The Worldcoin cryptocurrency undertaking, led by Sam Altman, the brains behind ChatGPT, is going through elevated scrutiny from regulators worldwide. The undertaking’s use of eye-ball scanning orbs for consumer enrollment has raised issues about potential violations of information safety legal guidelines.

The distinctive technique of accumulating biometric knowledge with out clear consent has prompted discussions on legality and ethics. Regulatory our bodies are carefully analyzing the undertaking’s compliance with privateness rules, highlighting the challenges of balancing innovation with authorized and moral requirements.

The worth of biometric investments made by means of Worldcoin’s crypto-based “free cash” promise has decreased by half since its launch. This decline may be attributed to the rising issues concerning the undertaking’s knowledge assortment and the unease it brought about regulators.

Why Is Worldcoin Token Crumbling?

Based mostly on data offered by CoinMarketCap, the present buying and selling worth of the WLD token stands at $1.28, on the time of writing. This determine signifies a considerable decline of 53% from its preliminary peak value of $2.71 on the day of the undertaking’s launch.

The day after WLD’s Binance itemizing, on July 25, it traded for $2.456. As of Friday morning, the token’s value had decreased from that point to $1.317. On condition that a number of altcoins and cryptocurrencies just lately had market crashes adopted by recoveries inside a number of weeks, this can be a massive lower for a token.

WLDUSDT buying and selling at $1.286 on the weekend chart: TradingView.com

Associated Studying: Tron Reverses August Stoop As TRX Open Curiosity Climbs

In accordance with knowledge from CoinGecko, the price of WLD has decreased from slightly below $2.50 initially of August to roughly $1.31 as of August 25. That represents a 44% decline within the earlier 30 days, and if it retains going within the improper route, WLD’s value will go to single digits within the subsequent 30 days.

Ongoing investigations by authorities in numerous nations around the globe have dealt a heavy blow to the worth of the WLD token. The undertaking’s purpose of building decentralized consumer identities has raised alarm bells due to its eye-ball scanning and biometric knowledge assortment. This course of probably breaches nationwide knowledge safety legal guidelines, resulting in investigations in Germany, France, and the UK.

The Euphoria Shortly Light

Worldcoin reported 2 million sign-ups for World ID and distributed 43 WLD tokens throughout its launch. Altman promoted iris scanning, however the preliminary pleasure waned. Early scanners acquired 25 WLD valued at $60, now diminished to round $30. Early buyers might have misplaced half their funding, whereas quick sellers profited from Worldcoin’s decline.

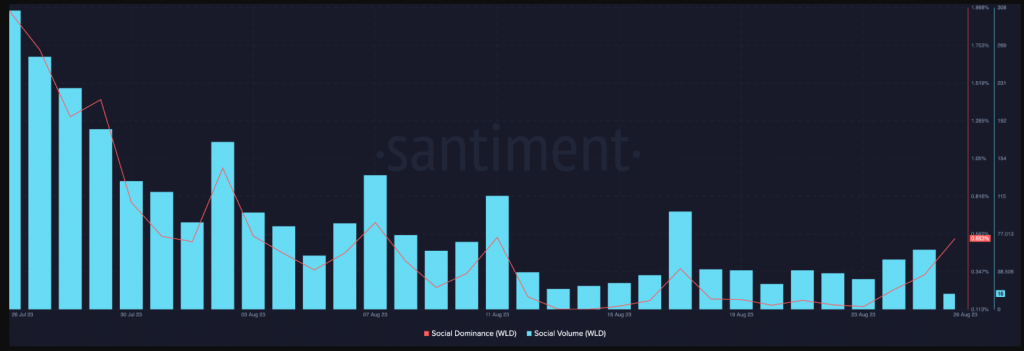

In the meantime, within the final 30 days, WLD’s social quantity and social dominance have decreased by a whopping 95% and 74%, respectively, in response to on-chain knowledge supply Santiment. This denotes a pointy decline within the undertaking’s hype.

Supply: Santiment

Worldcoin’s unique white paper outlined its aspiration to take part in world competitors, present funds to these with out monetary sources, and provide banking companies to these at present with out entry to conventional banking programs.

It seems that ambition will demand greater than mere lip service at this level.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails danger. If you make investments, your capital is topic to danger).

Featured picture from Nation Media Group