- Bitcoin’s efficiency in February reveals that traders are optimistic about long-term prospects.

- Bitcoin is off to a bullish begin, however trade inflows recommend that some extra promote stress could curtail the short-term rally.

Bitcoin [BTC] simply wound up the shortest month of the yr above its finish of January, shut regardless of extra uncertainty in February. Now the massive query for many buying and selling is whether or not it is going to maintain the bullish bias or maintain give in to the bears.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

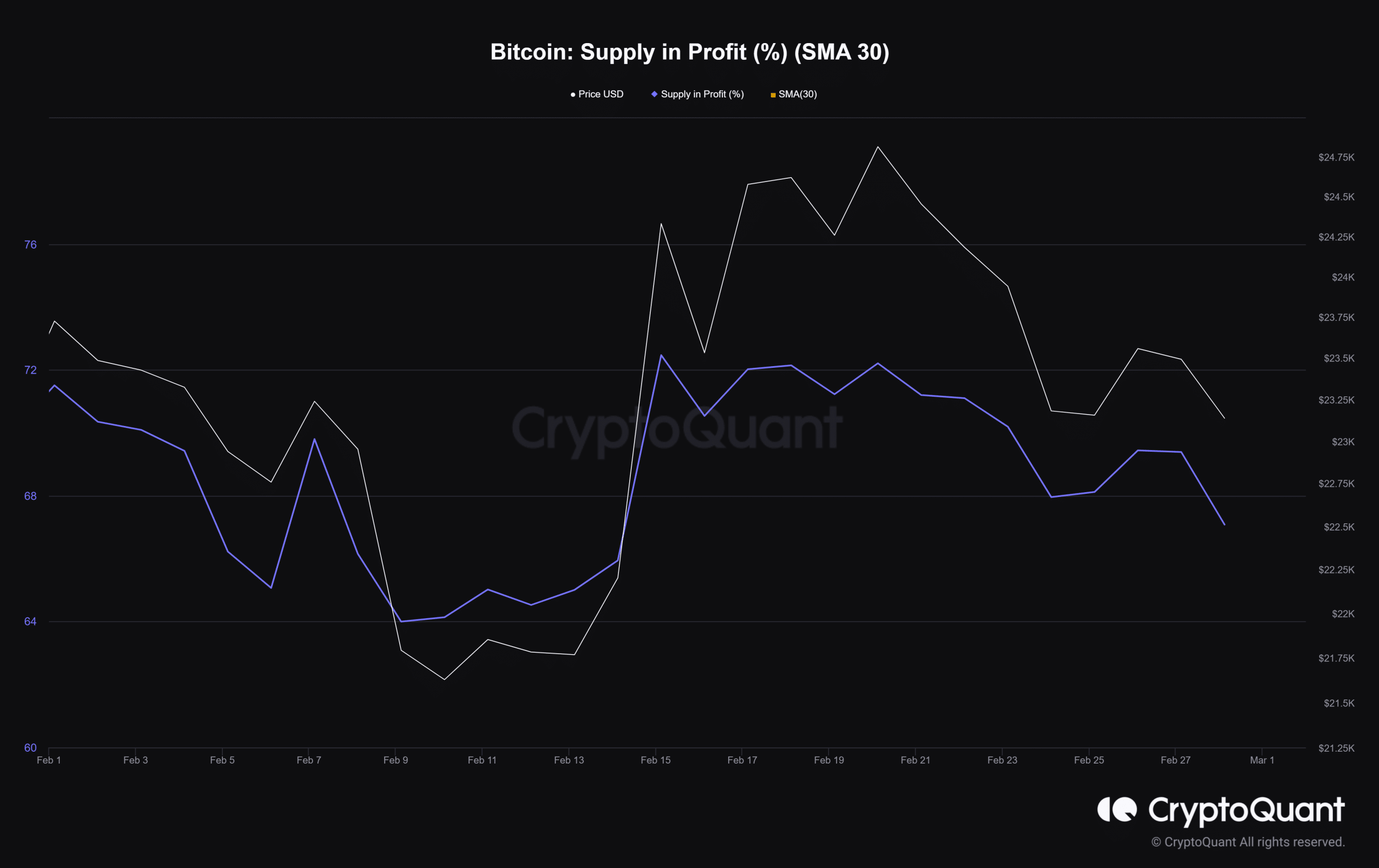

Bitcoin’s efficiency in February could supply some insights into the cryptocurrency market’s present situation and March expectations. BTC’s provide in revenue was right down to 67% by the tip of February, after peaking at 72.2% throughout the identical month.

This decline confirms that there was ample accumulation close to current highs with the expectation that costs will stay. It additionally confirms that a lot of the present holders purchased in January.

Supply: CryptoQuant

In distinction, the present degree of Bitcoin provide in revenue continues to be above the bottom degree within the final 4 weeks. The availability in revenue bottomed out at 63.99% in the course of the month. This implies there’s nonetheless some room for extra draw back earlier than it reaches the perceived backside vary under 45%. The glass half full view suggests that there’s a lot of room for extra upside earlier than it the height of the bull cycle.

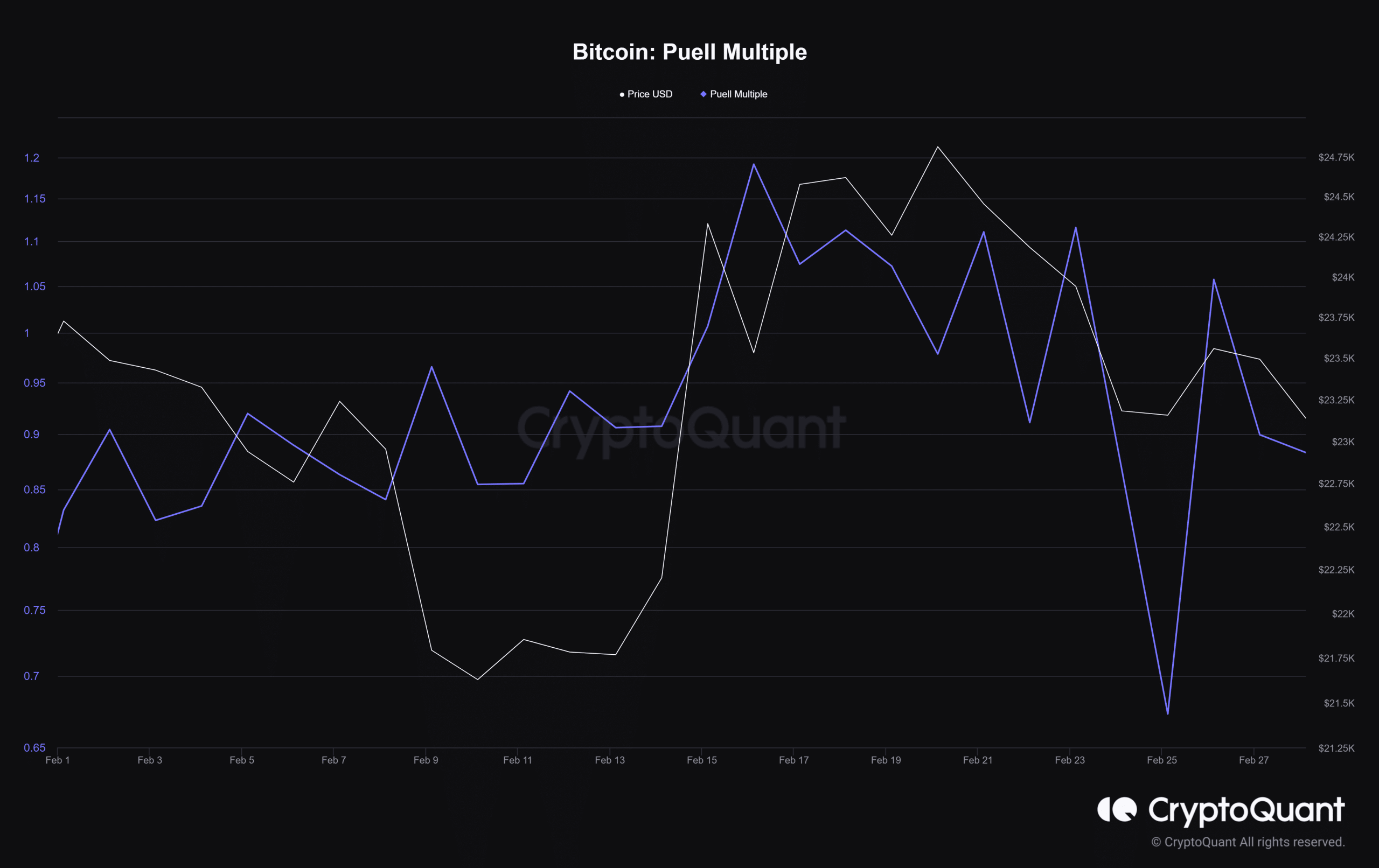

So far as the worth of the Bitcoin issued each day is anxious, the Puell a number of dropped to its lowest month-to-month degree on 25 February. Its worth on the lowest level was 0.67, therefore indicating relative energy among the many BTC holders.

Supply: CryptoQuant

Bitcoin’s peak Puell a number of determine was 1.19 in mid-February. This implies it was nicely under the extent thought-about as euphoria, however the decrease vary was additionally not within the capitulation vary. These findings additional add to the proof suggesting that traders maintained an optimistic sentiment in February.

Can Bitcoin maintain the optimism?

Thus far, the market has maintained a point of optimism, as was the case with most traders holding for long-term features. Nonetheless, the FOMC’s subsequent assembly, which is able to happen later this month, would possibly decide the subsequent main consequence. Press time sentiments count on FED to lift charges barely. Such a transfer could set off some market FUD and ship Bitcoin probably under $20,000 as soon as once more.

The financial cube is but to roll; therefore, the anticipated FED rate of interest hike just isn’t assured to happen. Bitcoin kicked off March with a little bit of a rally because it makes an attempt to bounce off the RSI mid-range.

Supply: TradingView

How a lot are 1,10,100 BTCs value as we speak?

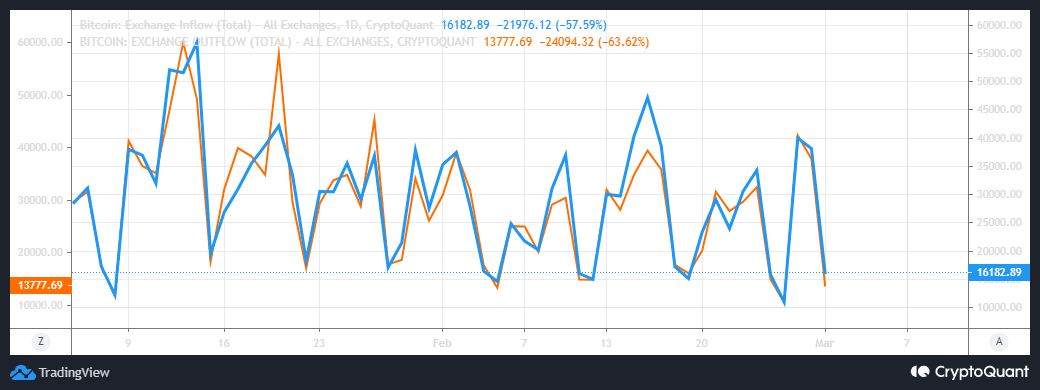

Bitcoin achieved a 2.63% rally within the final 24 hours, however the MFI signifies that it’s experiencing outflows. A take a look at the Bitcoin trade flows confirmed that trade inflows have been larger than trade outflows on the time of writing.

Supply: CryptoQuant

These larger trade outflows could give means for the bears within the short-run until a requirement shift happens.

![What these Bitcoin [BTC] metrics reveal about its current position](https://nomadabhitravel.com/wp-content/uploads/2023/03/Bitcoin-Supply-in-Profit-SMA-30-1536x967.png)