- Bitcoin now seeing renewed curiosity, nonetheless, new buyers may lose out

- Inscriptions have additionally contributed to the hike in curiosity in BTC

Due to the Silvergate and SVB (Silicon Valley Financial institution) saga, many buyers have misplaced religion in conventional banking techniques. The truth is, as a result of aforementioned, there was a brand new wave of sustained curiosity within the crypto-market, particularly blue chip cash resembling BTC and ETH.

Learn BTC’s Value Prediction 2023-2024

Holding on

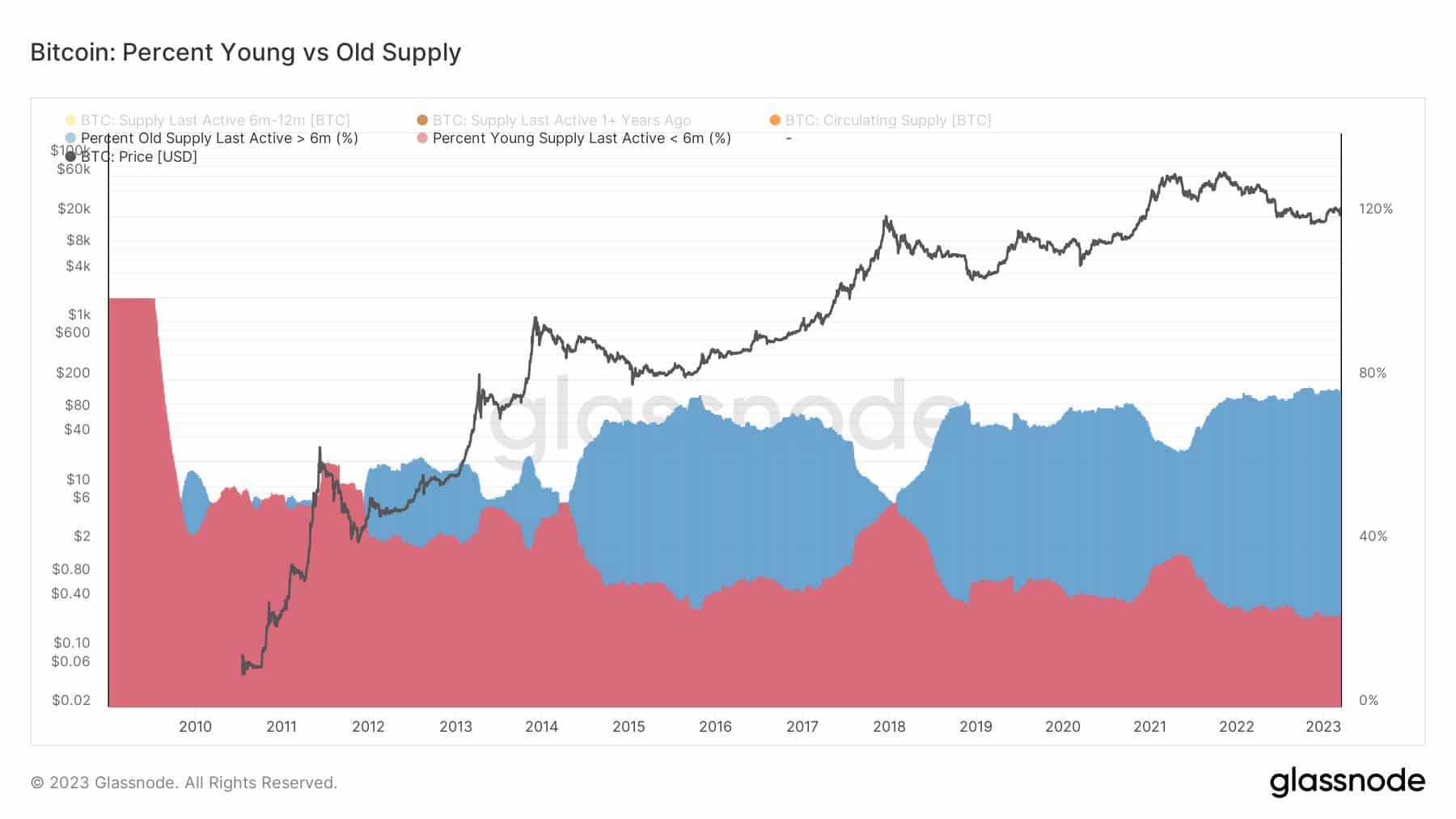

Nevertheless, new addresses planning to purchase BTC might have a tricky time doing in order at the moment, long-term buyers make up 73% of the general provide. These long-term buyers are much less more likely to promote their holdings and are extra susceptible to HODL their BTC.

This may make it tough for brand spanking new buyers to get their arms on BTC at discounted charges.

To buyers realizing that they may wish to personal some Bitcoin now that the Fed is already intervening, good luck getting what’s left.

Lengthy-term holders now have 73% of the whole provide.

You are not getting my cash, and there are a lot of others like me. pic.twitter.com/0sAZxskXl9

— Will Clemente (@WClementeIII) March 13, 2023

As the recognition of Bitcoins continues to rise, so will its costs, which might make it tougher for brand spanking new addresses to purchase BTC.

The hike in BTC’s rising reputation can’t be attributed solely to the USDC incident, nonetheless, as current developments associated to BTC inscriptions have additionally contributed to the identical.

BTC inscriptions have now allowed for NFTs to be minted by means of the Bitcoin community. They now make up for 63% of all inscription exercise. NFTs resembling Bitcoin Punks, Rocks, and Taproot Wizards have been exhibiting large potential for Bitcoin’s NFT market.

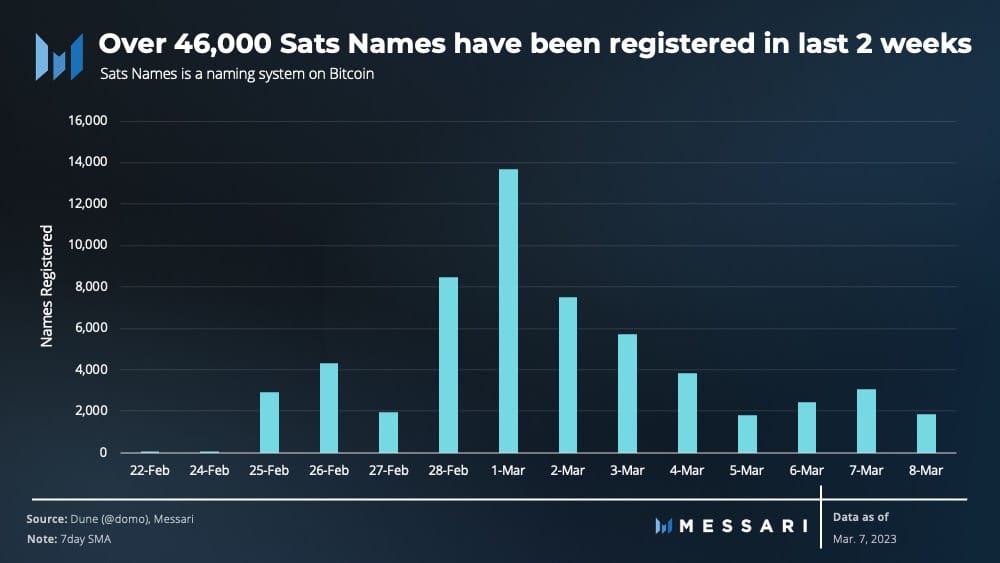

Apart from NFT’s, different providers resembling naming techniques have additionally generated curiosity within the Bitcoin community. The identical was evidenced by the recognition of Sats Names, with the latter recording 46,000 new registrations over the past 2 weeks.

Supply: Messari

On account of all these components, it’s unlikely that new addresses may come up with new BTC at decrease charges anytime quickly. Nevertheless, there are different indicators that recommend that there could also be an incentive for some BTC holders to promote their present holdings.

The lure of earnings…

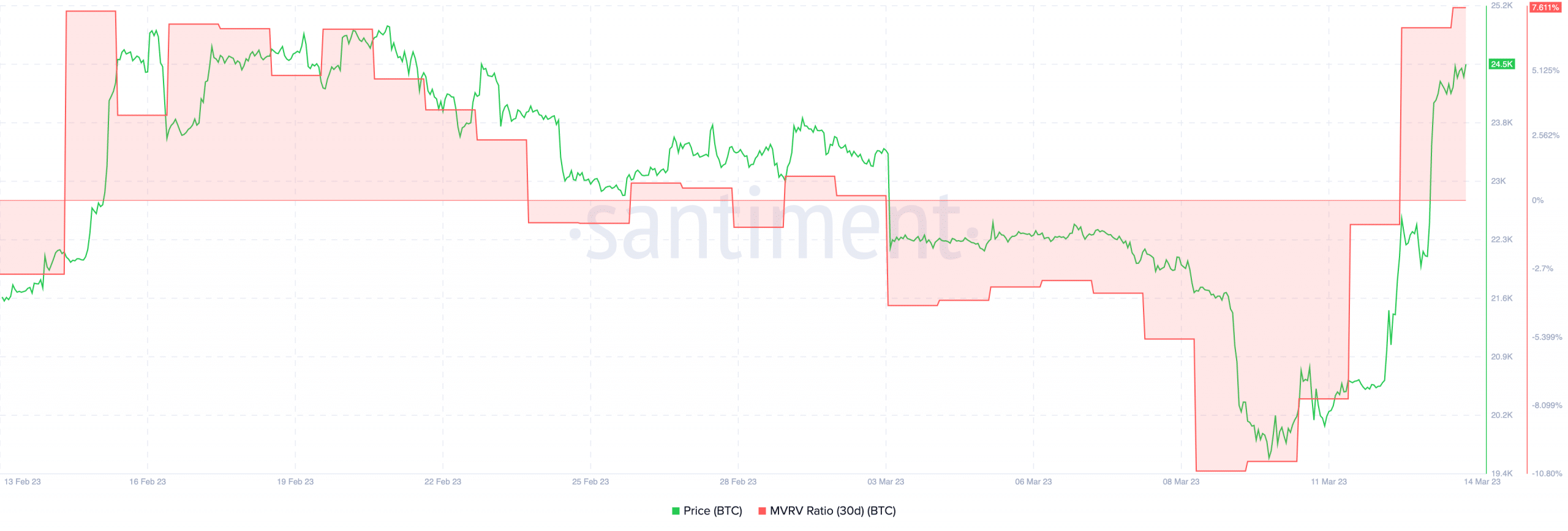

In response to Santiment, the MVRV ratio for BTC has hit a brand new excessive over the previous few days. This instructed {that a} overwhelming majority of BTC holders may promote their cash for a revenue.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Supply: Santiment

Regardless that long-term holders will not be as incentivized to promote their holdings, most of the short-term holders which can be nonetheless lively may find yourself exiting their positions.

This might drive BTC’s costs down and provides new buyers a possibility to purchase BTC at a pretty price.

Supply: glassnode

![Want to get in on Bitcoin [BTC]? Here’s the long and short of it all](https://nomadabhitravel.com/wp-content/uploads/2023/03/FrICKPMaQAA70cX.jpeg)