The value of Bitcoin was rejected because it approached important resistance north of $27,000, and promoting strain continues over as we speak’s buying and selling session. If consumers can’t defend present ranges, BTC’s worth will probably re-test important help, however this motion may set off a bounce for the cryptocurrency, in response to contemporary knowledge.

As of this writing, Bitcoin trades at $26,650, with a 2% loss within the final 24 hours. Over the earlier seven days, the cryptocurrency has recorded sideways worth motion and underperformed XRP and Toncoin’s TON, which recorded a 5% and 25% revenue, respectively, throughout an analogous interval.

The Bitcoin Stage To Watch If Bears Take Over

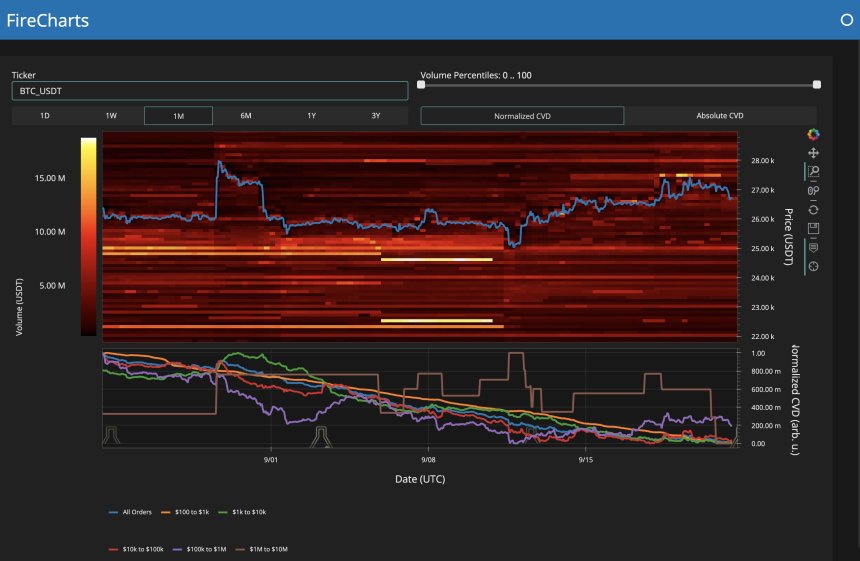

An analyst crypto analysis agency Materials Indicators shared a fireplace chart displaying essentially the most vital liquidity ranges for the BTCUSDT buying and selling pair on Binance. On a month-to-month foundation, merchants on this venue have been promoting the cryptocurrency and shifting liquidity beneath present ranges.

The chart beneath reveals that the Binance orderbook for this buying and selling pair seems “skinny.” The analyst claims a “small purchase wall” at round $24,700, which stands as a “line within the sand” that must be defended to stop additional draw back worth motion.

Liquidity round this important stage is low, however bulls can inject capital to defend the extent in case of additional draw back. If bulls succeed, Bitcoin will probably rally and reclaim beforehand misplaced territory.

In any other case, bears could have the chance to press additional on the value, returning it to important help round $23,000 and $22,000. These ranges show even much less liquidity than $25,000, which may trace at a deeper correction of “Bearadise,” because the analyst referred to as it.

Extra knowledge supplied by buying and selling desk QCP Capital signifies that macroeconomic forces have performed a important function in influencing the value of Bitcoin. Yesterday, the US Federal Reserve (Fed) despatched a “hawkish” shock throughout monetary markets, limiting any BTC upside momentum.

This occasion had a bearish affect on legacy markets, with the Nasdaq 100 and charges markets breaking “some very key ranges,” QCP Capital said. The buying and selling desk added:

(…) reflexivity can take over with the bearish thesis from right here. If we’re proper, then this macro transfer may seep into crypto markets and take BTC decrease with it (Chart 3), albeit with a decrease beta as in comparison with different very stretched macro markets just like the NASDAQ.

Cowl picture from Unsplash, chart from Tradingview