Over a billion {dollars} in liquidations despatched the XRP value and the crypto market again from the useless and into native highs. Nonetheless, new information suggests the rally may be quick, pushing down the nascent sector into vital assist.

As of this writing, the XRP value trades at $0.5 with a 4% revenue within the final week. The cryptocurrency rallied within the earlier 24 hours however has been retracing its steps over the previous few hours, hinting at potential losses except consumers step in and defend these ranges.

XRP Value Braces For Impression?

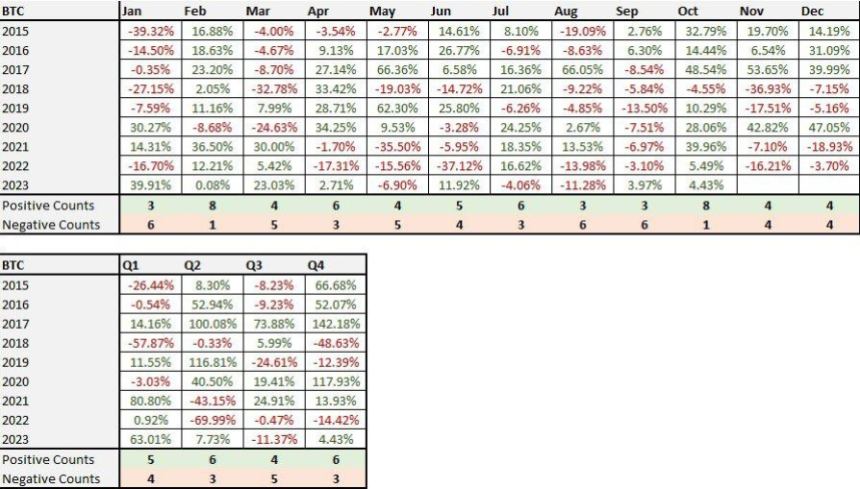

In keeping with the buying and selling desk QCP Capital, the present rally within the crypto market coincides with seasonality. Within the nascent sector, October is called “Uptober” as a result of main cryptocurrencies, together with the XRP value, pattern to the upside.

Previously years, each Bitcoin, Ethereum, and XRP value rally started in October, making it one of the best month for the market, as seen within the chart under. Nonetheless, the buying and selling desk warned its followers on social media X a couple of potential reverse that would have damaging results on cryptocurrencies:

Nonetheless, we’re not totally satisfied by this transfer, and we predict that BTC may take a look at tremendous key 25k assist someday within the last quarter of 2023 (…) This aggressive bounce has been due nearly completely to exogenous components so far and won’t have the momentum to maintain.

The buying and selling desk believes these components might lack the facility to maintain the present value motion. As well as, the narrative round approving an Ethereum future Alternate Traded Fund (ETF) within the US may set the stage for a massacre.

Two years in the past, when the worth of Bitcoin reached its all-time excessive of $69,000, the Securities and Alternate Fee (SEC) permitted a BTC futures ETF. This occasion marked the crypto market’s high, making the present ETH future ETF an ominous occasion for XRP and the altcoin market.

QCP Capital claims that the newly permitted monetary asset may enhance promoting stress within the sector attributable to including “artificial cash” to the market. In different phrases, the ETH futures ETF creates a disbalance between the provision and demand forces within the sector. The agency added:

We might even go additional to say a futures-only ETF is arguably detrimental to identify value – because it doubtlessly directs demand away from the spot market into an artificial market.

Good Information In The Quick Time period For XRP

The XRP value may gain advantage from the US authorities shutdown within the macro enviornment. The evaluation exhibits that previously 30 years, every US authorities shutdown preceded a bull run for the monetary market. That is the one constructive information for the cryptocurrency within the medium time period.

Within the quick time period, XRP nonetheless has an opportunity to run again above $0.6; as for Bitcoin, the buying and selling agency expects the $29,000 to $30,000 resistance to stay intact.

Cowl picture from Unsplash, chart from QCP Capital and Tradingview