A intently adopted crypto analyst believes Ethereum (ETH) might be gearing for a rally en path to liquidating merchants who’re bearish on the main good contract platform.

In a brand new weblog publish, Justin Bennett says that the S&P 500’s (SPX) rally on Friday might trace on the short-term efficiency of the crypto markets.

In accordance with the analyst, crypto tends to observe within the footsteps of the inventory market however there seems to be lag between the 2 asset lessons. Bennett provides that ought to crypto take cues from equities, he sees Ethereum taking out resistance at $1,840.

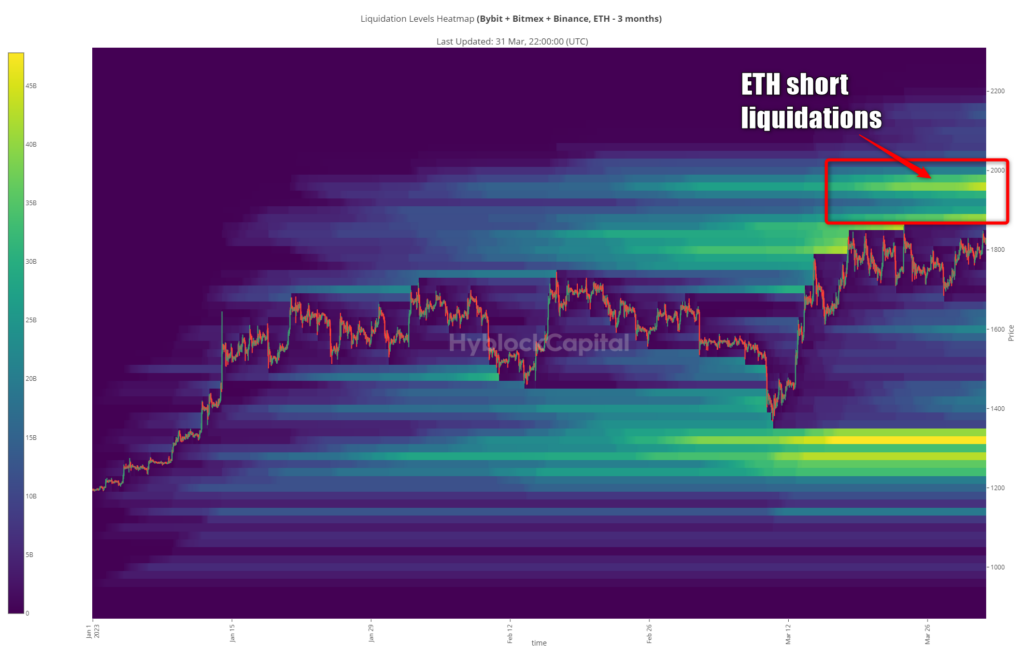

Bennett says an Ethereum breakout might set off a brief squeeze as he notes that there’s a “vital cluster” of quick liquidations up the the $2,000 worth degree for ETH.

A brief squeeze occurs when massive numbers of merchants who shorted an asset resolve to chop their losses in response to an sudden worth bump. The squeeze then triggers further rallies.

Says Bennett,

“That might be telling, as cryptocurrencies prefer to target these areas, and $2,030 is the August 2022 excessive. Much more lengthy liquidations are under present ranges, however proximity issues, so the quick liquidations as much as $2,000 might affect ETH within the quick time period.”

Nonetheless, Bennett says that the clock is ticking for crypto and Ethereum. In accordance with the dealer, the Ethereum quick squeeze should occur within the coming days. In any other case, he says that the rally might not materialize in any respect.

“However I’d prefer to see crypto play ‘catch up’ to equities sooner slightly than later if that is to materialize.

If we don’t see ETH flush these shorts within the subsequent few days, it’s much less prone to happen.”

At time of writing, Ethereum is buying and selling for $1,818.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney