- Solana’s liquid staking protocol proves to be useful for the community within the DeFi sector.

- The variety of builders is on the rise because the ecosystem begins to thrive; SOL witnesses a minor correction.

Over the previous couple of months, Solana [SOL] noticed huge volatility. This impacted the ecosystem it was part of and its value. Nonetheless, the latest reputation of its DeFi sector may have an effect on the protocol positively sooner or later.

Practical or not, right here’s SOL’s market cap in BTC’s phrases

Solana dips into Liquid Staking

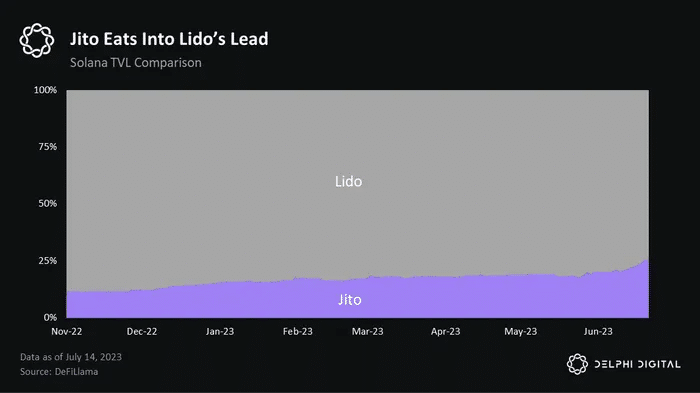

Based mostly on knowledge from Delphi Digital, the rise of Solana DeFi has been notable following the FTX debacle. Throughout this era, the neighborhood confirmed robust assist for Solana-first protocols like Jito, which stands as Solana’s first MEV-powered liquid staking by-product.

Jito’s token brings forth constructive yield alternatives whereas concurrently enhancing Solana’s decentralization and fortifying the safety of its community. Delphi Digital’s knowledge indicated that the Jito protocol was consuming into Lido’s market share at press time.

Supply: Delphi Digital

The recognition of Solana’s dApps could not solely enhance the state of the ecosystem but additionally entice new customers to the platform.

Solana has emerged as probably the most scalable blockchains, exhibiting a outstanding capability to course of as much as 65,000 transactions per second (TPS). With the problems surrounding FTX now resolved, the ecosystem and neighborhood utilized this era to reevaluate and deal with improvement. Moreover, the worth of SOL skilled a considerable improve of over 200% yr to this point.

Moreover, there was a constructive surge within the variety of builders deploying sensible contracts on the Solana blockchain. This replace highlighted the potential emergence of a promising future for the protocol.

Supply: token terminal

State of SOL

At press time, SOL was buying and selling at $23.81. Since 10 June, there was an 83.14% appreciation within the value of SOL, marked by a number of greater highs and better lows, indicative of a bullish development.

Nonetheless, after testing the assist degree at $32.33, SOL skilled a subsequent value decline. Regardless of the numerous fall, it was not ample to ascertain a bearish development conclusively.

Is your portfolio inexperienced? Take a look at the Solana Revenue Calculator

Nonetheless, the Relative Power Index (RSI) advised that the momentum was on the aspect of the sellers on the time of writing. The Chaikin Cash Movement (CMF) additionally implied that the cash stream showcased a bearish consequence for SOL.

Supply: Buying and selling View