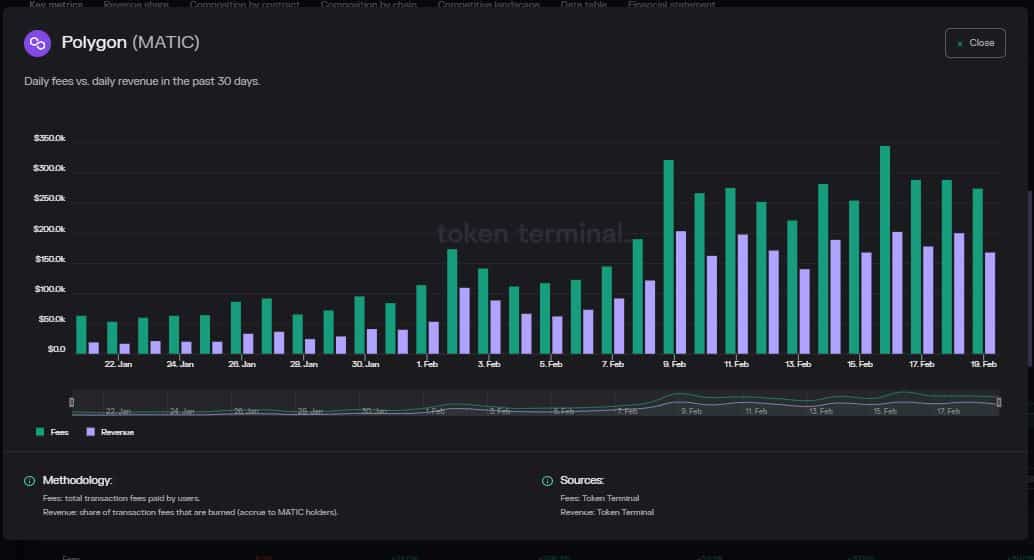

- The entire transaction charges paid on the community quadrupled over the past 30 days

- MATIC was one of many best-performing currencies out there in 2023, having leaped 94% because the begin of the yr

On 21 February, Hinkal, a privateness protocol which lets customers anonymize DeFi transactions, introduced on Twitter that it might make Polygon [MATIC] community its house.

We’re thrilled to announce that we’re launching on @0xPolygon Mainnet tomorrow – Tue twenty first Feb! 🚀

As soon as we’re stay, it is possible for you to to 👇

✅ Deposit/Swap/Switch/Withdraw your property privately

Supported tokens: $USDC, $USDT, $DAI, $WBTC, $WETH, and $MATIC#DeFi

🧵🎁👇 pic.twitter.com/xAQAFvW12q

— Hinkal Protocol (@hinkal_protocol) February 20, 2023

Is your portfolio inexperienced? Verify the MATIC Revenue Calculator

With an added layer of safety, Hinkal’s onboarding was a shot within the arm for Polygon’s DeFi ecosystem, which has skilled vital progress of late. Polygon’s complete worth locked (TVL) expanded 24% because the begin of 2023 and appeared heading in the right direction to get better the losses made because the FTX debacle, as per information from DeFiLlama.

Supply: DeFiLlama

Pleasure builds up as zkEVM has a launch date

Loads of the renewed curiosity could possibly be attributed to the much-anticipated Polygon’s zkEVM scaling answer, which is being touted as a sport changer for each Polygon [MATIC] and Ethereum [ETH]. The layer 2 scaling answer is predicted to extend community throughput considerably and scale back gasoline costs.

Not too long ago, Polygon introduced that it set 27 March because the launch date for the zkEVM mainnet beta.

Roses are purple 🌹

Violets are blue

Poems are onerous 😩

Mainnet Beta is right hereON MARCH 27, Polygon #zkEVM launches the way forward for Ethereum scaling

🚢💜🚢💜https://t.co/OqSOYTn8Uv pic.twitter.com/kpXavea3ff

— Polygon (@0xPolygon) February 14, 2023

The thrill was palpable as the whole transaction charges paid on the community quadrupled over the past 30 days, per information from Token Terminal. Since MATIC holders take a share of the whole charges paid on the community, the exponential surge drove the protocol income in the direction of the skies as properly.

Supply: Token Terminal

Polygon additionally discovered good allies in huge addresses. In line with WhaleStats, $208 million value of MATIC was being held by prime ETH whales on the time of writing.

🐳 The highest 2000 #ETH whales are hodling

$681,037,066 $SHIB

$208,037,515 $MATIC

$159,138,991 $LINK

$146,873,905 $BIT

$146,616,720 $BEST

$144,111,360 $CHSB

$104,702,156 $UNI

$79,455,364 $MANAWhale leaderboard 👇https://t.co/R19lKnPlsK pic.twitter.com/YNZ2v2D4BW

— WhaleStats (monitoring crypto whales) (@WhaleStats) February 21, 2023

MATIC appeared set for additional good points

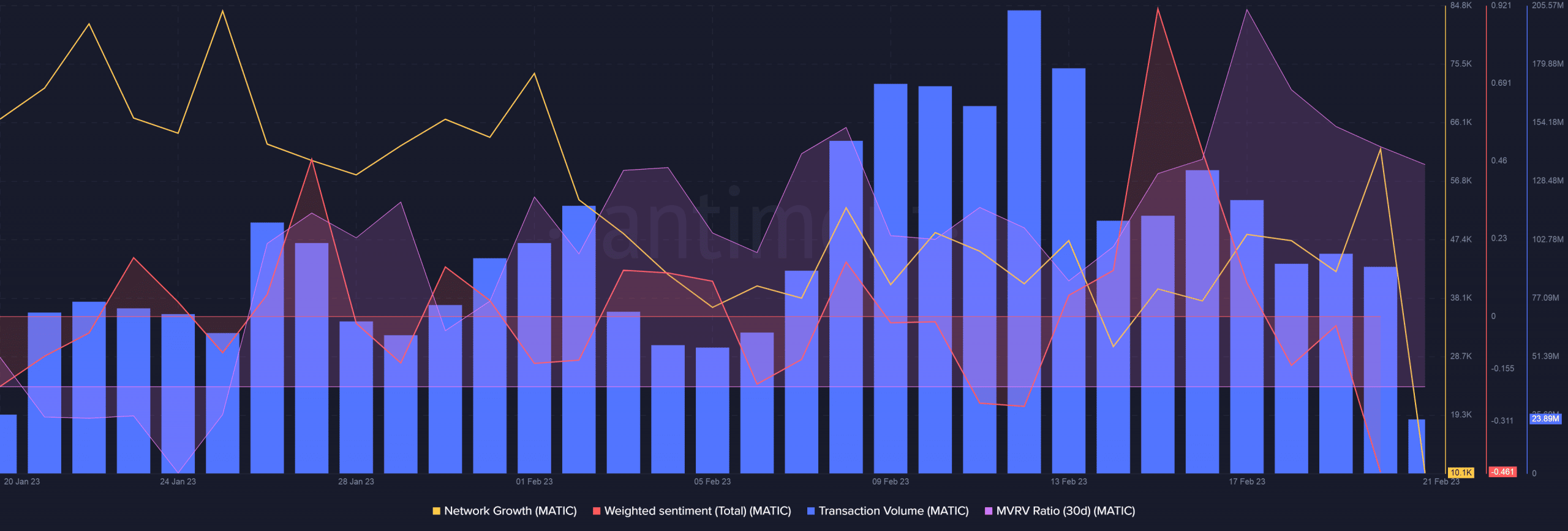

Regardless of this, Polygon’s on-chain exercise left lots to be desired. The Transaction Quantity steadily declined over the previous week whereas the speed at which new addresses adopted MATIC was uninspiring, information from Santiment revealed.

One other difficulty was the excessive 30-day MVRV Ratio, which indicated that the community was worthwhile for many token holders and it might trigger promoting stress for the coin.

It was evident that almost all holders have been in an accumulation mode in anticipation of the excessive returns that might come their means after the zkEVM launch subsequent month.

Supply: Santiment

MATIC was one of many best-performing currencies out there in 2023, having leaped 94% because the begin of the yr. Its each day chart appeared bullishly positioned, with higher-highs and higher-lows.

Life like or not, right here’s MATIC market cap in BTC’s phrases

The RSI (Relative Energy Index) rose sharply in the previous few days, and was seen shifting in the direction of overbought territory. The On Stability Quantity (OBV) has been on an upward trajectory since final week, indicating that purchasing was the flavour of the season.

Brief-term bulls trying to revenue might result in a pullback, however a reversal appeared unlikely at this stage.

Supply: Buying and selling View MATIC/USD