The competitors heats up within the dapp area as builders weigh Binance Good Chain towards Ethereum. How do elements like scalability and transaction prices have an effect on their selections?

The blockchain house is fiercely aggressive, significantly in terms of decentralized functions (dapps).

As of Feb. 2, in response to knowledge from DappRadar, a outstanding analytics platform, Binance Chain (BNB) is on the forefront with 5,215 dapps and a consumer base exceeding 5.3 million distinctive lively wallets (UAW) over the past 30 days.

Ethereum (ETH), alternatively, holds the second place with 4,497 dApps, though its consumer base of roughly 1.36 million UAWs pales compared to Binance Chain.

Main blockchain platforms for dapp growth | Supply: Dapp Radar

Nonetheless, Ethereum’s dapps quantity stands at a formidable $115 billion, greater than six occasions Binance Chain’s $17.5 billion, highlighting Ethereum’s substantial developer engagement.

Amid this, Xin Jiang, a former Vice President at Binance, proposed that the market may not require additional infrastructure enhancements, as dapps may emerge as the following catalysts for the crypto house.

What is occurring? Let’s dive deeper into how the dapp market is performing, which chains are main the event frontier, and which sectors are propelling the dapp market to new heights.

The present state of dapp market

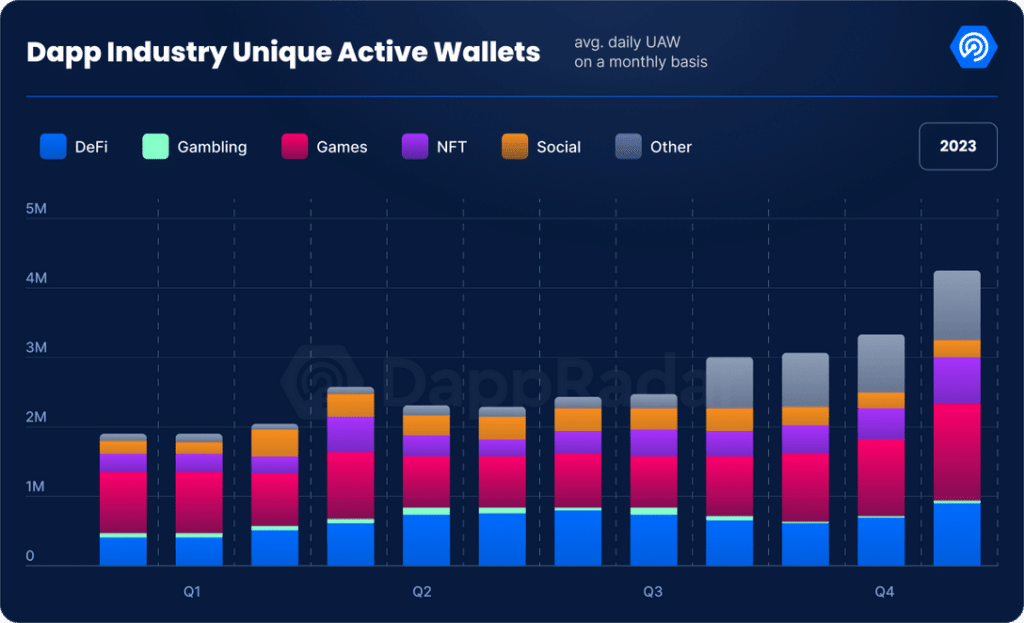

In line with a report from DappRadar, the dapp trade witnessed a formidable 124% year-over-year enhance in its UAW, culminating in a each day rely of 4.2 million UAW by the shut of 2023.

Quick ahead to the start of 2024, and the momentum reveals no indicators of slowing. As of Feb. 1, the dapp trade notched up a brand new milestone with 5.3 million each day UAW. This represents an 18% surge from the earlier month and the very best since 2022.

Breaking down the numbers by trade segments gives insights into the diversification of dapp utilization.

Supply: Dapp Business Report 2023

Blockchain gaming continues to steer the pack with a gradual 1.5 million dUAW, sustaining its dominance from the earlier month. This interprets to a 28% dominance over the complete dapp ecosystem,

Equally, the decentralized finance (defi) sector stays robust, holding regular at 1 million dUAW.

Nonetheless, it’s not simply gaming and finance which are driving progress. The non-fungible token (NFT) house has skilled a notable enlargement, with a 4% uptick this month, reaching 697,959 dUAW.

Amid this, the social dapp sector has gained headlines, boasting a formidable 868,091 dUAW. This surge, a 262% enhance over the earlier month, is essentially attributed to platforms like CARV and Dmail Community, indicating a surge of curiosity in social networking on decentralized platforms.

Rise of social dapps

The rising recognition of social dapps is available in response to growing worries about knowledge privateness breaches and on-line scams on conventional platforms.

The acquisition of Twitter by tech magnate Elon Musk in 2022 triggered a wave of discontent amongst its consumer base. Subsequent adjustments, like contemplating a paywall, led to a drop in month-to-month lively customers, anticipated to proceed into 2024.

Amid this, social dapps like Good friend.tech gained traction. Launched in Aug. 2023, Good friend.tech rapidly turned a serious participant within the social crypto scene, with over 100,000 customers and $25 million in income.

However the shift to decentralized apps isn’t nearly dissatisfaction with centralized platforms. Analysts spotlight that regulatory scrutiny and privateness issues, significantly within the EU, additionally drive this pattern.

Dapps differ from conventional platforms by avoiding centralized knowledge assortment for advertisements, with some being non-profit and prioritizing consumer privateness.

Nonetheless, whereas decentralized platforms supply extra freedom and anonymity, in addition they entice communities with excessive views, elevating issues concerning the unfold of extremist content material.

As of Feb. 26, primarily based on knowledge from DappRadar, CARV, Galxe, and Dmail Community have emerged because the foremost social dapps, gauged by complete UAWs previously 30 days.

CARV and Dmail Community have seen important progress, with volumes up by 330% and 120%, respectively. Nonetheless, Galxe has skilled a considerable decline of as much as 100%.

Why is Binance Chain main the dapp race?

When evaluating Binance Good Chain (BSC) and Ethereum in dApps efficiency, scalability, transaction charges, and consensus mechanisms, we achieve insights into their strengths and weaknesses.

BSC stands out for its low transaction charges and excessive scalability, enabling swift transaction processing at a fraction of the price in comparison with Ethereum.

As of Feb. 26, BSC can deal with as much as 45.3 transactions per second (TPS), a major enchancment over Ethereum’s present throughput, which stays below 15 TPS however goals for a considerable enhance with Ethereum 2.0.

Transaction charges on Ethereum have been a persistent concern, averaging at $0.89 as of Feb. 25. During times of community congestion, these charges can skyrocket even additional, posing challenges for customers and builders.

In distinction, BSC presents notably decrease transaction charges, averaging at $0.15 as of this writing, presenting a compelling benefit for these searching for cheaper blockchain interactions.

Selecting between BSC and Ethereum relies on the precise wants and priorities of dapp builders and customers. Every platform has its trade-offs in decentralization, safety, transaction pace, and price.

BSC excels in offering an environment friendly and economical resolution for high-frequency buying and selling and functions requiring swift transaction speeds and low charges.

Alternatively, Ethereum’s power lies in its strong decentralization and safety measures, together with a various array of dapps and an enormous ecosystem.

The street forward

The success of decentralized functions depends on enhancing consumer expertise to make blockchain-based options extra accessible. Simplifying interactions, refining interfaces, and incorporating acquainted options are essential to attracting a wider viewers.

In at this time’s security-conscious digital world, dapps should additionally prioritize strong privateness and safety measures. Improvements in cryptographic methods like zero-knowledge proofs and safe multi-party computation shall be important for enhancing safety.

Whereas finance and gaming have dominated the dapp scene, there are alternatives for enlargement into new areas reminiscent of social media, training, and healthcare.

Finally, the objective for dapps is mainstream adoption. Reaching this requires not simply technological developments but additionally academic initiatives to showcase the sensible advantages of dapps in on a regular basis life.