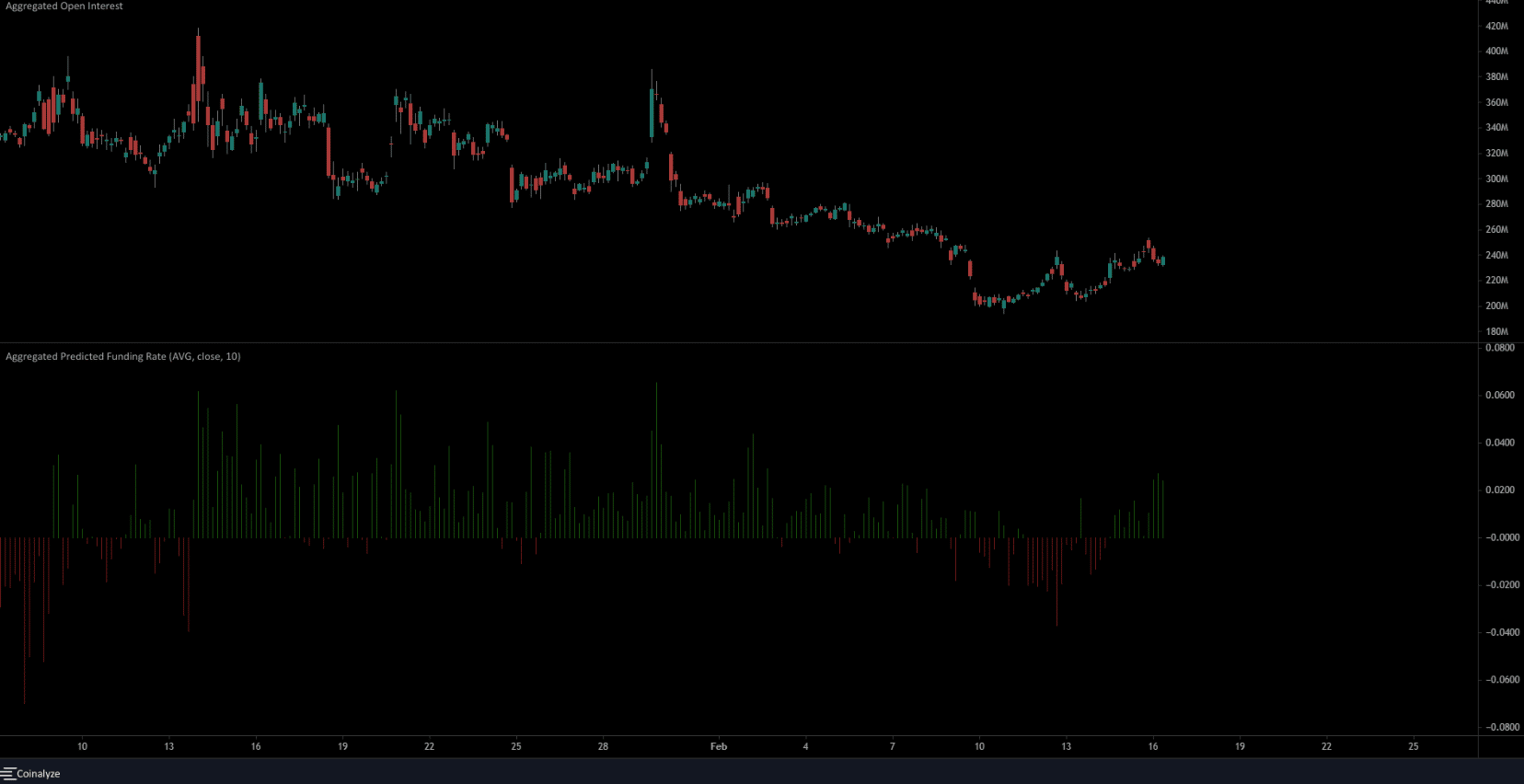

Supply: Coinalyze

On the 4-hour chart, we see that the Open Curiosity has been sliding decrease since late January. This corresponded with the value dealing with rejection at $26.6 and sliding towards the vary lows at $20. Subsequently, the inference was that the sentiment was bearish until 10 February. The anticipated funding fee had additionally been damaging then.

The previous week confirmed sentiment might need shifted. The worth rallied from the vary lows. Alongside it, the OI additionally climbed to make increased highs.

This strengthened capital movement into the market and a bullish outlook. Furthermore, the funding fee additionally flipped optimistic to indicate lengthy place holders paid funding charges to the quick sellers. Taken collectively, there was a probability that $23.5 and $22.4 will probably be defended as help over the following few days.

![The Solana [SOL] rally from $20 is not yet over as $23.5 is only a…](https://nomadabhitravel.com/wp-content/uploads/2023/02/PP-2-SOL-price-1-1536x870.png)