When Bitcoin value motion is sideways and directionless for the higher a part of a yr, bulls and bears argue over which route will probably be in the end chosen.

Nevertheless, contemplating macro situations like rising rates of interest, a sinking inventory market, and mounting ting debt, bears aren’t able to throw within the towel. However they may wish to after seeing this chart.

Bitcoin Worth Chooses A Route: Up And Away

Bitcoin and different cryptocurrencies are usually notoriously unstable. However volatility has dwindled to subsequent to nothing because the FTX collapse struck.

Few have been prepared to take the danger on BTC and altcoins whereas macro situations are this on the sting of collapse. It resulted in an enormous transfer off the underside, but additionally greater than six months of consolidation and confusion.

However after a number of months of sideways value motion, Bitcoin seems to have chosen a route and broke out to kind a brand new development. Bears, nonetheless, stay stubbornly brief per market sentiment.

Bearish merchants may wish to rethink their positioning after looking on the Directional Motion Index.

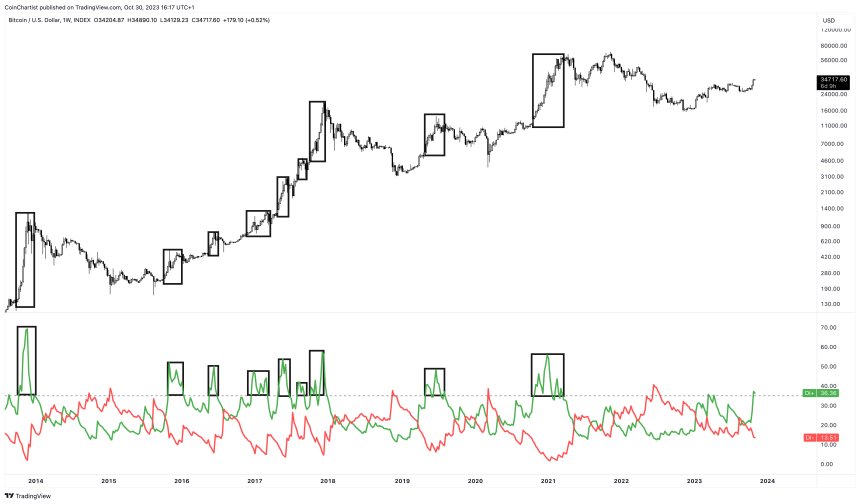

There isn't a denying: Bulls are in cost | BTCUSD on TradingView.com

Bullish Directional Motion Is Something However Common

The Directional Motion Index is usually discovered bundled with the Common Directional Index, and consists of a unfavorable and a constructive directional indicator. The device’s premise is easy: when DI+ (inexperienced) is above DI- (purple) the asset is bullish and DI- is above DI+ when bearish.

This technical evaluation indicator is at present exhibiting the DI+ hovering, whereas the DI- is falling and beneath the 20 line. The 20 line is notable extra for the ADX, which isn’t pictured. When the ADX rises above 20, the device suggests a development is energetic and strengthening.

Bitcoin isn’t above 20 on the weekly but, however has begun to take action on decrease timeframes. With how robust the latest transfer was, the ADX may verify above 20 over the subsequent week or two. At that time, bears may lastly be pressured to concede {that a} new bull development has blossomed.