Ripple’s XRP is a peer-to-peer personal centralized cryptocurrency based mostly on a distributed consensus ledger. The Ripple platform facilitates cash transfers, specializing in low operation charges and lightning-like transaction velocity.

Ripple is the world’s solely company crypto resolution for international funds. Some argue that Ripple can not even be known as a cryptocurrency, whereas others are assured that that is essentially the most promising digital asset. This platform goals to turn into the subsequent huge factor within the fee techniques trade and is already extensively utilized by monetary establishments worldwide.

What’s the Ripple consensus protocol like? How was the concept of such a platform conceived and what precisely can it do? Let’s check out what Ripple (XRP) is all about!

Ripple Overview

Ripple is at the beginning a cash switch and fee ecosystem. It has a broad scope of software. Ripple is used as:

- A method of low price forex alternate. Ripple considerably reduces transaction prices due to the low commissions it fees.

- A strategy to switch funds cross-border at excessive velocity. Cash transfers via Ripple are almost on the spot and take 4 seconds on common, which is far sooner than these of different fee techniques.

- It may also be used for P2P purchases, on-line voting, escrow, and so forth.

How Does Ripple Work?

XRP is the native cryptocurrency of the XRP Ledger and the Ripple community. Its major operate is to function a bridge forex for cross-border transactions when there’s a must commerce one forex for one more. Ripple rapidly attracted the eye of main institutional traders like massive banks. As we speak, a whole bunch of monetary corporations all over the world use this coin. The primary benefits of XRP are the excessive velocity and low price of transactions.

To place it merely, Ripple works as a medium forex. Say you wish to commerce some JPY for USD. In case you do it via the Ripple protocol, the community turns your JPY into XRP after which XRP into USD. Intuitively this association appears extra sophisticated than a easy JPY to USD alternate, however it’s a lot sooner and rather a lot cheaper. It takes solely 5 to 10 seconds to finish this specific transaction, in comparison with three to 5 days within the case of a standard process. As for the price, Ripple customers take pleasure in an nearly non-existent fee of 0.00001 XRP per transaction.

What Makes XRP a Distinctive Cryptocurrency?

Ripple (and its digital forex, XRP) differentiates itself from conventional cryptocurrencies in a number of key methods. Right here’s a breakdown of how and why Ripple departs from the norms of different cryptocurrencies and the way its underlying system operates:

- Centralization vs. Decentralization: Conventional cryptocurrencies like Bitcoin and Ethereum had been constructed with the core precept of decentralization. In different phrases, no single entity or group has management over the whole community. Ripple, then again, is usually criticized for being extra centralized because of the vital position Ripple Labs performs in its growth and the distribution of XRP.

- Goal and Design: Bitcoin was launched as an alternative choice to conventional currencies, permitting peer-to-peer transactions with out a government. Ethereum was developed as a platform for decentralized apps and sensible contracts. Ripple and XRP, nonetheless, had been particularly designed for banks and monetary establishments to facilitate real-time gross settlement system, forex alternate, and remittance.

- Consensus Mechanism: Ripple doesn’t use proof of stake (PoS) or proof of labor (PoW), the 2 most typical consensus mechanisms within the cryptocurrency world.

- Proof of Work (PoW): Utilized by Bitcoin, this mechanism includes fixing complicated mathematical puzzles to validate transactions and create new blocks. That is energy-intensive and is often known as “mining.”

- Proof of Stake (PoS): Right here, validators are chosen to create new blocks based mostly on the variety of cash they maintain and are keen to “stake” or lock up as collateral.

Ripple’s Distinctive Ledger Expertise and Consensus Mechanism

Ripple, recognized for its remittance community and real-time gross settlement system, essentially departs from conventional crypto approaches in its design and goals. Its major objective is to optimize monetary transactions, significantly within the realm of worldwide transfers, making them faster, extra clear, and environment friendly.

On the core of Ripple’s system lies its progressive ledger expertise. Not like the usual blockchain constructions of most cryptocurrencies, Ripple’s ledger is maintained by a community of impartial servers that evaluate their transaction information in real-time. This real-time settlement functionality is a game-changer for monetary establishments and remittance providers, making certain transactions are accomplished in seconds.

Nodes, within the context of Ripple, play an important position. They use one thing known as “node lists,” a particular checklist of validators that every node listens to and trusts to not defraud the system. This checklist of validators collaboratively decides on the validity of transactions.

An important function of Ripple’s design is its partnerships with banks and different monetary entities. By integrating with their techniques, Ripple goals to streamline cross-border funds and supply a sturdy remittance service. These partnerships enable XRP, Ripple’s native cryptocurrency, to behave as a bridge forex in monetary transactions. It’s no marvel that many main crypto exchanges checklist XRP given its growing relevance within the monetary sector.

Furthermore, Ripple’s lack of reliance on conventional consensus mechanisms like proof of labor or proof of stake units it aside. As an alternative of rewarding crypto miners, Ripple’s system includes validators. These validators don’t earn rewards for his or her efforts, eliminating monetary biases. They function based mostly on belief, utilizing their node lists to check transaction information.

In essence, Ripple’s design, pushed by its distinctive ledger expertise and its concentrate on real-time settlement, has made it a most well-liked selection for a lot of banks and remittance providers worldwide. Its continued development and integration into monetary techniques attest to its potential to redefine how we view and deal with monetary transactions.

What’s RippleNet?

It’s mandatory to differentiate between the RippleNet system and Ripple tokens. Most banks work with the fee system, and the cryptocurrency is tied to the On-Demand Liquidity challenge. Subsequently, the event of RippleNet doesn’t at all times result in a rise within the worth of XRP.

RippleNet is a world fee system that makes it doable to hold out funds and alternate processes (transfers) in additional than 40 currencies. It serves over 300 monetary establishments all over the world. Earlier (till the autumn of 2019), RippleNet included three merchandise: xVia, xCurrent, and xRapid.

- xCurrent is the software program aimed to supply interoperation between totally different ledgers and funds networks utilizing Interledger Protocol. Mainly, it permits banks to speak with one another and simply affirm fee particulars.

- xRapid is the supply of liquidity for the community: it permits XRP to be a bridge forex and facilitates quick alternate with a steady charge.

- xVia is a fee interface that’s merely used to ship funds between customers.

In October 2019, Ripple rebranded and split its products into two separate tasks. Now the title RippleNet covers two present merchandise: xVia, xCurrent. The xRapid product, tied to the promotion of the XRP cryptocurrency, has been dubbed “Liquidity on Demand”.

“As an alternative of shopping for xCurrent or xVia, clients will connect with RippleNet on-premises or within the cloud, and as an alternative of shopping for xRapid, they are going to use On-Demand Liquidity. These aren’t new merchandise, however a rebranding of present merchandise. It is a small change that won’t have an effect on our clients in any approach,” – the corporate representatives mentioned.

What Is the Ripple Protocol Consensus Algorithm (RPCA)?

The Ripple community is powered by the Ripple Protocol Consensus Algorithm. It doesn’t work like the favored proof-of-work or proof-of-stake protocols. As an alternative, it offers a consensus validation for the ecosystem’s accounts and transactions by quite a lot of impartial nodes. For an operation to be validated, all nodes must agree on it, and that’s the one approach the operation might be executed. This protocol permits the system to forestall double-spending, primarily by taking a ballot to find out the bulk vote.

Ripple gained’t let you spend the identical amount of cash twice or a number of instances as a result of the system determines which transaction was the primary to be requested and deletes all the next ones. This consensus protocol takes mere seconds to finish the validation course of, so the transaction time is minimal: it takes round 4 seconds on common to finish an operation.

Ripple protocol works via gateways. Gateway is an middleman used as a hyperlink within the belief chain between two events that wish to full a transaction. Normally, banks are these getaways. Ripple structure is much like that of SWIFT, a world quick fee system.

What Is Ripple’s Xpring?

Xpring (pronounced “spring”) is an ecosystem initiative by Ripple Labs that focuses on investing in, incubating, buying, and offering grants to tasks and firms that may assist increase the use instances for XRP past simply worldwide transactions. It goals to help the blockchain expertise adoption and the event of progressive crypto options for numerous sectors.

As a part of Ripple’s dedication to the expansion and adoption of XRP, Xpring actively seeks out alternatives to spend money on startups and initiatives that align with its imaginative and prescient. By strategic investments, Xpring goals to foster the event of latest applied sciences and purposes that may leverage the distinctive options of XRP.

Past investing, Xpring additionally affords help via incubation and acquisition. By working carefully with promising startups, Xpring offers them with entry to experience, sources, and networks mandatory for his or her development and success. Moreover, Xpring seeks acquisitions that may additional speed up the adoption of XRP and contribute to the general growth of the Ripple ecosystem.

Moreover, Xpring offers grants to open-source tasks and builders who’re constructing instruments, purposes, and infrastructure that make the most of XRP. These grants assist foster the event of latest use instances for XRP and drive innovation throughout the crypto house.

Ripple Historical past

In 2004, Canadian programmer Ryan Fugger and Jed McCaleb based Ripplepay, a fee system based mostly on a trusted peer-to-peer monetary community.

In 2012, the crew was joined by the well-known programmer Chris Larsen, the founding father of the mortgage corporations Prosper and E-Mortgage, who later grew to become the director of Ripple Labs. He approached Fugger with the concept of making his personal cryptographic forex contained in the Ripple platform, though initially, there was no discuss of his personal digital forex. The event crew then based the OpenCoin company and launched a brand new cryptocurrency platform Ripple, with the identical title inside forex (XRP).

Within the fall of 2013, a rebranding came about, and the OpenCoin firm grew to become generally known as Ripple Labs. In 2014-2019, Ripple Labs Inc. centered on the banking market. The primary financial institution to make use of Ripple was Fidor Financial institution in Munich.

Then the expertise was utilized by the American banks Cross River Financial institution, CBW Financial institution, the Earthport fee service (works in 65 nations, together with with banks). In 2017, the Ripple protocol started for use for worldwide funds between the US and the UK (American Categorical and Santander), in addition to between Japan and South Korea. In 2018, the system was built-in into one of many largest japanese banks NKB in Saudi Arabia.

The SEC’s Lawsuit In opposition to Ripple

The Securities and Trade Fee (SEC) initiated a lawsuit in opposition to Ripple Labs, the entity behind the cryptocurrency token XRP, in December 2020. The crux of the lawsuit centered on allegations that Ripple carried out an unregistered securities providing, purportedly elevating over $1.3 billion via the sale of XRP. The SEC posited that the XRP tokens had been akin to funding contracts, and thus, must be underneath the purview of federal securities laws. Ripple, in response, staunchly contested these allegations.

A pivotal flip within the case surfaced in July 2023 when a federal choose Analisa Torres dominated that though XRP choices weren’t thought-about funding contracts, the preliminary sale of XRP had certainly contravened federal securities legal guidelines. This judgment not solely has repercussions for Ripple but additionally units a precedent regarding the SEC’s perspective on digital belongings. It implies that Ripple needn’t categorize XRP as a safety sooner or later, nevertheless it casts a shadow on the legality of XRP’s inaugural sale and the possible ramifications for breaching securities statutes.

Quick ahead to October 19, 2023, the SEC retracted its fees in opposition to Ripple’s CEO, Brad Garlinghouse, and Chairman, Chris Larsen. This absolution basically exonerates Ripple’s management from the longstanding securities violation claims that had been navigating the intricacies of the federal authorized system. Furthermore, the fees annulled had been linked to institutional gross sales set for trial the next April.

Is the SEC vs. Ripple Case Over?

Not fairly. Whereas some fees have been dropped, Ripple stays steadfast in its pursuit of better regulatory lucidity throughout the U.S. framework.

The SEC, in its newest submitting, emphasised its intent to stick with claims in opposition to Ripple. Each events, it mentioned, “plan to convene to debate the forthcoming phases of the case, particularly addressing acceptable cures regarding Ripple’s Part 5 infringements associated to its Institutional Gross sales of XRP.”

The authorized tussle between the SEC and Ripple has garnered appreciable consideration from the crypto group and is perceived as a watershed second for the sector. The ultimate verdict is poised to affect future regulatory tips and protocols for digital currencies.

Can Ripple (XRP) Be Staked?

Since XRP is neither a proof-of-work nor proof-of-stake cryptocurrency, it can’t be mined or staked. Nonetheless, that doesn’t imply you possibly can’t earn curiosity in your Ripple crypto cash. There are some platforms that let you generate profits off of this cryptocurrency. A few of these providers embrace Nexo, Crypto.com, and Binance Earn.

Ripple Benefits & Disadvantages

The XRP forex has a authorized entity, consultant workplace, and headquarters in the US. This makes it engaging to traders from a capital funding reliability standpoint. On the similar time, this may also be thought-about a downside because it makes the community extra centralized than different crypto tasks.

Ripple can’t be mined. The builders deserted the concept of mining cash and launched 100 billion XRP tokens abruptly. Every coin is split into one million components, known as drops. On the similar time, cash are now not issued. This may also be thought-about each a professional and a con of this cryptocurrency relying on what your objectives and preferences are.

One of many greatest benefits of the XRP consensus ledger is its excessive transaction velocity. For instance, whereas Bitcoin transactions can take round 600 seconds, XRP ones solely take 4.

Execs and Cons of Ripple’s XRP Cryptocurrency

Ripple’s XRP, the digital heartbeat of the Ripple community, stands tall within the sprawling panorama of cryptocurrencies. Its distinct framework and purposes current a mixture of benefits and challenges price delving into.

Execs

- Speedy, Value-Environment friendly Transactions: XRP distinguishes itself with its consensus protocol, sidestepping the time-consuming and energy-intensive mining processes seen in networks like Bitcoin and Ethereum. The absence of miners leads to swift transaction confirmations and negligible charges.

- Bridge Forex Performance: With Ripple’s alliances with international banks and monetary entities, XRP streamlines cross-border cash actions. This synergy with Ripple’s fee ecosystem interprets to nearly instantaneous, low-fee, and safe worldwide transactions, outpacing typical, pricier strategies.

- Actual-time Liquidity Entry: A standout function of Ripple’s tech toolkit is the easy conversion between any forex and XRP. For monetary establishments, this obviates the need of sustaining huge international forex reserves, trimming bills and enhancing operational agility.

Cons

- Reference to Ripple Labs: Ripple Labs, the personal entity that owns a large XRP tokens, is a double-edged sword. Detractors imagine such concentrated possession contradicts the decentralized ethos of cryptocurrencies, prompting introspection about XRP’s autonomy as a digital forex.

- Regulatory Clouds: Ripple Labs’ ongoing authorized skirmish with the U.S. Securities and Trade Fee (SEC) casts a shadow over XRP’s future. Accusations that XRP’s preliminary sale breached federal securities laws might affect its authorized standing and market reception.

- Validator Centralization Issues: Ripple’s decentralized validator community isn’t with out criticism. Issues simmer about Ripple’s outsized sway over validator choice and the general XRP ledger operate, probably threatening the community’s decentralized character and safety.

Ripple vs Bitcoin

Ripple is likely one of the greatest cryptocurrencies on the planet – it has been ranked throughout the high 10 by market capitalization for a really very long time. Consequently, it naturally will get in comparison with Bitcoin rather a lot.

These two cryptocurrencies, nonetheless, couldn’t have been extra totally different. For one, let’s check out their functions: BTC is supposed to be a way of alternate, whereas Ripple is a world funds community able to conducting cross-border funds in an affordable and environment friendly approach.

Nonetheless, each BTC and XRP can be utilized as digital belongings, traded and exchanged for revenue. Bitcoin has a better market cap and profit-making potential, whereas XRP is concentrated on adoption and cooperation with present monetary establishments, which can make it extra dependable in the long term. Moreover, XRP transactions are rather a lot sooner and cheaper than those on the Bitcoin community – so they’re much more environment friendly and thus engaging to customers.

How To Purchase Ripple

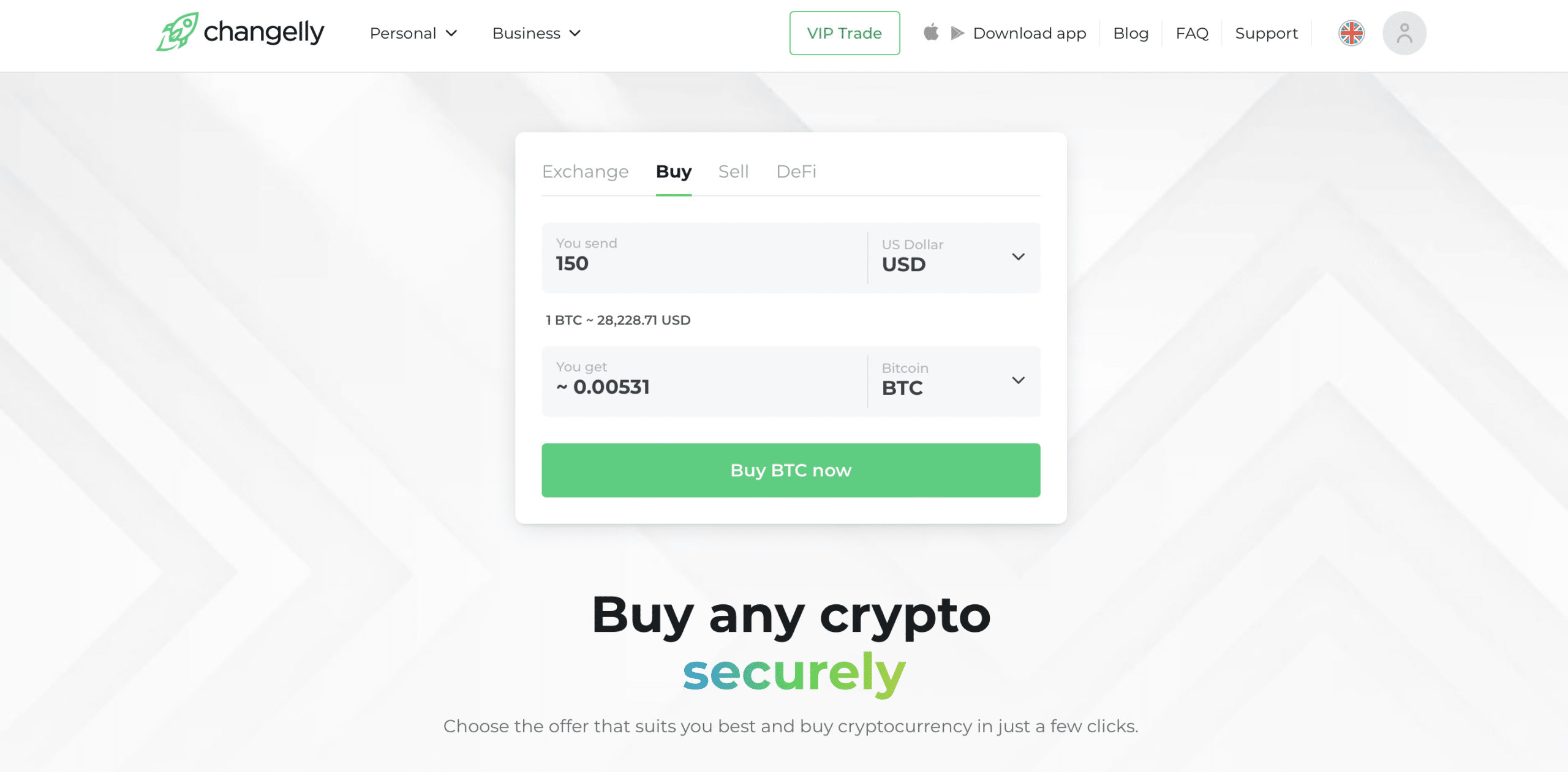

You should buy XRP on most cryptocurrency exchanges. In case you’re on the lookout for a platform that’s each straightforward to make use of and has nice charges with low charges, look no additional than our market, Changelly!

You should utilize our web site or cell app to both get Ripple with one of many 200+ cryptocurrencies we’ve got beforehand listed on our service or purchase it with one of many over 40 fiat currencies supported by our fiat gateway companions. Right here’s a step-by-step information to purchasing XRP on Changelly.

- Go to changelly.com/purchase.

- Choose XRP from the dropdown menu and the fiat forex you wish to use to purchase it.

- Enter the quantity you’ll spend and choose your fee methodology.

- You’ll be introduced with a number of fiat suppliers. Decide the one you want essentially the most.

- Enter the deal with of the pockets that you really want your XRP tokens to be despatched to and the Vacation spot Tag.

- Conform to the Phrases of Use and click on on the “Purchase” button under to proceed. You may be redirected to our companion’s web site – observe their directions to get your XRP.

FAQ

Is Ripple and XRP the identical?

Ripple is the title of an organization. It’s a international fee settlement community. XRP is the native digital forex of that platform.

What’s Ripple well-known for?

Ripple is famend for its digital fee community and protocol, offering a platform for seamless monetary transactions.

How is Ripple earning profits?

Ripple generates income via the sale of its cryptocurrency, XRP, coupled with fee charges. Moreover, they garner earnings from investments and gather curiosity charges on loans.

What’s Ripple (XRP) used for?

XRP acts as an middleman between two currencies or networks. Merely put, it can provide different currencies a extra environment friendly strategy to conduct transactions.

Is Ripple (XRP) funding?

XRP could be a welcome boost to your portfolio. It has a excessive market cap and good future prospects. Nonetheless, you need to do your personal analysis earlier than deciding whether or not you need to spend money on it or not.

Is XRP higher than Bitcoin?

It’s onerous to check these two as they serve totally different functions. When contemplating XRP as an impartial digital asset, nonetheless, and never part of a world fee community, it may possibly lose out to BTC as it’s much less well-liked and widespread.

Who’re the founders of Ripple?

Ripple Labs founders are Chris Larsen and Jed McCaleb.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.